VC investment in crypto firms falls in the first quarter of 2023

A recovery in the crypto market could attract more venture capital investments. Here we examine the close relationship between venture activities and crypto prices.

Historically, the blockchain and crypto sectors have attracted significant venture capital (VC) funding, especially during the 2017-2018 and 2020-2021 boom. However, funding may fluctuate based on market conditions, regulatory changes and other factors.

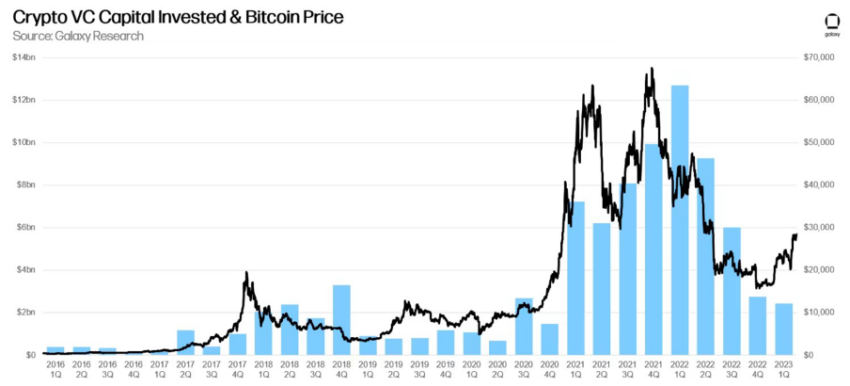

Amid changing scenarios in the crypto domain, funding initiatives have fluctuated drastically. There is a correlation between venture investment activity and crypto asset prices, especially for blockchain and cryptocurrency projects. When cryptoassets experience an increase in value, there tends to be an increase in investment in related startups and projects.

Conversely, when the prices of cryptoassets fall, there may be a decrease in investment activity in this area.

However, it is worth noting that this connection is not necessarily a direct causal connection. Other factors, such as regulatory changes or market sentiment, can also affect venture investment activity in the crypto space. In addition, venture investment activity in any industry is influenced by a wide range of factors beyond asset prices, such as the quality of the team, the strength of the business model, and the potential for growth and profitability.

Investor’s role

Venture capital investments play a critical role in the growth and development of crypto firms. The crypto industry has experienced explosive growth in recent years, driven by increased adoption and mainstream acceptance. Despite the huge potential of this industry, crypto firms still need to overcome challenges, including regulatory uncertainties, technological obstacles and lack of funding.

VC investments provide money to fuel the growth of crypto firms. These investments make it possible for startups to scale up their operations, expand their product offering and bring innovative solutions. With VC funding, crypto firms can invest in research and development, marketing and talent acquisition, among other critical areas. This, in turn, helps them stay competitive and meet the ever-increasing market demands.

Moreover, VC investments provide more than just financial support to crypto firms. It provides valuable expertise, guidance and networking. VC firms have years of experience in identifying promising startups, evaluating their potential and supporting them through their growth. They bring industry knowledge and connections that can help crypto firms navigate the complex and rapidly evolving landscape of the crypto industry.

Investment agreements

VC investments also play a critical role in attracting further investment in the crypto industry. When reputable VC firms invest in crypto firms, they validate the potential of these startups and signal to others that the industry is worth investing in. This in turn attracts more investment, promoting a virtuous cycle of growth.

Furthermore, VC investments in crypto firms help foster innovation and creativity. The crypto industry is still in an early phase, and there is great potential for new and innovative solutions. However, crypto firms need plenty of funding to bring these solutions to market. VC investments provide the capital to drive this innovation and create new products and services to revolutionize our lives and work.

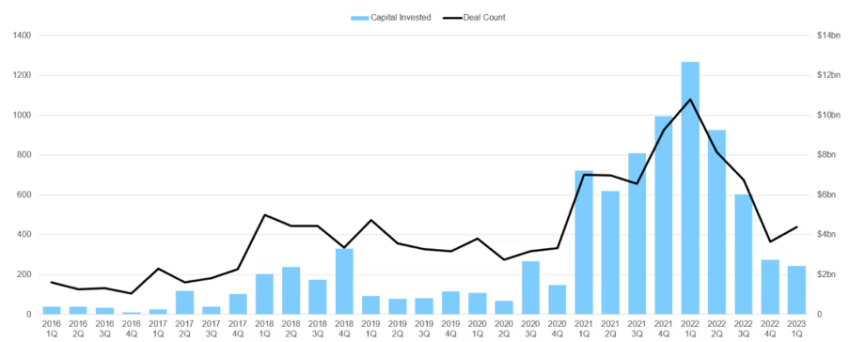

However, things can go south. With the collapses of 2022, investors pulled away as the industry lost credibility. According to a report from Galaxy Research, the research arm of crypto investment firm Galaxy Digital, the first quarter of 2023 supports a similar conclusion. Q1 saw the lowest crypto VC activity in two years, with $2.40 billion invested across 439 deals.

VC investment has fallen since peaking at nearly $13 billion in Q1 2022, with last quarter’s results representing a decline of over 80% compared to last year.

Baggage of the past

The drop is “not a surprise,” said PitchBook crypto analyst Robert Le, who noted that venture capital spending has slowed across the board this year. In addition to rising interest rates, Silicon Valley Bank, an institution that relies on venture-backed companies, was also liquidated in the first quarter.

“There is still a lot of fear about what is going to happen as the macro environment is still very uncertain,” Le said.

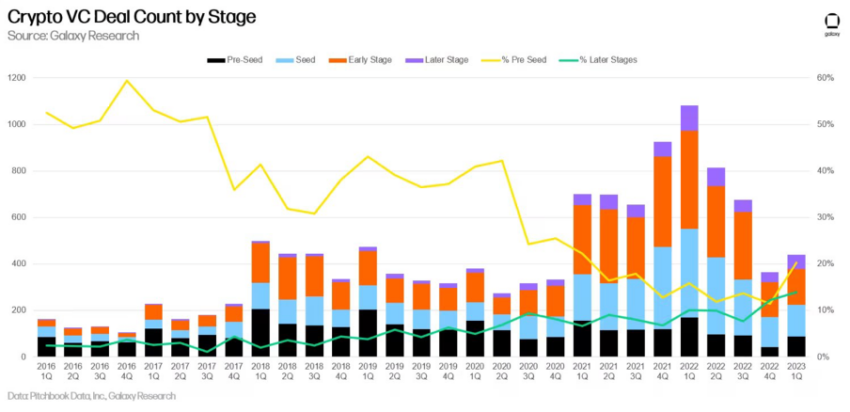

Regardless of the downward trend in invested capital, deal activity picked up in Q1 2023, with 439 deals up from 366 in Q4 2022. The gains were primarily driven by relative increases in pre-seed activity (89) following a dismal Q4. quarter 2022 which saw just 42 pre-seed deals.

Even the funding rating on average witnessed a significant increase. The average new fund size increased in Q1 2023, reaching $211 million. At the same time, the median fund size fell for the first time since 2020 ($62.50 million).

Could the numbers rise if the crypto market picks up again in the second quarter of this year? Alex Thornlead researcher at Galaxy Research, told BeInCrypto:

“Historically, venture activity has tracked crypto asset prices pretty closely. (It) will be interesting to see if crypto VC activity can pick up again if prices remain resilient or constructive this year. Lots of macro and monetary headwinds, though.”

Hope for recovery

While a crypto market may attract more venture capitalists and investors, many factors can influence investment decisions beyond market performance.

Investors usually look at various factors before investing in an asset, including cryptocurrencies. These may include the underlying technology, the strength of the development team, the potential market size, the regulatory environment, etc.

Furthermore, many investors and venture capitalists are actively investing in the crypto space even during a downturn. Many have a long-term perspective and see current market conditions as an opportunity to acquire assets at a discount.

So while an extractive market may help attract more investors, market performance is only one factor influencing investment decisions.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.