Top 5 Crypto Stories to Watch for in 2023

The year 2022 will certainly go down in history as one of the toughest years for the digital asset industry, from a hawkish Fed to idiosyncratic risks that saw crypto giants like Three Arrows Capital and FTX bite the dust. But for those who have been around for a while, you probably understand that it is in times like these that you as an investor should regroup, digest and position yourself for a possible reversal.

Now, more than one month into the new year, the question investors should be asking is what trends will pick up in 2023. So far, the market has bounced back, up more than 40% since the annual open, while some others assets have recorded even more impressive gains. Most notably, staking derivatives which and have more than doubled in price.

1. Builders are back at work

It’s hard to get caught up in the depth of the crypto bear markets, but it’s worth noting how builders are withering the “cold winter” as they develop the next game-changing innovations in the crypto ecosystem. But as always, it is difficult to find the trends worth noticing in the noise, and it is a difficult task to determine which themes have a concrete value proposition from those that are more speculatively based.

For this reason, I have decided to outline a few sub-niches that I believe will thrive in 2023, and potentially be winning sectors in an emerging bull market. Let’s dive right in:

2. DeFi: Still knocking it out of the park

As much as 2022 may have been a rollercoaster for the entire crypto market, it is hard to ignore the fundamental developments that took place in the DeFi market. First, the number of daily active users (DAU) increased by 2% to 641,510, according to DappRadar. Although this growth is a drop in the ocean compared to 2020 and 2021, the growth we saw last year should be an indication of how well the sector is thriving with improving market conditions.

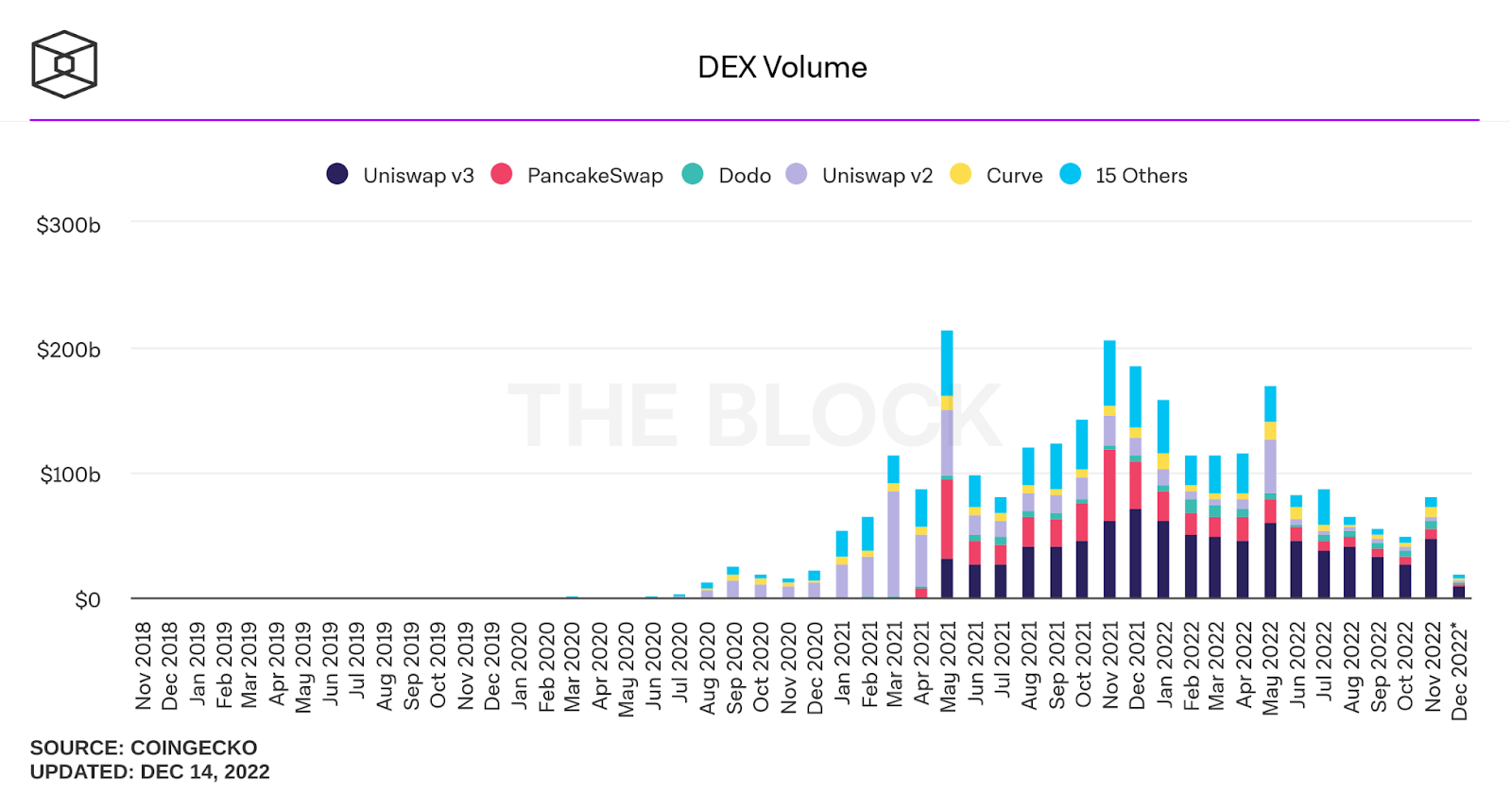

So, what exactly is the play here? At the very least, more crypto-natives will gravitate towards decentralized platforms given the events that unfolded last year; some of the most trusted custody platforms went under, with billions of dollars worth of client funds. The shift is already happening, with decentralized exchanges recording a 93% month-over-month increase in November 2022 following the collapse of the FTX exchange.

Besides the growth in adoption, 2023 is likely to be the year when we see the integration of DeFi protocols with traditional financial instruments. MakerDAO, one of the biggest players in the DeFi lending space, recently adopted a proposal to invest in US Treasuries and corporate bonds, as well as to form partnerships with traditional banks to provide loans backed by liquidity from real assets (RWA).

Finally, more traditional financial institutions are going to make a debut in the DeFi space; JPMorgan already set the pace with its first DeFi transaction in 2022. This introduces a likelihood that permissioned DeFi protocols will emerge to serve the growing demand from TradFi companies looking to tap into decentralized markets while playing by the regulators’ book.

3. NFTs and the Metaverse: GameFi on the Rise

GameFi, an intersection between financial and gaming communities, is another niche that crypto enthusiasts should be on the lookout for. Last year, blockchain-oriented games accounted for 49% of active DApp usage. There was also a growing interest from VCs, with notable players such as Andreessen Horowitz (a16z) and Sequoia Capital expanding their footprint in the NFT and Metaverse ecosystems.

As 2023 unfolds, signs on the wall show that GameFi is poised for more growth, both in terms of adoption and infrastructure development. Innovators in this space are already taking up the challenge of developing more engaging games as opposed to focusing only on ecosystem rewards. But more importantly, traditional game publishers are integrating their established infrastructures with the metaverse; Atari recently launched a suite of experiences in The Sandbox.

Well, that’s just the tip of the iceberg. Gamification trends through NFT technology are also being adopted by other industries. For example, we have new DApps like Fashion League, which uses NFTs to allow players to design personalized 3D fashion NFTs and compete with other participants in the ecosystem. While there is still an emerging space for innovation, the gamification of traditional industries is certainly one of the trends to watch this year.

What’s even more fascinating is that international companies such as Gucci, Nike (NYSE: ), McDonald’s (NYSE: ) and Campbell (NYSE: ) have already pioneered digital collectibles as a promotional strategy to increase interest in their offerings. It is clear that NFTs are changing the landscape of how businesses interact with consumers in the digital age and will continue to do so for the foreseeable future.

4. Ethereum’s Shanghai Upgrade

For Ethereum diehard fans, the much-anticipated Shanghai upgrade (EIP-4895) is the talk of the town. This improvement proposal will introduce a withdrawal feature, which will allow ETH validators to remove their funds locked in the beacon chain. In particular, the event will affect the demand and supply of ETH, as stakers will be able to liquidate their locked ETH while it will be much easier for more crypto users to opt in and out of ETH stakes.

According to the latest update from Ethereum’s developers, the Shanghai upgrade is scheduled for March 2023, and the narrative already seems to be fueling the price action of liquid derivative tokens like $LDO and $RPL. But more importantly, both of these ETH staking platforms have gained massive traction, with LIDO leading the pack with a total value locked (TVL) of $8.9 billion, while RPL enjoys just under $1 billion according to DeFiLlama metrics .

If this upgrade is successful, it is likely that the associated tokens will experience drastic fluctuations, either up or down. All in all, it is remarkable to witness Ethereum’s gradual transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus. Whether ETH’s market cap will challenge BTC’s dominance this year remains to be seen; it may be too ambitious for now.

Asset Tokenization: A new era of economic opportunity

The tokenization of real-world assets is another major theme that is likely to shape the outlook for the digital asset industry in 2023. BCG estimates that the tokenization market will grow to a $16 trillion ecosystem by 2030. While this number may seem excessive, other leading investment companies are also of the opinion that asset tokenization will be a focus area for financial institutions this year. VanEck predicts that close to $25 billion in off-chain assets will be tokenized this year.

So far, the central bank of Singapore has already partnered with JPMorgan to launch a blockchain pilot called ‘project Guardian’, an initiative that seeks to tokenize bonds and deposits, using smart contracts to facilitate trade executions. Although we are still early in the year, asset tokenization is clearly becoming an important topic for institutions looking to improve the efficiency and accessibility of their market instruments.

Larry Fink, CEO of BlackRock – the world’s largest asset manager, said:

“The next generation for markets and the next generation for securities will be the tokenization of securities.”

5. Central Bank Digital Currencies (CBDCs)

Over 100 central banks worldwide are currently exploring the possibility of CBDCs, some are in the research phase while others have already launched. The big question, however, is whether CBDCs will take off, co-exist with crypto, or replace the entire ecosystem.

According to a recent report by the People’s Bank of China (PBoC), the digital yuan accounted for 0.13% of the total circulation of the Chinese renminbi by 2022. Meanwhile, Nigeria’s eNaira usage is only 0.5% of the country’s population. Still, a drop in the ocean compared to the circulation of fiat currencies in both jurisdictions.

That said, the bottom line remains that we will likely see more CBDC initiatives in 2023. The European Central Bank (ECB) is in the investigative phase of the digital euro, with an implementing law set for proposal this year. Meanwhile, India recently launched two digital rupee pilots, one for the wholesale market and another for the retail market.

Based on these trends, the CBDC topic will continue to be a major topic of discussion in 2023. It comes as no surprise that CBDCs were identified as the top technological innovation challenge in last year’s G20 TechSprint.

***

Original post