Updates on Binance, FTX founder Sam Bankman-Fried highlights crypto risks

The updates on disgraced FTX founder Sam Bankman-Fried and troubled crypto exchange Binance reflect the risks associated with crypto markets and the need for strict regulation. Bankman-Fried now faces a new charge of bribing at least one Chinese government official, the The Wall Street Journal reported. Meanwhile, the lawsuit filed by the US Commodity Futures Trading Commission (CFTC) against Binance and founder Changpeng Zhao over alleged violations has led to increased outflows from the crypto exchange.

In a new indictment unsealed Tuesday, prosecutors accused Bankman-Fried of conspiring to bribe Chinese government officials to release accounts and regain access to more than $1 billion worth of cryptocurrency.

Prosecutors alleged that in 2021, Bankman-Fried authorized the bribery of one or more Chinese government officials with at least $40 million in cryptocurrency to regain access to accounts frozen during an investigation into a party dealing with his crypto trading firm Alameda Research.

These accounts, which held over $1 billion in cryptocurrency, were reportedly unfrozen when the first illegal payment was made. The indictment states that Bankman-Fried then authorized further bribes of several tens of millions.

Overall, Bankman-Fried faces mounting legal charges, including fraud, conspiracy and violating campaign finance laws.

Binance outflows rise

Meanwhile, crypto data provider Nansen cites The Wall Street Journal reported that Binance witnessed net outflows of $2.1 billion on Ethereum (ETH-USD) blockchain in the last seven days, from Monday evening. Binance has $63.2 billion in its publicly disclosed wallets, based on Nansen’s estimates.

Furthermore, Andrew Thurman, an analyst at Nansen, highlighted that “the speed of withdrawals is increased compared to normal activity” and has increased following the news of the CFTC lawsuit. As per CoindeskCryptoQuant data indicates that Binance-branded stablecoin Binance USD (BUSD-USD) faced over $500 million in outflows in roughly 24 hours since news of the CFTC lawsuit.

Still, Binance has experienced even larger outflows in the past due to regulatory moves. In February, the crypto exchange saw $1 billion of outflows every 24 hours at its peak, after New York regulators announced a ban on new issuance of BUSD.

Meanwhile, a federal judge has blocked Binance.US, the US subsidiary of Binance, from buying Voyager Digital’s customer accounts out of bankruptcy.

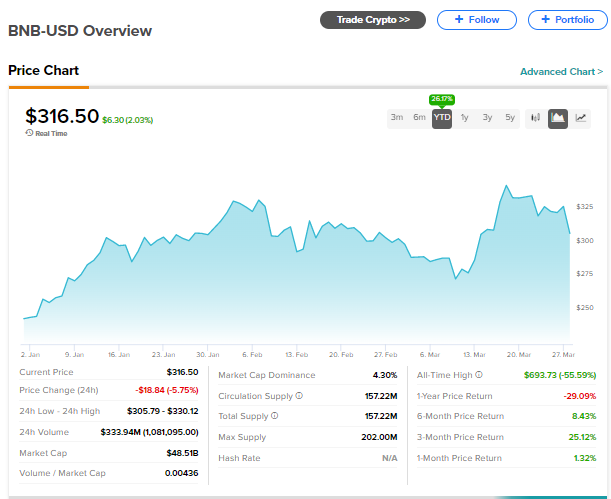

Investors are closely watching developments related to Binance and FTX as they continue to assess the risks associated with crypto markets. Binance’s own cryptocurrency, Binance Coin (BNB-USD), fell on March 27, the day the CFTC lawsuit was announced. Still, BNB-USD has risen 26.2% so far in 2023. However, it has fallen 29% in the past year.

Mediation