Top Crypto Analyst Explores Bitcoin (BTC) Market Structure Giving Traders ‘Nightmares’

A popular crypto strategist says Bitcoin (BTC) is forming a structure that tends to give traders sleepless nights.

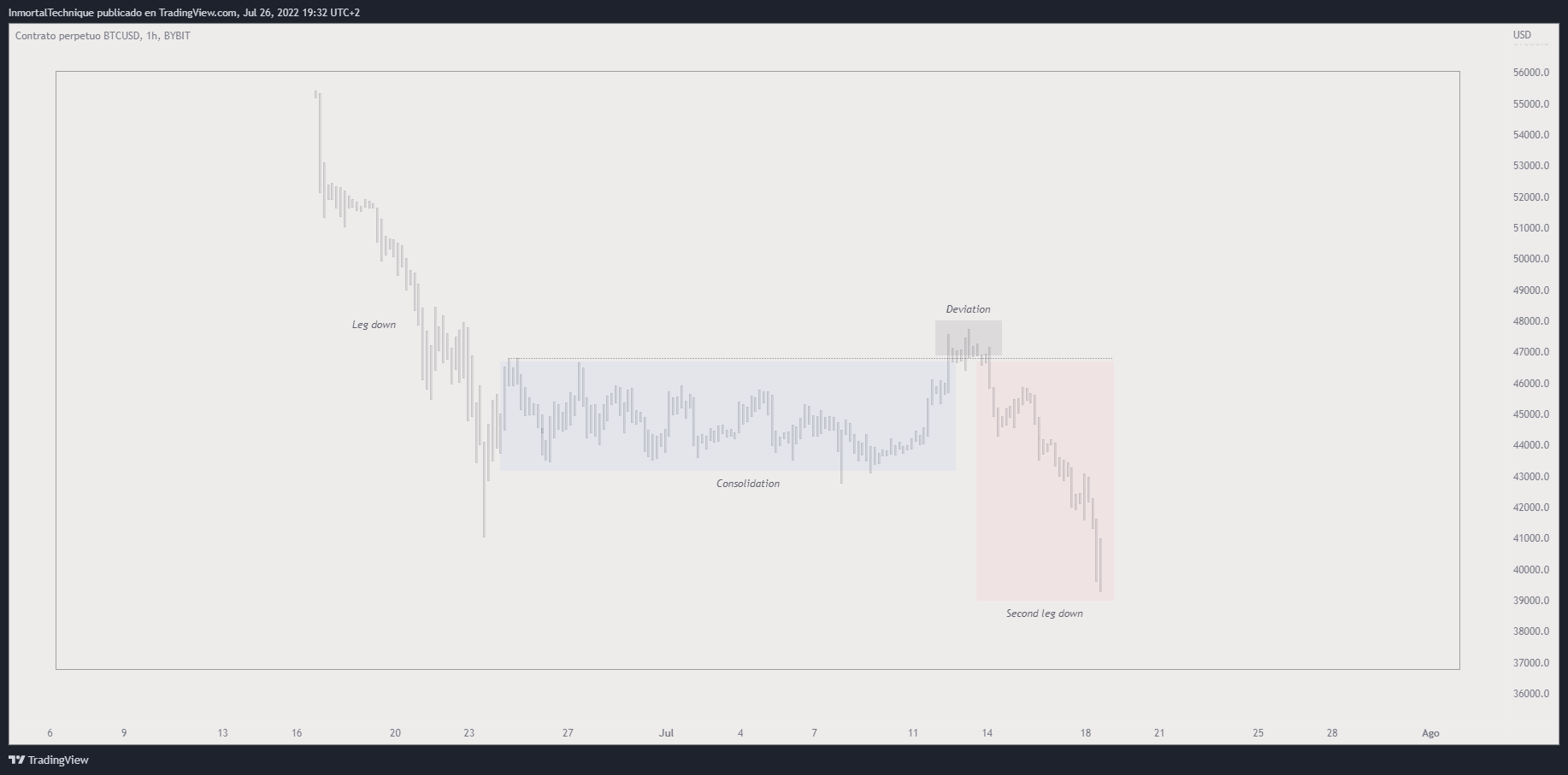

The pseudonymous analyst Inmortal says his 174,000 Twitter followers about Bitcoin’s recent pattern of long consolidation followed by a brief rally and then a deeper price decline.

“Recently, a structure has emerged that is giving many traders nightmares. Let’s see why it happens and how we can trade it.”

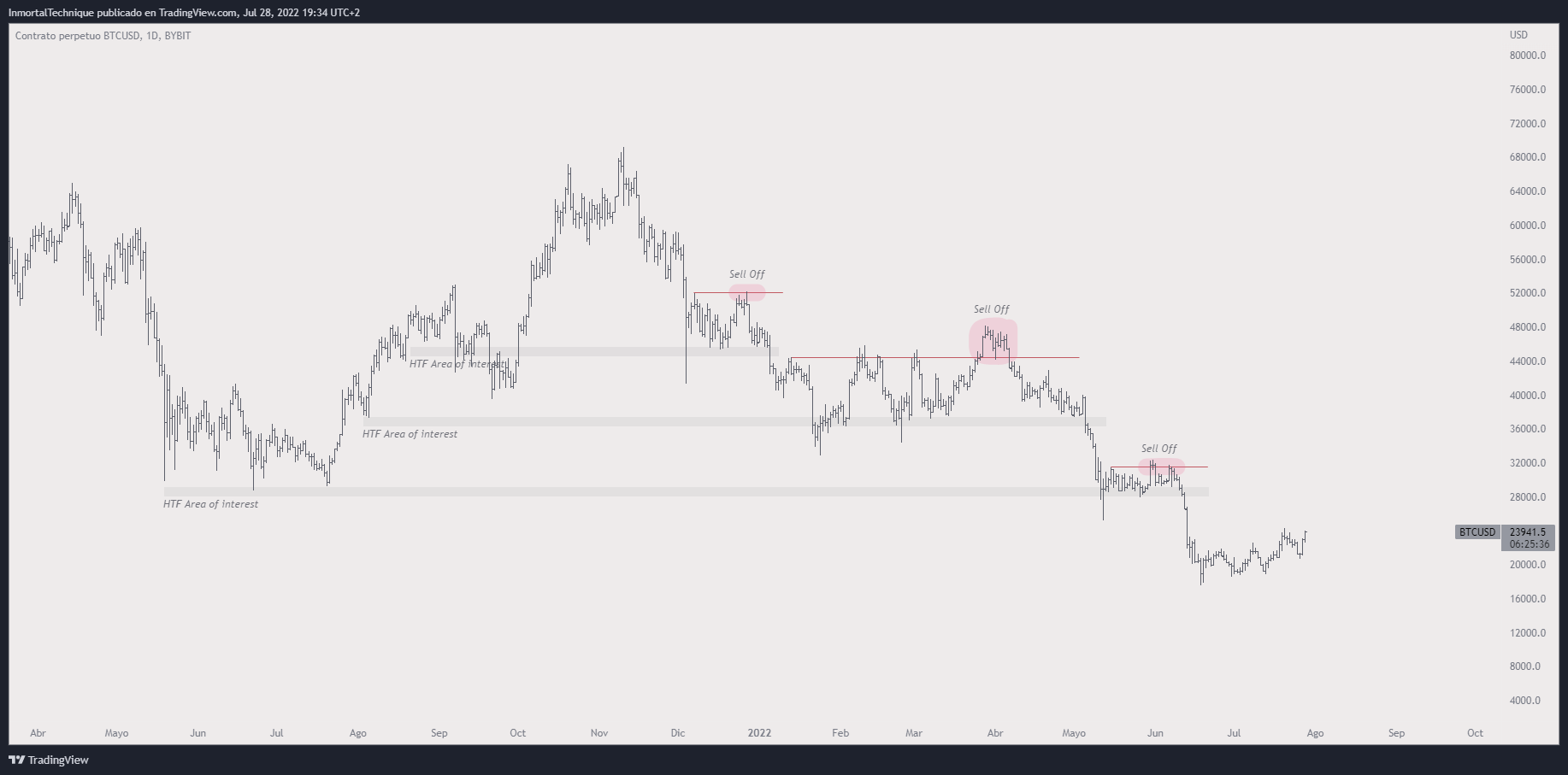

He says that the structure has become so common because during the bear market most people trade against the trend. The problem is that there is no real demand during the downturn, so average investors fall into bull traps and eventually get liquidated.

“On the way down, the price finds areas of interest with enough liquidity to cause the price to stop and form what looks like a bottom structure, prices rise a bit and people FOMO [fear of missing out] buy it while big players use these moves as an exit.

There [are] no new players and real demand to maintain an uptrend, so the price sells off at the first resistance level and makes new lows.”

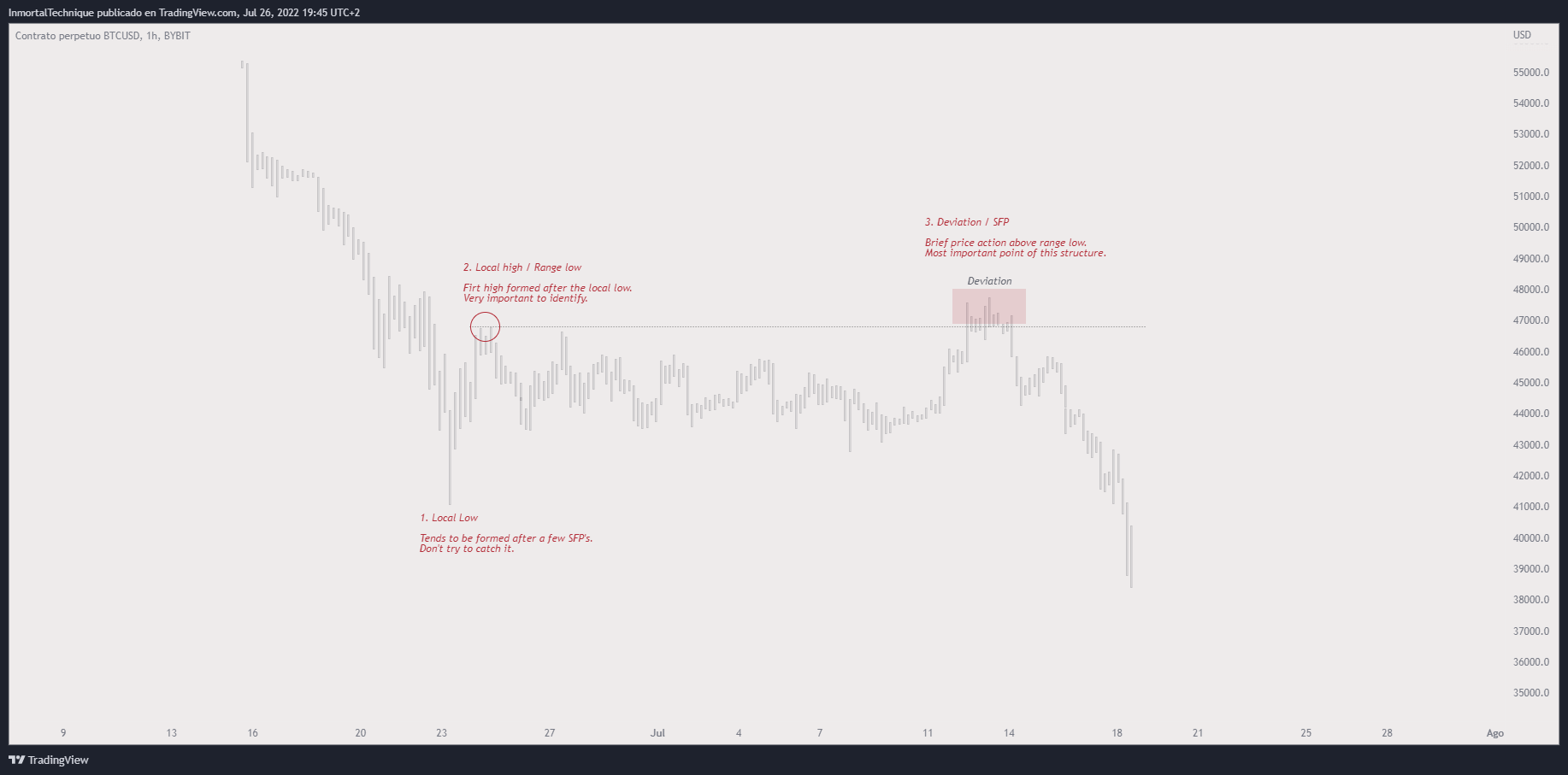

Immortal then says his followers how he thinks they could navigate this market structure.

“The first part of this structure is the local low, but the most important point is the high that forms after it, because after a dull consolidation, it will be the level where average investors will FOMO in and big players will fade them and sell …

After a deviation/SFP [swing failure pattern]we usually see a selloff that drives us into low territory (of consolidation, not local lows), if the reaction is weak, we are likely to see new lows soon.”

The trader says that, just like other market structures, this one is likely to change as it is repeated more often and more people notice it.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/CI Photos/phanurak rubpol

![This Bitcoin [BTC] the system is finally bearing the brunt of the ongoing crypto blizzard This Bitcoin [BTC] the system is finally bearing the brunt of the ongoing crypto blizzard](https://www.cryptoproductivity.org/wp-content/uploads/2022/10/piggybank-qmNt1PgbLqA-unsplash-1000x600.jpg)