Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto Vs. inflation

- Bitcoin price prints a new high for December after rising 7% on the week.

- Ethereum price moved in unison with BTC and marked a key level of interest.

- The XRP price has remained the same, suggesting that the digital transfer token may be decorrelated from the market.

The crypto market has shown strength after the US consumer price index, which came in lower than expected. Key levels are defined to measure where bulls in the market can aim.

Bitcoin price bounces back

Bitcoin price has shown applauding price action as the bulls have achieved a 7% rally. On December 13, the peer-to-peer digital currency rose to the $18,000 level after finding support from the 8-day exponential moving average. When a consolidation with profits occurs, traders are forced to consider the idea that the BTC rally will continue.

Bitcoin price is currently auctioned at $17,784. The rally is interesting as November’s US consumer price index (CPI) came in lower than expected. At 7.1% for November, the index was lower than October’s 7.7%. The CPI is a metric used by the Federal Reserve to measure inflation. As a result of the decline, risky assets like BTC have lured investors to bid for short-term gains in anticipation of a Santa Rally.

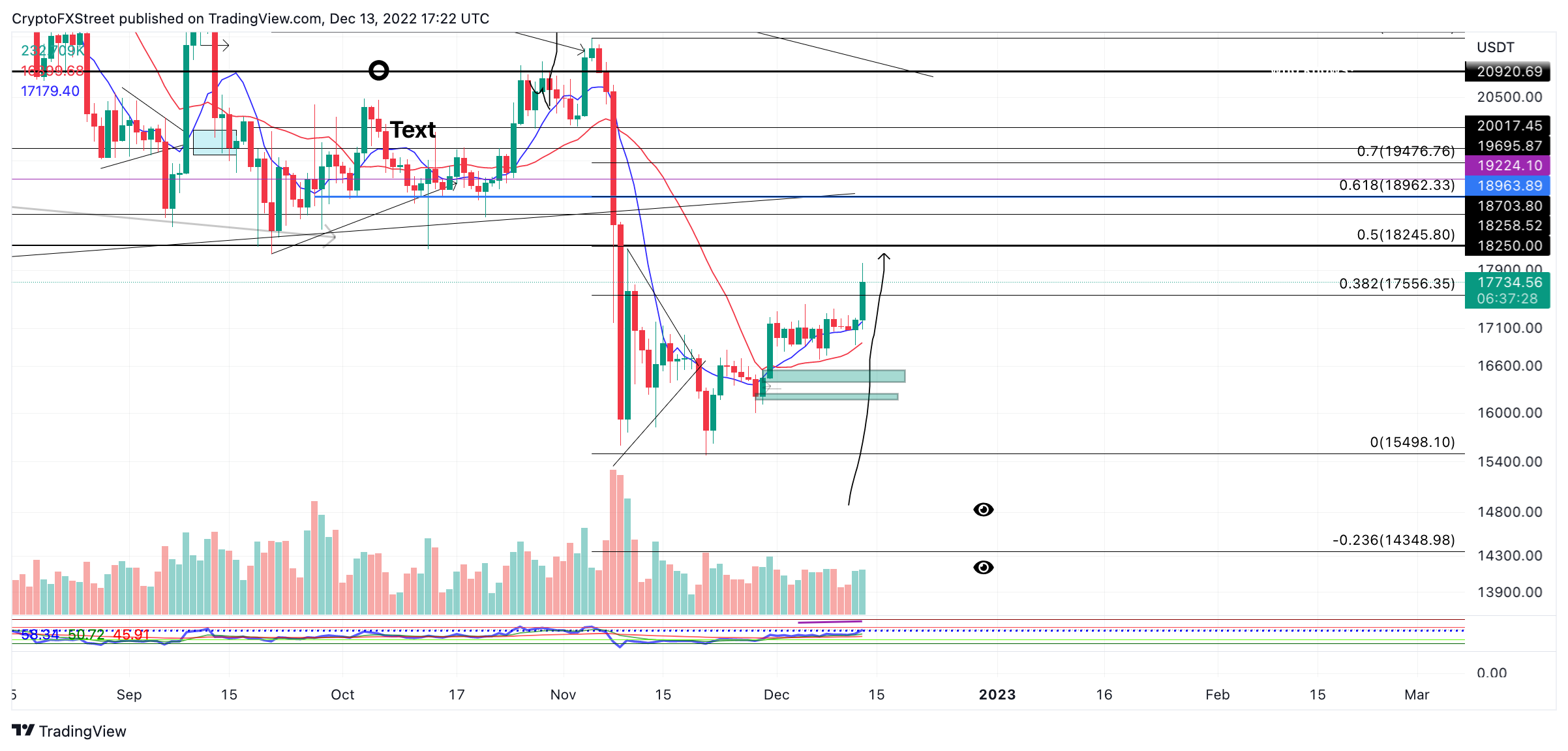

BTC/USDT 1-Day Chart

If the market is genuinely bullish, the next target will be the 50% retracement level at $18,245 and the 61.8% Fib retracement level just below the psychological $19,000 level. The Fib levels are based on the November swing high to swing low on the logarithmic scale.

The uptrend scenario will be invalidated if the bears pierce the previous traffic zone near $16,900. The bears could lead to a decline towards the yearly low of $15,476 if the bearish scenario occurred.

The Ethereum price takes charge

Ethereum’s price has moved in sync with its Bitcoin counterpart, returning 7% of lost market value to investors. On December 13th, the bulls pierced a descending trend line that served as resistance on three separate occasions since December 2nd. A classic technical analysis concept suited the ETH price action perfectly as “the fourth touch of the trend” solidified gains for bulls in the market.

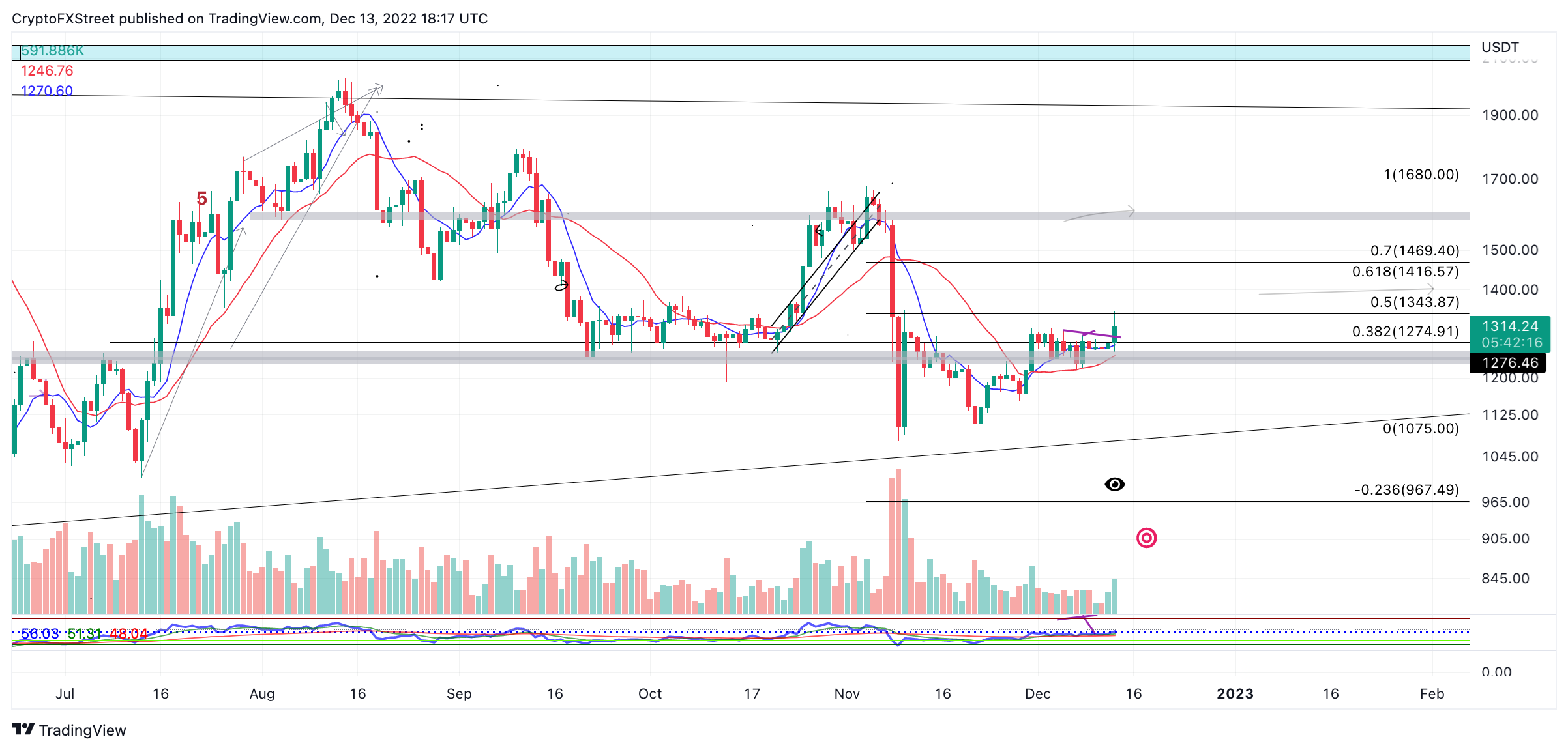

Ethereum price is currently auctioning at $1,317 as a consolidation of gains has begun near the 50% retracement level. Like BTC, the target zone was drawn out from the November high of $1,680 to the November low of $1,075. The volume indicator shows an increase in transactions, but fewer bulls are bidding prices now than on the bullish days of November 10 and November 30. Because ETH rallied 20% and 10% on the previous dates with more volume, conservative bullish targets should be used until more evidence is presented.

If the bulls can sustain their price action above the recently broken trendline, the 61.8% Fib retracement level at $1416 will be the next bullish target. ETH’s market cap would increase by 7% if said price action occurred.

ETH/USDT 1-Day Chart

A break below the recent swing low of $1,238 would invalidate the bullish potential. If the low is marked, ETH could fall back to the range and tackle the low area near $1,075, resulting in an 18% reduction from the current market cap.

The XRP price differs from the others

The XRP price witnessed no change in price despite the US CPI data release. At the time of writing, Ripple remains coiled between the 8-day exponential and 21-day simple moving averages, while finding support on a previously resistant trend line.

The XRP price is currently auctioned at $0.389. The digital remittance token’s refusal to rally higher, like Ethereum and Bitcoin, shows that XRP’s correlation to risk assets is declining. Furthermore, on December 12, the XRP price subtly changed the market structure by printing a lower low than the previous two swings at $0.370. While the signs may be early, XRP price could be setting up for a drop towards the second half of November’s trading range.

XRP/USDT 1-Day Chart

If the market is genuinely bearish, a second attempt at $0.37 could catalyze a 17% decline towards November’s low near $0.32. A break above the previous high of $0.41 would be needed to consider a countertrend bounce, potentially towards October’s broken support zone of $0.44. XRP will rise by 13% increase as a result of the bullish scenario.