Tom Brady probably lost big with the FTX Crypto Collapse

The collapse and acquisition of one of the world’s largest cryptocurrency exchanges FTX is set to hurt the company’s investors bigtime. Notably, one of these investors is one of American football’s most famous players who might be stuck on the track even longer than he wants to be.

Star Wars: Shatterpoint Announcement Trailer

02:27

The first things to do in VR, part 3

Today 09:39

Back in 2021 Tom Brady and his then-wife, Brazilian model Gisele Bündchen reportedly planted a large stake in the FTX crypto exchange, having already announced a partnership with FTX and its CEO Sam Bankman-Fried back in 2020. As brand ambassadors, the two received an undisclosed stake in the company in exchange for cryptoprobably FTX’s original coin FTT.

On Tuesday, FTX announced that it would be bought out by its rival Binance, which now wants to cement itself as the biggest decomposing egg carton on the fast-dissolving crypto trash heap. This comes on top of liquidity issues that have stopped users from being able to withdraw their crypto assets from the exchange. FTX has promised users that they will refund them, but they have not yet made a timetable for when this might happen.

The Buccaneers quarterback reportedly has a net worth of $250 million compared to Bündchen’s $400 million, according to the tracking site Celebrity Net Worth. The “long-term partnership” with FTX that was written in 2021 also mentioned that both celebrities and the crypto company would make an annual contribution of several millions to charity. The collapse of FTX could jeopardize the fortunes of both stars.

At the time, Brady said in a press release that “Sam and the revolutionary FTX team continues to open my eyes to the endless possibilities of crypto. Bündchen also said in the release, “Cryptocurrency will become more and more familiar to all of us as time goes on.”

G/O Media may receive a commission

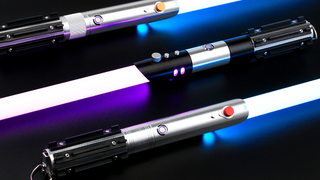

*light saber hum*

SabresPro

For the Star Wars fan of everything.

These lightsabers powered by Neopixels, LED strips that run inside the blade shape that allow for adjustable colors, interactive sounds, and changing animation effects as you duel.

How much both celebrities put into the stock exchange remains unclear, though reports showed FTX’s valuation increased by over 1,000% in 2021 from $89 million to over $1 billion. As pointed out by CoinDesksaw FTX on a $1 billion funding round and a $32 billion valuation in recent months.

Gizmodo reached out to press teams for both Brady and Bündchen, but we did not immediately hear back. Brady and Bündchen finalized the divorce in October, and although the 45– year-old Brady had originally planned to retire from the NFL this year, he has continued as Buccaneers quarterback. The jokes are already flying that this latest financial disappointment could set back Brady’s retirement even further.

Brady has already been active in the cryptosphere and helping out found an NFT startup called Autograph which created non-fungible tokens for the NFL. He just was one of many celebrities who jumped on the crypto bandwagon back in 2021, when blockchain bulls promoted that the value of crypto would only ever go up. During this year’s superbowl, actor Matt Damon stumped for Crypto.com with his infamous “Fortune Favors the Brave” ad.

Brady is likely throw much more than a Microsoft Surface out on the field with news that FTX is going up in smoke, but that’s probably nothing compared to how publicly calm and collected FTX founder Sam Bankman-Fried reacted to the news.

Now that it’s becoming more clear that FTX was a sandcastle built on an outgoing tide, Bankman-Fried’s $15.6 billion piggy bank may disappear as well. The 30-year-old billionaire held a 53% stake in his own company worth $6.2 billion and another $7.5 billion in his crypto research firm Alameda, according to Bloomberg. As of Tuesday, Bankman-Fried is nowhere to be found Bloomberg Billionaires Indexmeaning the company expects the young man’s fortune to all but wipe out, leaving him with just $1 billion, a 94% loss.

Crypto and financial analysts have already analyzed Binance CEO Chengpeng Zhao’s motivations and methods as to why he has decided to acquire the competitor. Zhao held a fairly large stake in FTT tokens after the founder split from Bankman-Fried and took a payout in crypto, according to Fortune. After dumping all those tokens over the weekend, Zhao essentially took the bottom out of SBF’s ship, and in just a few days, neither FTX nor Alameda had any real legs to stand on.