Uncover the hidden crypto exposures in your investment portfolio

The cryptocurrency market has seen as much volatility as it has promised. From the collapses of luna, FTX and Three Arrows Capital, to the decline in bitcoin’s value by more than 70% during 2022 (from $60,000 to $16,000), these events have had a ripple effect of financial losses and ultimately led to a decline in investor confidence in cryptocurrency.

When cryptocurrency was on the rise, some listed companies started offering cryptocurrency-enabled services, such as crypto mining, financial technology solutions, and payment platforms, in addition to keeping cryptocurrencies on their balance sheets.

However, companies with these “tangential links” have witnessed the domino effect of crypto markets such as the closure of Signature Bank SBNY, the bankruptcy of Core Scientific CORZQ and the fallout of Argo Blockchain ARBKF, where investors have lost record sums of money. Unwary investors may find themselves surprised with such exposures, as business areas of companies may not be immediately apparent.

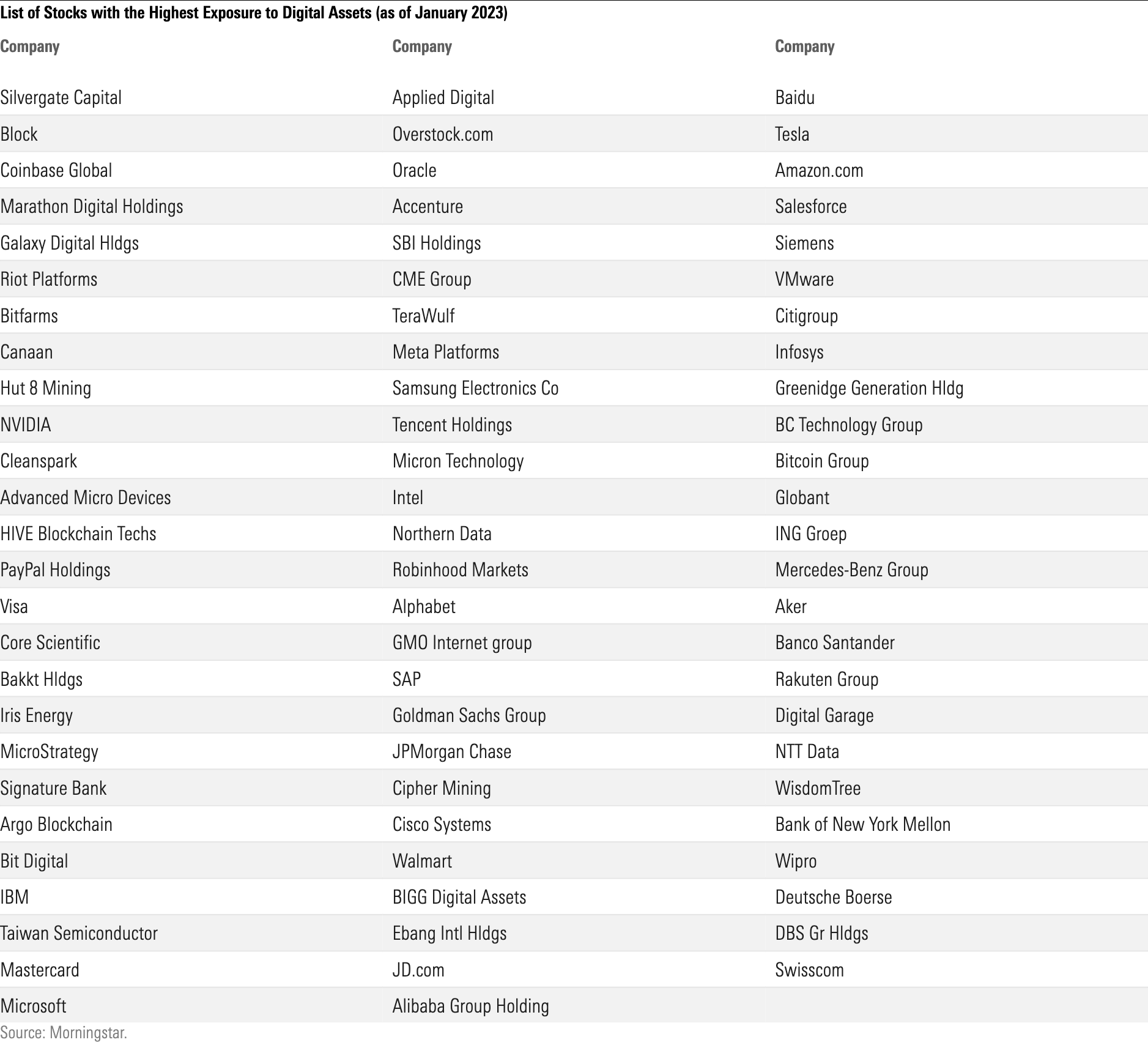

Our research report, “Intended and Unintended Crypto Exposures,” used a rules-based quantitative algorithm to identify companies in the global universe beyond the Morningstar Global Target Market Exposure Index that may be vulnerable to the unpredictability of the crypto markets. We have identified 77 stocks and more than 150 funds that have this tangential exposure to digital assets in managed investments and common stocks.

Stocks exposed to digital assets

In the table below, we list the global companies exposed to the actions of crypto markets, in order of decreasing net exposure. This includes companies that work explicitly in the digital asset space (such as Block SQ and Silvergate Capital SI) as well as companies that either enable the digital asset space or are involved in it in another form, such as Microsoft MSFT and PayPal PYPL.

This gives investors insight into their portfolio’s exposure to crypto assets.

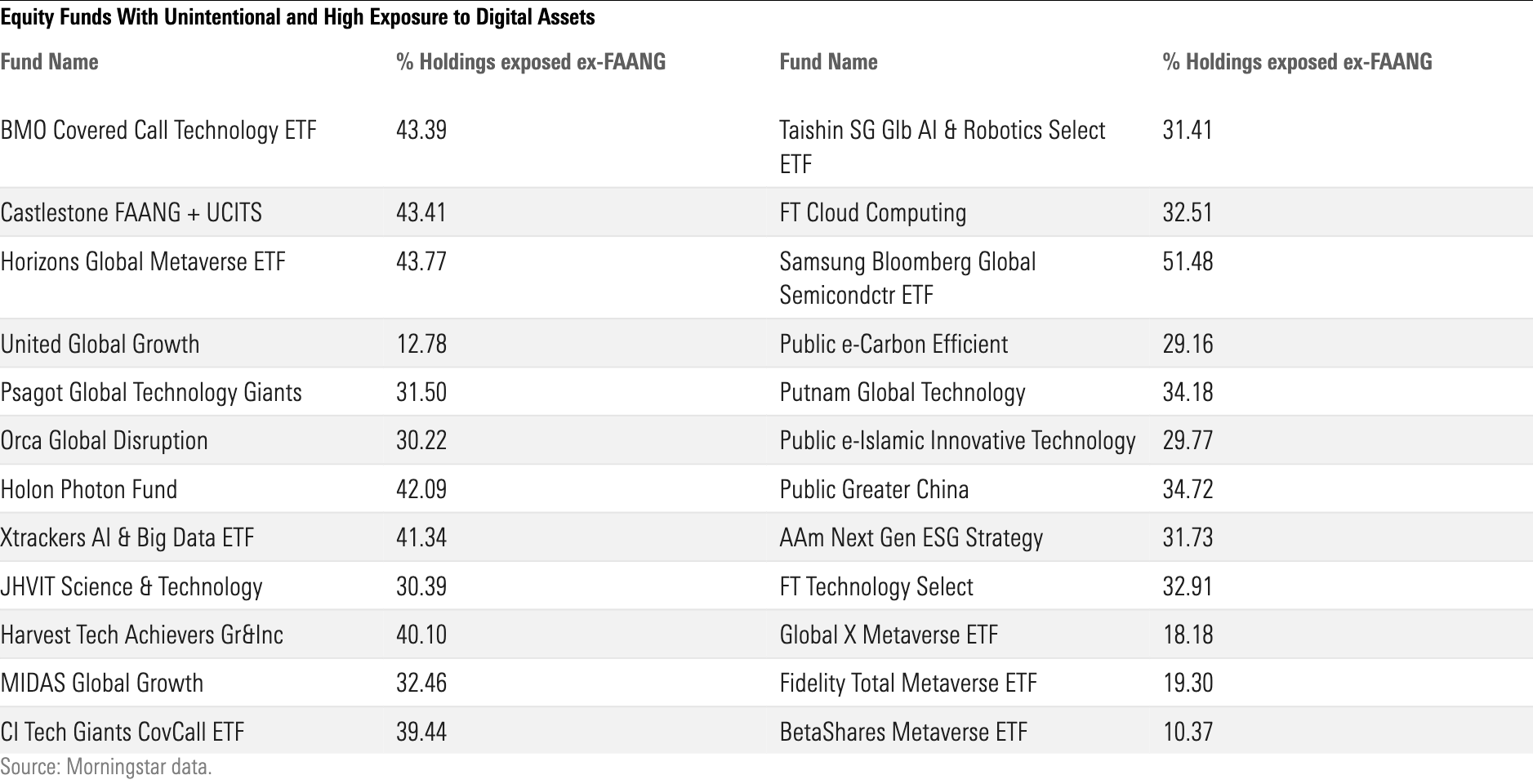

Funds exposed to digital assets

By analyzing the holdings of various funds, we discovered that crypto exposures are gradually finding their way into the portfolios of investors, both intentionally and unintentionally. These exposures amounted to more than $250 billion in global assets under management as of January 2023.

Intentional exposures are easily identifiable as fund managers expressly declare their willingness to invest in companies with cryptocurrency exposure, which is also reflected in the Morningstar Thematic Fund Landscape.

The accidental exposures are more exciting. These exposures are not disclosed by funds and investors are unaware of them. Our analysis suggests that some funds marketed to track themes such as artificial intelligence and big data, the metaverse and cloud computing are inadvertently exposed to crypto and blockchain assets.

The table below shows the funds with the largest exposure to digital assets, along with their percentage of holdings. The holdings exclude the FAANG stocks — Facebook parent Meta META, Amazon.com AMZN, Apple AAPL, Netflix NFLX and Google parent Alphabet GOOG — because of their different businesses.

The table serves as a reminder that appearances can be deceiving and that a polished exterior does not guarantee a good interior.

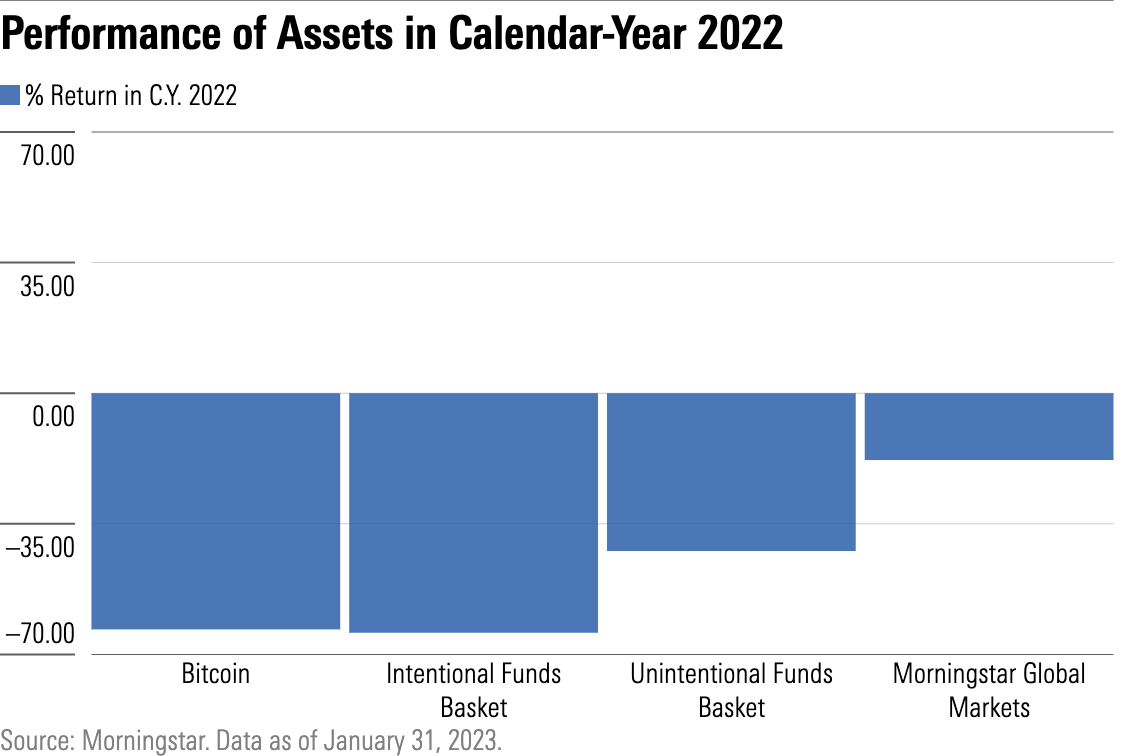

Is there still value in owning cryptocurrency?

Our research shows that such exposures have not been beneficial for investors, especially during the cryptocurrency downturn of 2022. As shown below, both the intended and unintended fund baskets have performed similarly to bitcoin, with returns significantly lower than the broader equity markets.

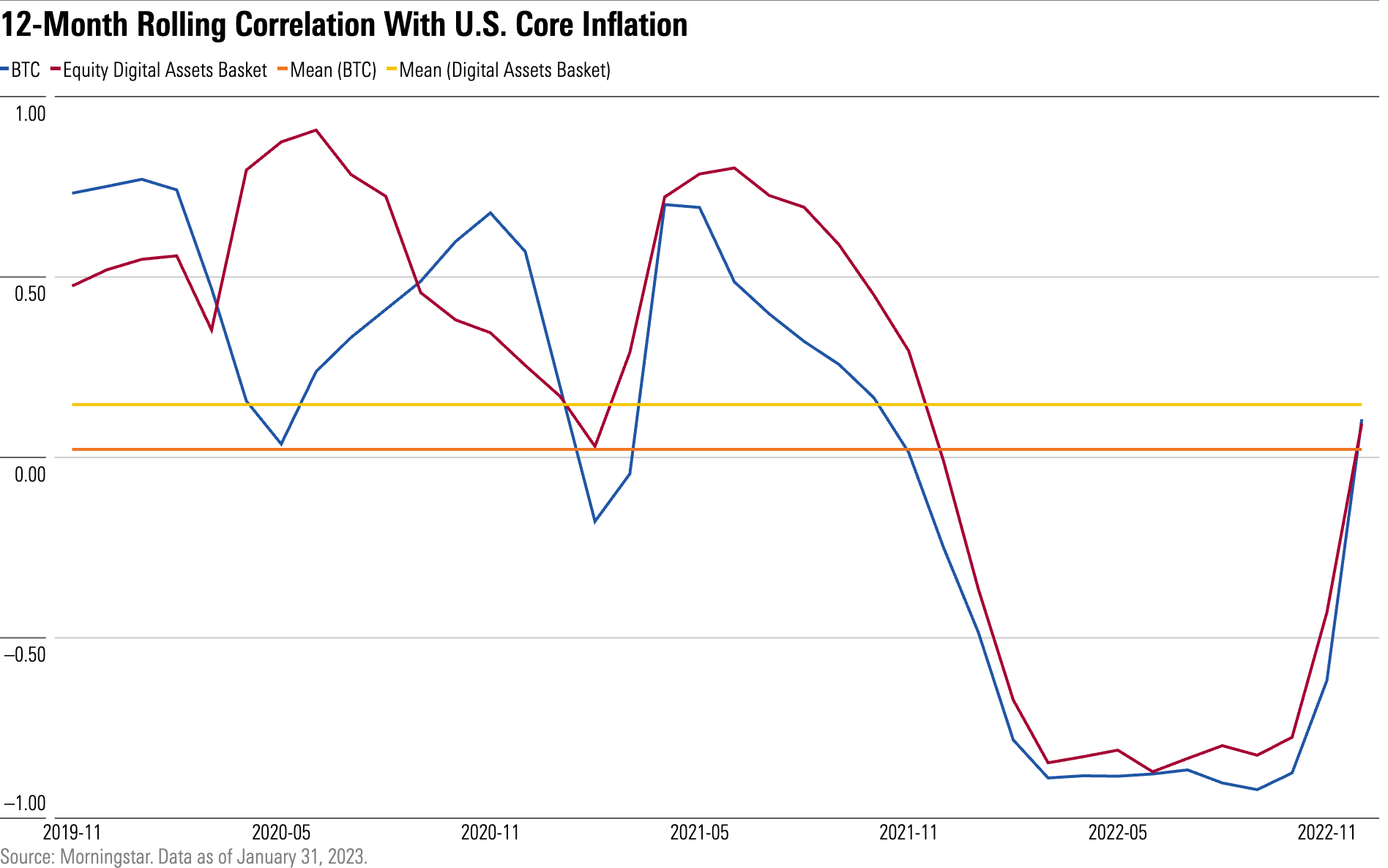

Despite the volatility, some investors have been intrigued by the idea of using digital assets as a hedge against inflation.

However, our research suggests that there is no observable correlation between tangential exposure to digital assets and US core CPI inflation, as illustrated in the following visualization.

While the rolling correlation between the two was positive during the bull markets until 2021, the correlation has reversed since the start of 2022. This suggests that there is no conclusive evidence to support the notion that crypto exposures can serve as a reliable hedge against inflation.

Our research suggests that it may be beneficial for investors to understand the full extent of their exposure to crypto as an asset class, as it may lurk in funds that do not necessarily market themselves as digital asset focused and potentially negatively impact portfolio performance.

Investors would do well to prioritize thorough due diligence when building their portfolios.