Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Discount vs. destruction

- Bitcoin settles below $19,000 on daily time frames, suggesting more declines ahead.

- The Ethereum price is losing support at $1,300, and buying that low requires a clear void point.

- The XRP price has become the divergent outperformer in the crypto space, rising 30% this week.

The cryptocurrency market has been at its lowest point since the spring. Time will tell if these prices are worth buying.

The Bitcoin price is discounting

Bitcoin price has failed to hold ground above $19,000. On September 20, the bears have established a large bearish engulfing candle on the 2-day chart, while double establishing a new September low of $18,125

Bitcoin price is currently auctioned at $18,927. An influx of volume continues to enter the market with falling price. The relative strength index is still close to a significant level that has acted as support during previous bull runs. Additionally, there is a difference between the newly established low and the previous September low of $18,510.

A market bottom may be near, but buying the actual low will not be easy. A break of the summer low of $17,622 is within reach. Using it as an invalidation point might be too risky. The macro invalidation point for a Bitcoin bull run remains at $13,880.

BTC USDT 2-Day Chart

In the following video, our analysts dive deep into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

BTC USDT 2-Day Chart

Ethereum Price has lost support at $1300

The Ethereum price printed a 2-day candle settled at $1,245, the lowest trading price for ETH since mid-July. The volume profile indicator is still leaning upwards as the bulls own the strongest inflow days. However, the Relative Strength Index has broken a definitive line in the sand, suggesting that a change in market behavior may be unfolding amid the next countertrend rally.–

Ethereum price currency is trading at $1.262. Buying the lowest at this time will be very challenging. The safest invalidation to use if you are trying to buy a dip is the June 12 low of $1006. Under no circumstances should the Ethereum price break this level. Doing so would invalidate the entire uptrend scenario. A decline towards the June 20 low of $881 would be the next stop, resulting in a 30% decline from the current Ethereum price.

ETH USDT 2-Day Chart

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

The XRP price continues to fluctuate

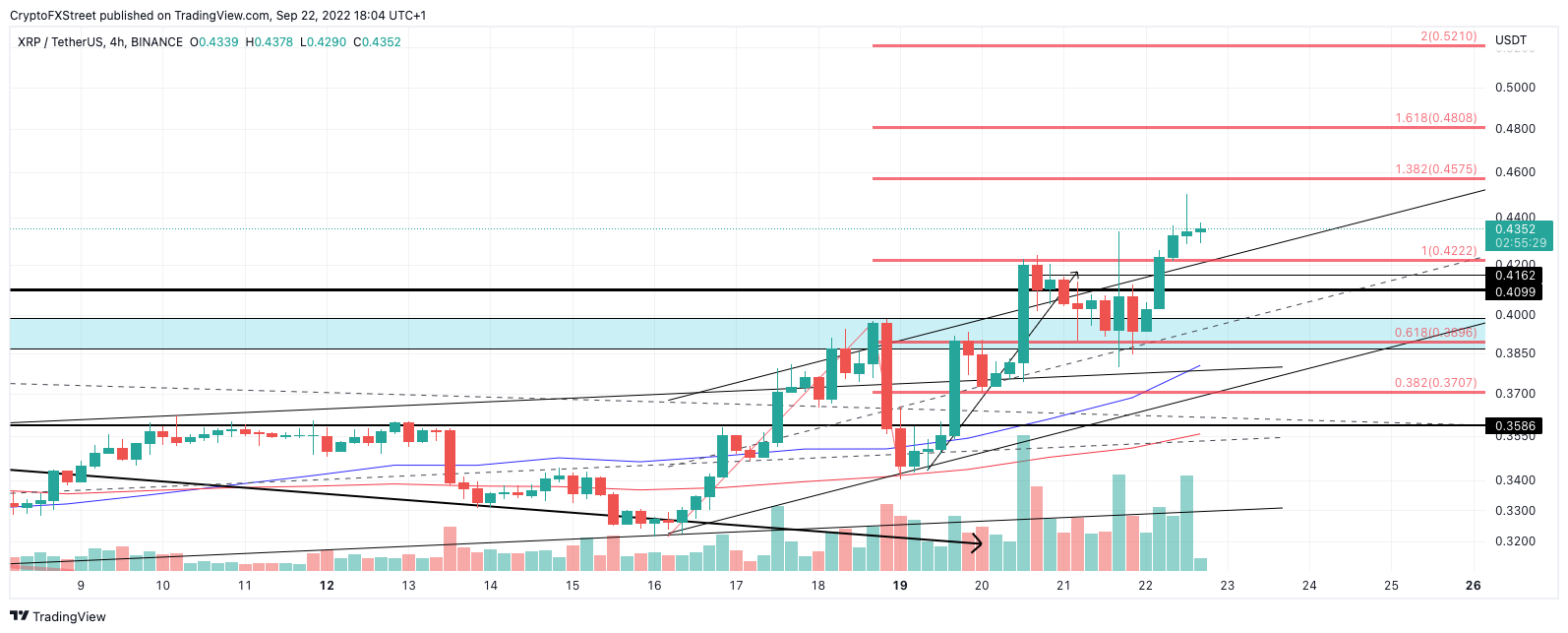

The XRP price has outperformed the pack, rising 30% since September 19. The buyers have produced applauding price action as consecutive bullish engulfing candles have been shown on the 4-hour chart.

The XRP price is currently auctioning at $0.4373 as the digital remittance hovers above a rising parallel channel. An influx of volume has entered the market, reinforcing the idea that there will be more gains for the Digital Transfer Certificate.

The next major resistance level is $0.4575 (based on Fibonacci projections from September’s rally and pullback). If the bulls find support at this level, an XRP price of $0.50 will occur in the coming days. Such a move would result in a 16% increase from the current XRP price.

XRP USDT 4 Hour Chart

In the following video, our analysts dive deep into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team