Tags in this story

Alex Gladstein, bitcoin all time highs, bitcoin hodler, bitcoin maximalist, BTC, Cryptocurrency, John Bollinger, michael saylor, Peter Brandt, Satoshi, rate

all about cryptop referances

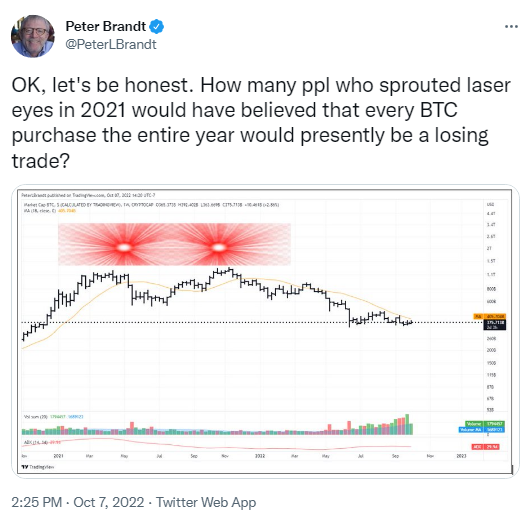

Veteran trader Peter Brandt’s latest comments mocking crypto traders who still use laser-eye crypto memes have sparked an immediate and angry response from bitcoiners on Twitter. A well-known bitcoiner, Michael Saylor, reminded Brandt that the laser eyes mean “a long-term commitment to bitcoin based on its ethical, technical and economic superiority to alternative assets.” Technical analyst and inventor of the Bollinger Bands technical indicator, John Bollinger, suggested that Brandt’s tweet was “a bit mean”.

Veteran trader Peter Brandt recently reignited his feud with bitcoiners using laser-eye crypto memes after he reminded them that every bitcoin purchase in 2021 is currently “a losing trade.” Brandt added that even he could not have predicted that the crypto would trade below $20,000 in October 2022.

In response to the veteran trader’s tweet, Micheal Saylor, who recently left his position as CEO of Microstrategy, explained why he and other bitcoiners remain committed to the laser-eye cause. He said:

Laser eyes mean a long-term commitment to bitcoin based on its ethical, technical and financial superiority to alternative assets. All major financial asset classes have lost trades over the past year. That’s why we don’t act, we hodl.

Saylor’s comments were echoed by another Twitter user named Stephen Livera who insisted that the main goal of those ascribing to the laser eye movement is “to increase the number of bets stacked and freedom achieved.” In addition, the user also appeared to attack Brandt’s use of technical indicators when trying to understand an asset’s future price movement.

“Predicting short-term price movements is foolish. Growing and advancing the movement is the real goal,” Livera tweeted.

Alex Gladstein, a human rights activist and proponent of laser eyes, reminded Brandt that “the idea was simply to put them on the journey to $100k.” Gladstein predicted that the laser eye movement is not going to let up until one BTC equals $100,000.

When a Twitter user named Bazooka responded to Brandt’s tweet by claiming to have bought BTC when the cryptoasset’s US dollar value was between $17,000 and $18,000, the veteran trader fired back by reminding the user that “BTC never traded below $24,000 in 2021.”

But when John Bollinger, a technical analyst and inventor of Bollinger Bands, suggested that Brandt’s tweet was “a little mean,” the veteran trader agreed, but insisted that his goal was to remind followers of the laser-eye movement of the dangers “of dogmatic thinking.”

During the 2021 crypto bull market, many bitcoin maxis started adding red laser eyes to their social media profile pictures. Using the red laser eyes then signified the bearer’s bullishness. As the movement gained traction, Brandt became one of the first prominent traders to question the movement, which he compared to a cult.

For example, on March 31, 2021, when bitcoin was trading above $58,000, Brandt said:

“I will use my laser eyes when $BTC experiences a $50k correction and many of you trade your lasers for tears.”

Months after Brandt said this, bitcoin hit an all-time high of $68,789.63. Since then, the top cryptocurrency has been trending down, trading primarily between $23,000 and $18,000 since September 1, 2022.

What are your thoughts on this story? Let us know what you think in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.