USD is no longer too big to fail, says Bitcoin :Balaji

Coinbase former CTO Balaji Srinivasan said the US dollar (USD) is not too big to fail and expects Bitcoin (BTC) to replace it as the global reserve currency.

Srinivasan pointed out that unlike in the past when investors have flocked to dollar-denominated assets during times of stress, this is a different time. He noted that historical data shows that people stop devaluing currencies, which is where the USD falls.

“Dalio has a different definition of historical reserve currencies. He says it’s the US dollar, before the British pound, then before the Dutch guilder. But the bottom line is that reserve currency status does not last,” Balaji added.

He noted that this is the difference between 2008 and 2023 when the USD no longer held its strong position. Balaji also suggested that the Chinese RMB could even replace the USD as the world reserve currency.

This continues his earlier views that Bitcoin could reach $1 million in 90 days as the US financial system suffers from hyperinflation. Meanwhile, many believe that Balaji’s predicted changes will take generations to happen, not 90 days.

The US Dollar is weakening

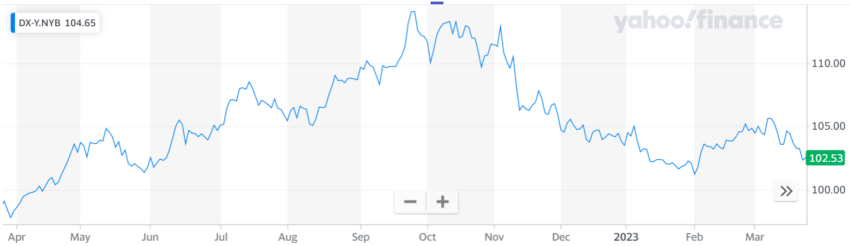

While not everyone believes BTC will replace the USD, there are clear signs that the US dollar is weakening against other cryptocurrencies. The US Dollar Index is down 8.9% over the past 6 months and has lost 1.34% of its value over the past year.

The USDX measures the value of the USD against a basket of other major fiat currencies, and its decline over the past 6 months suggests that the dollar is losing value. This decline is due to fears of a recession due to the Fed’s rate hike and the recent collapse of major US banks.

Bitcoin gains strength

Meanwhile, Bitcoin has strengthened in recent months. The cryptocurrency is up 46.18% over the past 6 months and is up 65.54% year-to-date, according to BeInCrypto data.

Interestingly, most of the BTC gains in recent weeks have been attributed to trading in the US. The performance has prompted some to push for higher Bitcoin prices and faster adoption. But experts believe that any growth in the Bitcoin price is unlikely to reach levels predicted by those who believe in hyperbitcoinization.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.