Three Altcoins to Consider in 2023

ArtistGND photography

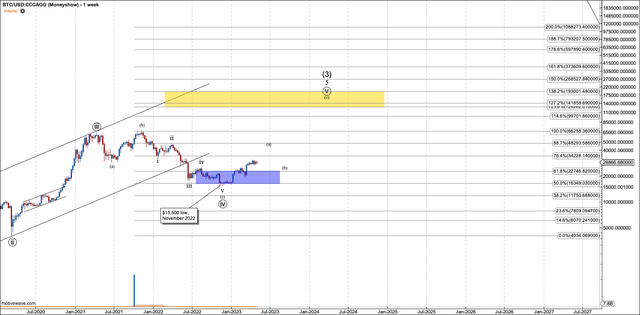

The last articles that Jason and I published discussed the possibility that Bitcoin (BTC-USD) will behave bullishly for the rest of 2023. However, we do not foresee the price action in Bitcoin as clean. If Bitcoin does it at six-figure prices over the next year or two, it will do so in a very choppy fashion. I see the price action in Bitcoin from 2018 to today as a big ending diagonal. That means the leg from $15,500 to my expected $125K should take on an ABC structure. It is much more difficult to trade than the five-wave structure of an impulse, which tends to have more upward velocity and shallower retracement than ABC structures.

As difficult as I expect the price action to be, since the November 2022 low, Bitcoin has been hitting higher lows on its daily chart without any signs of a breakup.

Bitcoin, daily chart (created in Motivewave)

A warning

Before we dive into a few select altcoins, we need to acknowledge the risks. First, I liken investing in altcoins to participating in venture capitalism, but without the legal rights inherent in the agreements in which VCs participate. Altcoin investors bet on projects they are passionate about. But most of the time, the tokens involved do not give rights to the cash flows of such projects if they are successful.

That being said, I still believe that the crypto sector has given birth to many projects that have changed the economy forever. As an example, the utility of decentralized DEXs has seen their volume eclipse that of centralized exchanges over the past year. I support many such projects. But that doesn’t mean you have to own a DEX’s token. Most often, the best way to participate in the fees of DEX traders is to participate in the liquidity pools of such DEXs. The tokens of leading DEXs such as Uniswap (UNI-USD), SushiSwap (SUSHI-USD) and PancakeSwap (CAKE-USD), have by and large done terribly despite the success of the products they represent.

Jason and I have seen many counts in altcoins fail. They consistently tend not to fill out impulses on a large scale, often failing for three waves before beginning a path to all-time lows. That said, using Elliott Wave analysis on altcoins is a means of evaluating when sentiment is likely to lead to higher prices. We have been able to track stops and get out when errors occur. Trailing stops combined with regular profit taking lead to big profits.

This is to say: if you are an investor, don’t touch altcoins. Stick with Bitcoin and Ethereum (ETH-USD) as they have proven their long-term trends. And if you’re venturing into altcoins, you need to know when to exit early, sometimes at a loss, when warranted.

Having heard my fair warning, let’s look at three I’m interested in now.

ImmutableX

ImmutableX is a company that builds web3 infrastructure to create games to make money and NFTs. It is a Layer-2 scaling solution on the Ethereum blockchain.

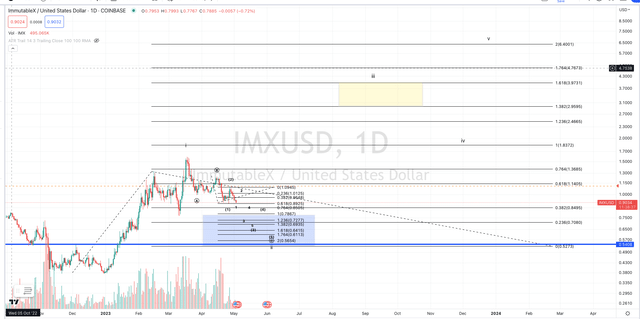

The ImmutableX token, IMX (IMX-USD), is a highly speculative play. It was launched at the beginning of the 2021-22 bear market, in November 2021. Naturally, after its launch, it remained in a relentless downtrend through December 2022. That means there are many serious sellers eager to get their money back.

However, after posting an all-time low of 37 cents on December 30, 2022, IMX started a strong rally that brought it to $1.59 on March 18, 2023. That made many former owners whole. But after the high, a new downtrend started.

From an Elliott Wave perspective, the 2023 rally in IMX looks to be a nice impulsive rally with five waves into the march high. That means the current correction since the high is likely to be a wave 2 before IMX begins to form a five-wave structure to a greater extent. This wave 2, shown on my chart below, should bottom between 77 and 54 cents. Right now it looks like it will come very close to the lower number. Below 54 cents, sustained, I will no longer have a bullish perspective and will expect new all-time lows. But assuming IMX can hold, and depending on where it finds a final bottom, my target for the next degree could range from $4.85 to $10.

IMX Daily Chart (Trade View)

GMX

The GMX (GMX-USD) token is issued by GMX.io, a decentralized perpetual futures exchange running on the Arbitrum (ARB-USD) and Avalanche (AVAX-USD) networks. It acts as a management token and the exchange shares 30% of the fees with the holders. That makes it one of the few tokens that provides a cash flow that is not produced by inflation, but rather a cash flow that enters the ecosystem from users via trading fees.

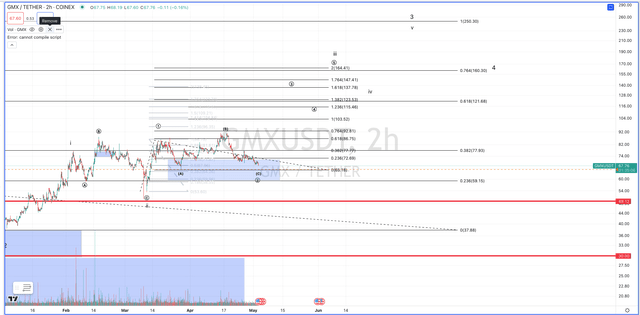

GMX was born during the crypto bear market of 2022, but never participated in that year’s downtrend as volume on the exchange continued to grow. The low on my chart was June 15, 2022 when it traded at $9.70. At the time, Bitcoin was trading at $22,500. As Bitcoin posted its 52-week low on November 9, 2022, near $15,500, GMX traded at $26.45. As Bitcoin began its latest rally from the lows, GMX only strengthened. It is trading at $69.17 at the time of writing.

I don’t think the long chart is incredibly clean, in part because of its short history. That causes caution when suggesting long-term swing trades. However, today we have a nice, immediately bullish, low-risk setup in GMX. Support for the trade is $59.30. Wrestling that is not necessarily bearish, but it makes an already cloudy long-term chart even less clear. So I will use that level as a stop. If that level holds, GMX is targeted at $164. That level is probably the top of the third in a big C wave. However, after that level is reached, I will take significant profits until the long-term intentions of the chart are clearer.

GMX Daily Chart (Trade View)

Rocket pool

This next coin is a long term setup. It is not meant to conflict with my warnings about altcoins. I am saying that this setup may take time to materialize into gains. You still have to be careful with how much you risk in this coin.

Rocketpool is among a few protocols that allow users to participate in Ethereum validation and its monetary rewards by staking as little as 0.01 Ethereum. Without the protocol, to be an Ethereum validator, one must stake at least 32 Ethereum. The difference in today’s prices is $18 versus $58,400.

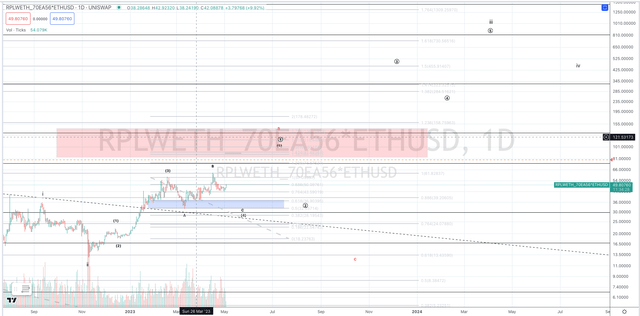

The protocol’s token, RPL (RPL-USD), is used as a governance token and a currency to pay protocol fees. RPL rose from $1.20 to $63 in 2021 in a structure that can be called a leading diagonal. After peaking in 2021, it fell to the $7 region in June 2022. But it did not continue to fall with Bitcoin into November of that year. It reversed, went back to $35, and started a series of higher highs and lows. Finally, in the last two months, it reached new records.

In the short term, I can see RPL continuing into the $90 to $120 region as long as $33 holds. However, this region requires care. If at any point it holds below $33, it could fall back to the $7 region in my red c wave. I treat it as likely and hold my position very lightly. I would scale to the $30s, should the pullback happen. That’s because circle-2 is valid down to $2.91. If it holds, RPL has a chance to reach $600 above in its third wave. If it never prints the lower red C wave, then it must be; my small position will give big profit on percentage basis.

These are monstrous areas to deal with, so you can’t take on the position size you’re used to in low beta stocks, or high beta for that matter. You need to keep it light so you can afford to capture volatility.

I pride myself on making a lot of money in crypto by risking very little on each trade.

RPL Daily Chart (Trade View)

Conclusion

In conclusion, Bitcoin is likely to be bullish for the rest of 2023. But unfortunately, the action so far suggests a very choppy path to $125K. If at any point $18K breaks, this view becomes questionable. Because Bitcoin tends to carry a lot of altcoins with it, a bullish Bitcoin cycle is a safer time to trade altcoins. But we can’t pick any altcoin and assume it will act bullishly. We must judge the structure of any chart we are interested in. In light of this perspective, I have selected three altcoins for your consideration: IMX, GMX and RPL.

Editor’s Note: This article covers one or more microcap stocks. Be aware of the risks associated with these stocks.