Traders sweat as PCE numbers may hold positive surprises

- Bitcoin price is flirting with a break lower that could see a 10% devaluation.

- The Ethereum price is in the middle of a pennant and is due to a breakout with PCE as a catalyst.

- XRP price remains firm as hardliners remain reluctant to give up support at 55-day SMA.

Bitcoin price, Ethereum and other cryptocurrencies are preparing for a significant economic data point out of the US this Friday. The Personal Consumer Expenditure Index or PCE is the Fed’s preferred instrument for measuring underlying inflation in the United States. After an optimistic surprise out of Europe this week, where final inflation figures were revised higher, US PCE may also reveal an upturn.

Bitcoin price tanks with $21,000 as support to defend against strong PCE data

Bitcoin (BTC) price is set to end this week with a loss after all as the Bitcoin price has sold off after the peak on Thursday. Markets remain focused on the one-year anniversary of the war in Ukraine and continue to price in a risk premium for further escalation. With a very selective club allowed to assemble under these conditions, cryptocurrencies have fallen out of favor for the time being.

BTC faces another challenge with the PCE numbers due out on Friday. This data point is preferred for the Fed to decide on penciling in a hike of 25 or 50 basis points in March. With the final inflation numbers from Europe as a guide, BTC will crack under the pressure of a higher PCE number and could tank as far as $21,969 with the 55-day Simple moving Average (SMA) as a speed bump and the monthly pivot just above $21,000 like a sandbox to catch the correction.

BTC/USD Daily Chart

A further decline in inflation would lead to a 25 basis point increase from the Fed in March, implying a dovish outcome. During this event, expect risk assets to go higher. Cryptocurrencies will see bulls re-enter the action and boost prices as Bitcoin price could go as far as $26,000 to break the monthly R1 resistance level.

Ethereum price has traders flipping a coin and going for a breakout on Friday

The Ethereum (ETH) price has a more technical approach as price action is traded daily in a much narrower range. Meanwhile, bulls and bears respect the limits of both upside and downside, painting a pennant formation on the daily chart. The bulls look pretty weak here with many tests to the upside and only one assured test to the downside.

ETH has a higher chance of a bearish breakout due to the number of upside rejections and entry opportunities bears have had so far. The Relative Strength Index (RSI) confirms it with its downward trend since the peak in January. Expect a moderate breakout lower towards $1,500 and $1,440 as a circuit breaker in the form of the 200-day SMA.

ETH/USD daily chart

Expect some whipsaw movement on the back end of the PCE data set coming out Friday morning. When the dust settles and reveals that inflation is still on target, a bullish opportunity will open up. Expect a shot through $1,688, with bulls trying to reach near $1,800 before or during the weekend.

XRP price will move on inflation data, but will PCE be enough to move the needle significantly?

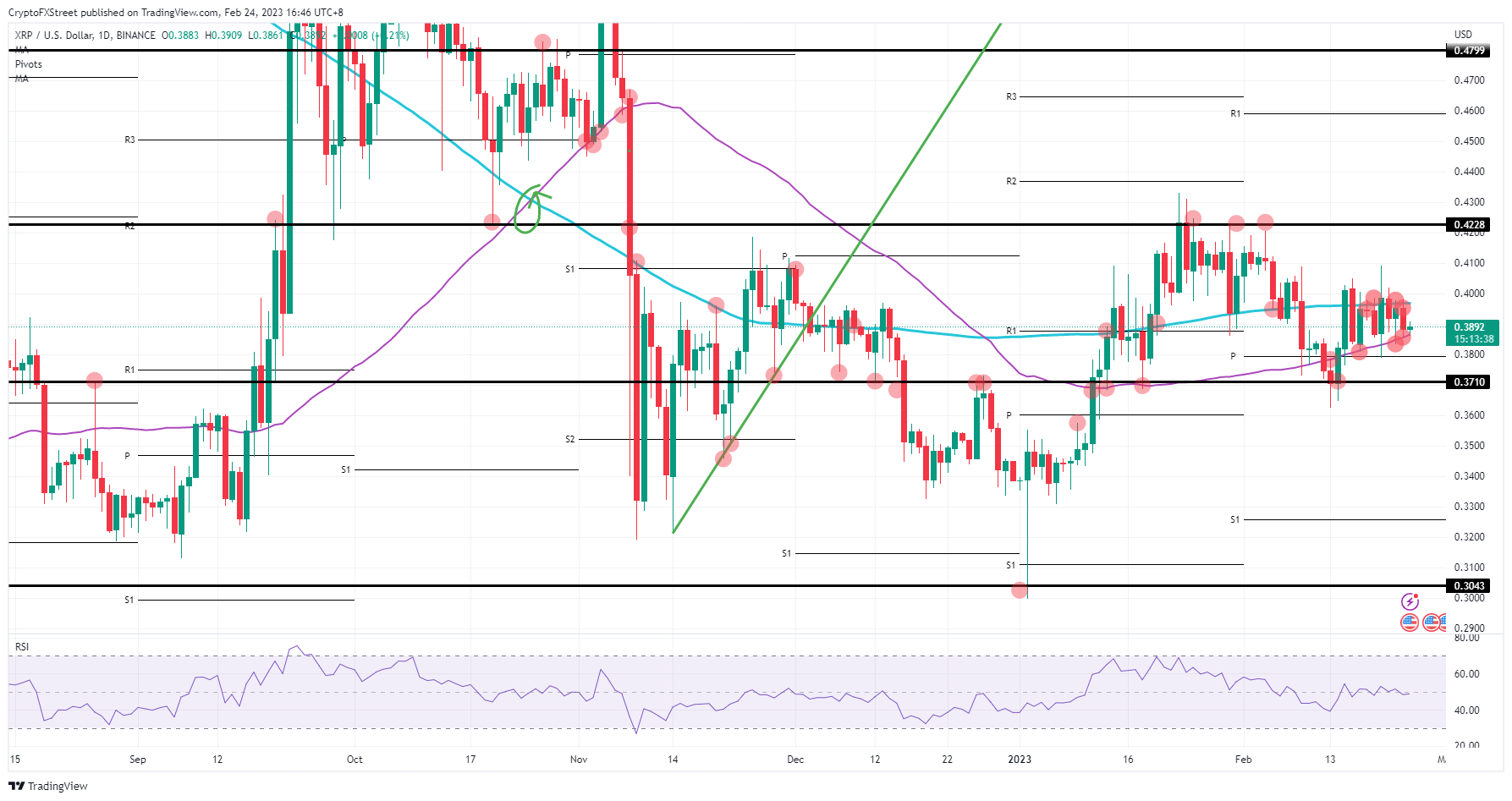

Ripple (XRP) price is still stuck between the 55-day and 200-day SMA and does not seem to be able to switch from either of them easily. Expect to see a move lower today with the PCE deflator hanging over the market this Friday as a big event. Although the data is quite different, it will determine the outcome of the Fed meeting in March.

XRP could drop that support below from the 55-day SMA and remove all stops placed just below there from the bulls entering at or just above the same 55-day SMA. A quick dive can be seen towards $0.37 as these stops will trigger a domino effect. If the PCE figures point to a solid increase in inflation, a catalytic drop towards $0.34 could be in the cards, as $0.37 lacks enough strength and support.

XRP/USD Daily Chart

The bond segment will be the element to watch in the markets in the coming days. Often traders forget to look at this asset class as it can paint a clear picture of what will happen in the near future. This Friday in ASIA-PAC and European opening hours, bonds rose in price (yields fell), confirming that the markets are moving back towards the Goldilocks scenario, which would mean that XRP traders could expect a breakout higher above $0.40 against $0 .42 by next week.