Three months in, Coinbase NFT has been a disaster

Important takeaways

- Coinbase NFT has failed to gain any significant traction in the three months since its launch.

- Since its launch on April 20, the NFT marketplace has done about $37,000 in average daily trading volume, or about 2,000 times less than its biggest competitor, OpenSea.

- In the same period, Coinbase NFT has only attracted around 8,668 users in total.

Share this article

Coinbase has one product that is performing even worse than the sluggish stock: the NFT marketplace.

Coinbase NFT Flops

Three months later, Coinbase’s NFT platform is proving to be a complete failure.

The largest US-based cryptocurrency exchange and one of the industry’s oldest centralized marketplaces appears to have botched the launch of its social marketplace for non-fungible tokens, Coinbase NFT.

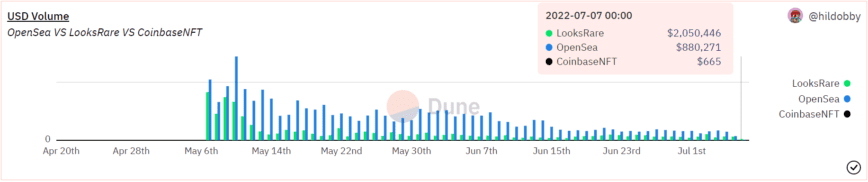

According to open source provider of crypto data Dune, Coinbase NFT has recorded only about $2.9 million in trading volume since its launch on April 20, putting its average daily volume at about $37,000. To put that into perspective, the largest NFT marketplace in the space, Open seahas seen over $5.9 billion in trading volume over the same period. Looks Weird, which launched just after the NFT market peaked in January, has recorded around $2.53 billion in trading volume. In the last 24 hours, Coinbase NFT has recorded only 6.1 ETH, or about $7,200, in trading volume.

While the exact reasons for Coinbase’s apparent failure are hard to pin down, it comes months late to the NFT bull cycle (and four months after it planned to launch), putting the spotlight on dubious NFT projects like MekaVerse (a once-hyped collection that was accused with rigging down and finally the tank), and blocking the platform’s launch certainly didn’t help.

Coinbase launched its NFT marketplace hoping to attract the masses and differentiated itself from the competition by styling itself as “the Web3 social marketplace for NFTs.” However, it appears that the product came too late for everyone to care. By the time the exchange released the product’s beta version in April – at least four months later than promised – the NFT market was already well on its way down to reach the same trading volume it had before the NFT bullrun even started.

The best month so far for NFTs was January, when the total monthly trading volume peaked around 17.1 billion dollars. That’s more than the total trading volume recorded since Coinbase NFT was launched. While interest in NFTs was in free fall, Coinbase made the decision to give the platform’s release to a limited number of waitlisted users at launch, likely hurting its adoption prospects in the process. Before launch, the platform had around four million users waiting in line to try it, while today it has only registered around 8,668 users in total.

Despite launching five full years before the now largest cryptocurrency exchange in the world, Binance, and seven years before its rapidly encroaching competitor, FTX, Coinbase has begun to lose its industry relevance and market share over time. While the exchange listed on the Nasdaq in April 2021 in what was described as a “watershed moment” for the crypto industry, the stock has since fallen amid a shaky macroeconomic environment, trading about 84% off its high of $51.71. The botched launch of the NFT marketplace “for social engagement” only adds to its downfall, setting the company back millions of dollars with little to show for it.

Disclosure: At the time of writing, the author of this article owned ETH and several other cryptocurrencies.