Top 5 Use Cases of Bitcoin and Cryptocurrencies

3 January 2009 is not an ordinary date, but the beginning of a revolution that changed the course of money as we know it. Satoshi Nakamoto created the Bitcoin network by mining the first block in the chain, called the Genesis block. Bitcoin started its journey as a peer-to-peer electronic cash system and now has a trillion dollar market cap with thousands of different cryptocurrencies that followed. In fact, as of November 2021, the total market capitalization of all cryptocurrencies exceeded $3 trillion.

Adoption of Bitcoin and Cryptocurrencies in the Global Economy

Considered a rebellion by a few adventurers against the global banking system, cryptocurrencies were not embraced as a legitimate financial asset for a long time. Bitcoin was mostly considered a fad that could be used for short-term speculative trades or the purchase of illegal goods on dark web markets. Whenever there was a price crash, critics were quick to announce that this was finally the time when Bitcoin would rightfully go to zero. However, Bitcoin has shown incredible resilience and has reached new all-time highs even after seeing crashes of 80% or more.

”Rapid rise in the crypto markets after the Fed’s interest rate decision.”

If you had shown this quote to an economist 10 years ago, they would have laughed at you. However, cryptocurrencies are now part of the world’s economic system and crypto markets react to what is happening in terms of regulation, stock markets, monetary policy and so on.

Bitcoin, cryptocurrencies and blockchain technology are increasingly common in both daily life and the global financial system. This article will discuss the most popular use cases of Bitcoin and other cryptocurrencies.

1. Trade and investment

Bitcoin is still primarily a speculative asset, as it is mostly used for trading and investment purposes. The size of the Bitcoin market is significant, as the global BTC trading volume regularly exceeds $300 billion per day. While trading in Bitcoin was initially dominated by retail traders, professional investors also began to enter the market as it became clear that Bitcoin has serious staying power and was not just a fad.

Now, cryptocurrency trading platforms like Binance and Coinbase provide significant liquidity, making BTC a viable asset even for institutional traders. Bitcoin has even attracted the interest of billionaire investors, including Bill Miller, Stanley Druckenmiller and Paul Tudor Jones.

From 2020 onwards, a number of publicly traded companies started adding Bitcoin to their balance sheets. The most notable example is MicroStrategy, which has bought Bitcoin for nearly $4 billion. Other companies that have invested large amounts in buying Bitcoin include Tesla, Block (formerly known as Square), and Marathon Digital Holdings.

Some believe that Bitcoin’s fixed supply and predictable issuance policy make it a hedge against the deterioration of traditional currencies. However, Bitcoin is much more volatile than traditional stores of value such as gold. From a short-term perspective, Bitcoin does not appear to be overly suitable as an inflation hedge, although it can definitely be argued that holding Bitcoin can help preserve one’s wealth in the long term.

2. Buy products and services

Advances in technology allow people to shop from the other side of the world with a few keystrokes. Moreover, you can reach your anonymity in these purchases whenever you want. You had to leave your house to buy a CD of a newly released game, but now there’s no travel to spoil your enjoyment of the game. These examples can be multiplied and we will examine some of them in a little more detail, but it is obvious that one of the most common uses of Bitcoin and other cryptocurrencies is to make purchases of goods and services.

E-commerce and personal expenses

The spread of e-commerce is one of the biggest contributors to the popularization of cryptocurrencies.

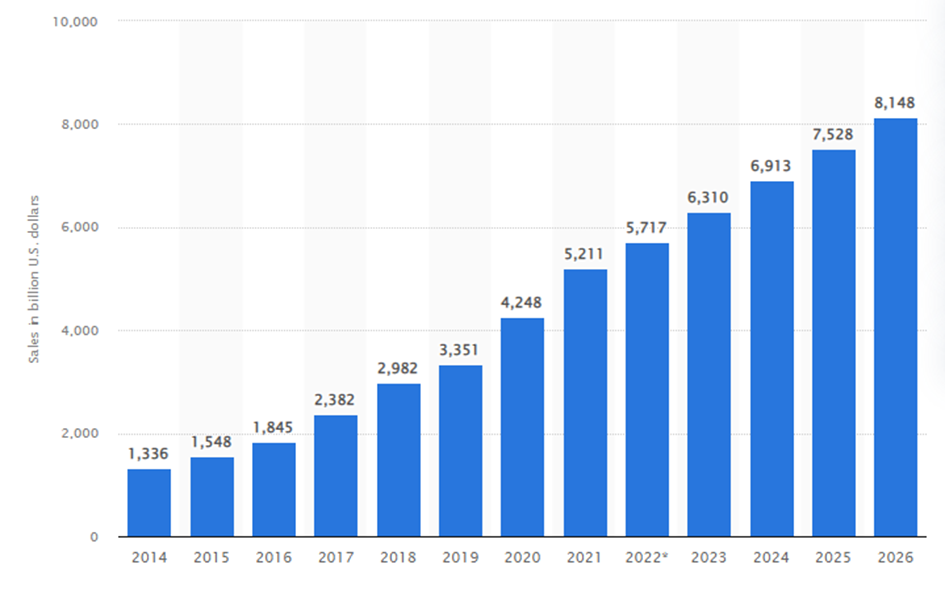

”In 2021, e-commerce sales amounted to approximately 5.2 trillion US dollars worldwide. This figure is projected to grow by 56 percent over the next few years, reaching around $8.1 trillion by 2026.”

Global e-commerce retail sales from 2014 to 2026 (estimated). Image source: Statista

E-commerce giant Amazon does not currently accept payments in Bitcoin or other cryptocurrencies. However, you can use the coupons you bought with Bitcoin on other sites on Amazon.

According to the latest data, more than 15,000 businesses currently accept Bitcoin payments. Among them are brands such as the technology giant Microsoft, Tesla from the car industry and leading brands from the food industry such as McDonald’s, KFC and Starbucks. Every day, $1 million worth of Bitcoin is spent on products and services by Americans; up to 40% of these customers are first-time buyers who spend twice as much as credit card users.

International trade (cross-border payments)

Payments are one of the most difficult stages of international trade. Even if the parties have mutual trust, they may have to pay high commissions to the intermediaries. Another disadvantage is that banks hold large amounts of payments. Dozens of payment orders, notifications, obligations, etc. are another step in the work. However, payments made with Bitcoin or other cryptocurrencies serve their purpose in a very short time with relatively low fees compared to other cross-border payment and remittance services.

Emmanuelle Ganne, one of the authors of the World Trade Organization (WTO), covers the subject in detail in her book titled ”Can Blockchain Revolutionize International Trade?”

”Trade has always been shaped by technological innovation. In recent times, a new technology – Blockchain – has been greeted by many as the next big game changer.”

Purchase of goods and services restricted by the authorities

Whether we like it or not, one of the first real uses for Bitcoin was to buy illegal goods like drugs on dark web markets. The reason this is possible is that Bitcoin is a decentralized and censorship-resistant payment method. No authority can stop transactions from happening on the Bitcoin network, as it is maintained by thousands upon thousands of miners and node operators worldwide.

While the use of Bitcoin to buy drugs certainly makes for attractive headlines, Bitcoin’s censorship resistance also enables more noble use cases. For example, someone living in an authoritarian regime may use cryptocurrency to pay for web hosting services and publish content that the government wants to restrict.

Due to the traceability of the Bitcoin blockchain, privacy coins such as Monero have grown in popularity for purchasing goods and services that are restricted by governments.

3. Gaming industry

Years ago, you had to leave your house and go to the CD store to play a newly released game. But right now you can buy it from one of the online gaming platforms with Bitcoin or online payment and download it to your gaming console or to a cloud drive.

1.1 million people worldwide play online games and the size of this industry is expected to reach $304.7 trillion by 2027. The use of blockchain technology is becoming widespread, and this development is also reflected in the market volume of the gaming industry. Institutional investors place exceptionally large bets in the Play2Earn and Metaverse categories.

The use of NFTs in characters and other game assets is growing in popularity in RPGs. On the other hand, some mobile games accept the use of cryptocurrencies as in-game assets or tokens.

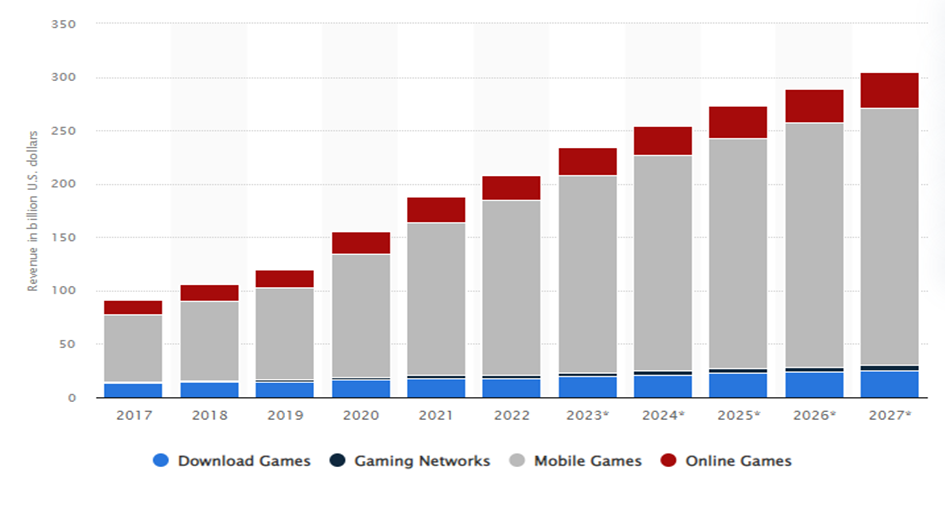

”In 2022, global mobile gaming revenue was estimated at US$164.1 billion, making it the largest segment of the digital gaming market. Online gaming was ranked second with approximately US$23.7 billion in revenue. The total digital gaming market is estimated to reach US$304.7 billion in 2027.”

Digital video game revenue worldwide from 2017 to 2027 (estimated), by segment. Image source: Statista

4. Gambling

Advances in technology have also led to the proliferation of online casinos. Factors such as user-friendly interfaces, alternative deposit options and easy access have increased interest in online casinos.

“The size of the global online gambling and betting industry stood at US$61.5 billion in 2021. This has been forecast to rise to US$114.4 billion by 2028, representing an increase of just over 86 percent.”

One of the biggest reasons why the online gambling industry is growing so quickly is Bitcoin. Bitcoin and cryptocurrencies allow users to make deposits without revealing their personal information, and this privacy increases people’s use of Bitcoin for online gambling. Instant deposits and withdrawals, security, the ability to play games without leaving the comfort zone are other factors that enable the integration of Bitcoin and cryptocurrencies with the online gambling industry.

According to a survey conducted by Chainalysis, there are approximately 70+ crypto-friendly casinos currently operating, with an estimated $2.8 billion in revenue so far this year and the industry making $10 billion last year, a 64 percent increase from 2020.

5. Other use

Beyond the use cases we have already outlined, Bitcoin and other cryptocurrencies are also commonly used in the following scenarios.

Donations

Another popular use for Bitcoin and cryptocurrencies is donations. Especially after 2020, Covid-19, environmental and natural disasters have been a big factor in this increase, of course we can associate this with the widespread use of cryptocurrencies. While the cryptocurrency donation volume was $4.2 million in 2020, this amount reached approximately $70 million in 2021.

Another factor in donations is to reduce the tax burden. Institutional Bitcoin and cryptocurrency investors in particular can deduct these donations from taxes. Proper use of these strategies can move the donation title to higher ranks on the list for years to come.

Property

Blockchain technology is used in almost every industry. It is used in a variety of applications, including the collection, processing and modeling of land or property information in a database. Bitcoin and other cryptocurrencies are used to pay for these services. There are currently websites all over the world where you can buy real estate using Bitcoin and cryptocurrency.

Trade in collectibles and art

The rapid growth of NFT marketplaces and the increase in the frequency of use of cryptocurrencies allowed collectors to concentrate on this area. Famous works of art, music productions, photographs and many more meet buyers on NFT marketplaces such as Opensea and Rarible. By 2021, the trading volume of non-fungible tokens (NFTs) exceeded almost $20 billion. Online art auctions, which are already attended by well-known collectors, are becoming more and more common. Bitcoin and cryptocurrencies are very likely to peak in this diverse field of use.

Conclusion

People have used different methods since ancient times to obtain goods or services that they needed but could not produce. The barter method, which was used in the early days based on overlapping needs, gradually gave way to other payment methods as time went on. According to the barter method, payments were made in precious metals such as gold, silver and copper.

Paper money eventually took the place of these precious metals in terms of convenience. It is now easier to make payments with paper money and to meet people’s needs faster. In the twenty-first century, cryptocurrencies that reveal significant changes in the monetary structure have emerged.

These days when paper money is replaced by digital payment systems and cryptocurrency, people encounter another new cryptocurrency every day. The ecosystem and blockchain technology has become so huge; they cover almost all of humanity’s needs.

In our article above, we examined the most popular use cases of Bitcoin and cryptocurrencies. Apart from these, Bitcoin and cryptocurrencies are used in dozens of different areas and these uses are gaining more adoption day by day.