Top Bitcoin Miners Are Hemorrhaging Cash, But Analysts Remain Bullish

The three largest bitcoin (BTC-USD) Mining companies posted over $1 billion in losses in Q2 amid this year’s “crypto winter.” Despite the large losses, analysts expect a high upside potential from these companies. In accordance Bloombergin Q2, Core Scientific (CORZ) posted a net loss of $862 million, Riot Blockchain (RIOT) lost $366 million, and Marathon Digital Holdings (MARA) lost another $192 million.

Crypto winter is a term that was first introduced during the previous bear market 2018-2020. It refers to a condition where the crypto market experiences large falls, sideways movements and fear.

What is the crypto mining industry?

Bitcoin works in a system called “Proof of Work”. In short, this means that every time a transaction is attempted on the blockchain, “miners” must approve it by solving long strings of numbers. These strings are similar to mathematical equations or, simply put, a complex puzzle that must be solved to prove that the transaction is legitimate. This is done by using computer power to run through all possible combinations of the puzzle until the right one is found.

When the miner succeeds in solving the puzzle, they are rewarded in bitcoin, and the more computers working on the network, the more likely they are to succeed.

The current reward rate is 6.25 bitcoins per block and a new puzzle is solved around every 10 minutes.

This has led to a large mining industry where companies build huge “mining farms” with the intention of mining and collecting as much bitcoin as possible to later sell into the markets. This is done by building huge facilities filled with mining rigs that solve the puzzle time and time again.

For example, Core Scientific has 180,000 servers and is responsible for around 10% of the current computing power of the entire bitcoin blockchain network.

Riot Blockchain, one of the largest US-based publicly traded bitcoin miners in North America, had an amazing year in 2021, fueled by the crypto market’s bull run. The company’s revenue increased to $213.2 million (1,665% year-over-year growth) in 2021, compared to $12.1 million in the same period last year. The number of bitcoins held by the company increased by 353% to 4,884 bitcoins as of December 31, 2021, compared to 1,078 bitcoins 12 months earlier.

Marathon Digital became the first North American bitcoin miner to have over 10,000 BTC on its balance sheet. It has a total of 49,000 miners installed and maintains its goal of reaching nearly 200,000 by 2023.

Why were the losses so great?

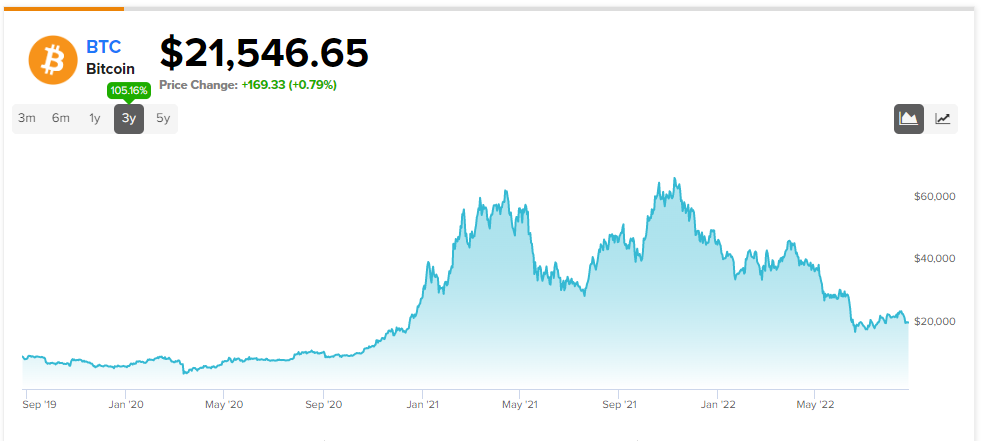

The main reason for the losses for bitcoin miners is the large drop in the price of bitcoin in the last quarter. This drop in price forced miners to sell significant portions of their bitcoin holdings to cover operating costs and repay debt.

From the report, it is clear that public miners are still selling their bitcoin holdings at a higher rate than the rate of production. In June, miners sold 14,600 coins despite only producing 3,900, and in July, public miners sold 6,200 coins, making it the month with the second highest bitcoin sales rate this year.

But selling their bitcoin bags is still not enough of an income for some of these companies. Marathon took out another $100 million loan in addition to selling about $60 million in mining rigs, while Core Scientific entered into a $100 million equity purchase with a VC firm.

How Bitcoin Miners Affect the Price of Bitcoin

These mining companies are always looking for the opportunity to sell their bitcoins at the highest possible price and take advantage of every move higher to sell more coins.

This added additional selling pressure to the price of bitcoin, which was already struggling due to the tough market conditions last year, further pushing the price down.

Which Bitcoin Mining Stock is Best to Buy?

According to analysts, the highest implied upside potential of these three companies is assigned to CORZ stock. It has five unanimous Buy ratings, and the average CORZ stock price estimate of $8.22 implies 232.1% upside potential.

Next, there is Riot Blockchain. It is currently trading at around $7.25 after falling ~67% year to date. However, it has a strong buy rating based on six unanimous buy ratings from Wall Street analysts. The average Riot Blockchain price forecast is $14.83, suggesting 104.3% upside potential.

Finally, there is Marathon Digital Holdings, which has the least hinted upside potential. Based on five Buys and two Holds from Wall Street analysts, it has a Moderate Buy consensus rating. Average MARA price target is $20.43, implying upside potential of 61.9%.

Conclusion: Bitcoin miners must adapt

It is clear from the latest quarterly report that only mining and selling bitcoin can be profitable when the price is high, at $60,000, but not as much as it gets closer to the $20,000 level. With the constant increase in energy prices, and as the world moves away from polluting energy to a greener environment, the entire mining industry will have to adapt or it will be left behind and will continue to lose money. This means that miners have to find more income streams than just mining and selling coins.

Riot Blockchain found a creative solution to the problem when it sold its extra power reserves to the state of Texas, making millions in the process.

Unless the price of bitcoin returns to roughly $40,000, it will be very challenging for these companies to make a profit for themselves and their investors.

Mediation