US crypto clampdown promises benefits for Coinbase

Hello and welcome to the latest edition of the Cryptofinance newsletter. This week we take a look at how the US crypto cleanup is affecting Coinbase.

America’s top market regulator has ruled that most crypto companies cannot be trusted to look after investors’ assets. This is a less than shocking conclusion to anyone who has followed crypto markets over the past year. So who can be trusted?

The question is prompted by news this week that the Securities and Exchange Commission is proposing tougher rules for hedging assets like crypto.

It wants investment advisers, who advise stock, pension and hedge funds and who have access to investors’ money, to use a qualified custodian bank to protect crypto assets.

It’s the latest salvo as the agency goes after the industry’s biggest companies, whether they survived last year’s carnage – as Kraken and Gemini did – or not.

The motivation this time is to clean up the language crypto companies use when they say customer funds are safe.

“When these platforms fail — as we’ve seen time and time again recently — investors’ assets often become the property of the failed company, leaving investors in line at bankruptcy court,” SEC Chairman Gary Gensler said in a scathing review.

“Make no mistake: based on how crypto platforms generally operate, investment advisors cannot rely on them as qualified custodians.”

Qualified custodians must submit to independent audits and provide officials with key documents, behavior that has not always been a strong suit in the crypto industry. So who can win?

One company is Anchorage Digital, the only crypto bank with a charter from regulators at the Office of the Comptroller of the Currency. Another is Coinbase, the exchange.

Since it is Nasdaq-listed, independent audits and SEC requests for documents are common. For a good while this week, it also said that Coinbase Custody Trust Co was recognized as a qualified custodian by the SEC. Paul Grewal, chief legal officer, said Coinbase was “confident” it would stay that way if the SEC’s rules take effect.

Taking advantage of regulation would be a nice twist of fate for a company that has often had a bad relationship with the government.

“The bottom line would be that Coinbase is by far the market leader in terms of brand, but even if that’s true, that doesn’t make them immune to regulators,” said Chris Brendler, an analyst at DA Davidson.

Just a day earlier, Grewal told me that the SEC’s “regulation-by-enforcement approach” to big crypto was pushing jobs overseas and leaving Americans behind the curve.

The exchange remains at loggerheads with the SEC over what should be considered a cryptocurrency, and only in January settled charges with New York’s attorney general for poor compliance standards for $100 million.

Still, there are some parallels with the financial industry after 2008. Many of the surviving banks and brokers were fined billions of dollars for violations, but the tougher regulatory barriers made it harder for new entrants to break into the market.

“You could argue that Coinbase is one of the only adults left in town,” Ram Ahluwalia, CEO of investment adviser Lumida Wealth Management told me over the phone. “The most regulated players are the biggest beneficiaries of more regulation.”

What is your view on Coinbase’s relationship with regulation? Email me your thoughts at [email protected].

Weekly highlights

-

Late Thursday, the SEC sued Terraform Labs — the company behind unstable stablecoin TerraUSD — and its founder Do Kwon for allegedly orchestrating a cryptocurrency scam that led to billions of dollars in losses. “This case shows the lengths some crypto firms will go to avoid complying with securities laws,” Gensler said. Attorneys for Terraform and Kwon did not immediately respond to requests for comment when my colleague Stefania covered the story here.

-

As the US continues its blitz on the crypto industry, it looks like UK authorities want their own (very small) piece of the action. In relation to law enforcement, the Financial Conduct Authority took action against operators of unregistered crypto ATMs in Yorkshire. Local police described it as a “national first”. Historical things.

-

New court documents related to crypto lender Celsius’ bankruptcy allege former CEO Alex Mashinsky and some of his associates profited by secretly selling the platform’s initial tokens from their own private wallets. Over the course of three years, Mashinsky allegedly sold more than $50 million in CEL tokens, often in direct violation of the company’s trading policy.

-

The $250 million bond used to secure Sam Bankman-Fried’s bail late last year was described as the largest ever. Recently unsealed court documents reveal two academics at Stanford University – where the disgraced crypto boss’s parents worked – put up a combined $700,000 to secure the bail. My colleague Joe Miller in New York has the story here.

-

An update on crypto’s hacker underbelly: blockchain analytics company Elliptic published a report indicating that Blender.io — a blending service allegedly used by North Korean hackers to launder illicit goods — may have relaunched as a new service called Sinbad. I looked at US efforts to crack down on North Korea’s illegal crypto regime, but Elliptic’s latest findings show how quickly they are regrouping.

Soundbite of the week: What does innovation really help?

One of my pet peeves in this industry is the claim technology is “neutral”. It’s not: every bit of crypto technology carries with it a value judgment on topics like privacy, financial inclusion, government overreach and energy consumption.

Technology is often relieved of moral baggage, but in contrast “innovation” is considered inherently good, often without qualification. At a Senate hearing on crypto this week, Lee Reiners, policy director at the Duke Financial Economics Center, expertly deconstructed one of the most common lines for regulatory scrutiny of the space.

“Another self-serving line spun by crypto boosters is that policymakers must embrace innovation or the crypto industry will migrate to other jurisdictions with a more favorable regulatory climate, but this implies that innovation is an unlimited good.

The truth is that innovation is value neutral, it can be used for good or bad. Instagram for kids is technically innovative, but does anyone think it’s a good idea?”

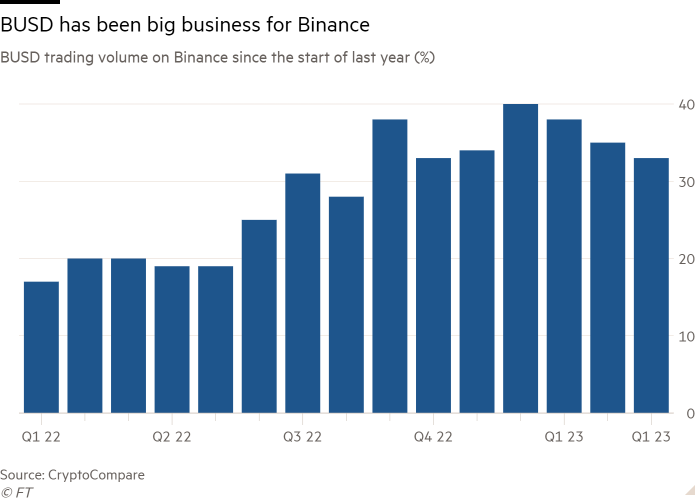

Data mining: Binance’s big BUSD business

The New York Department of Financial Services this week halted the issuance of BUSD, a Binance-branded stablecoin pegged to the US dollar. Binance CEO Changpeng Zhao tried to distance his exchange from the token, which was minted by another company, Paxos.

During a Twitter Spaces session earlier this week, Zhao said BUSD was “never a big business” for Binance. He even went so far as to say that he thought the BUSD project may have failed at its inception.

But figures from data provider CryptoCompare actually show that BUSD represented at least roughly a fifth of Binance’s trading volume over the past year.

In December 2022, BUSD accounted for 40 percent of Binance’s trading volume. That sounds like pretty big business to me.

Cryptofinance is edited by Philip Stafford. Send any thoughts and feedback to [email protected].

Your comments are welcome.