This will reduce Bitcoin, Ethereum Tx fees to cents: Vitalik Buterin

Any currency must have an exchange value, i.e. it can be exchanged for products or services. Cryptocurrency has been trying to bridge this usability gap for some time now; But to make it popular as a means of payment, the industry was characterized by periods of high transaction fees. Ethereum, the second largest cryptocurrency and the leader of altcoins, has become synonymous with high gas taxes. Ethereum co-founder Vitalik Buterin acknowledged the same, that crypto payments would once again “make sense” as transaction costs are reduced to mere cents due to layer-2 rollovers.

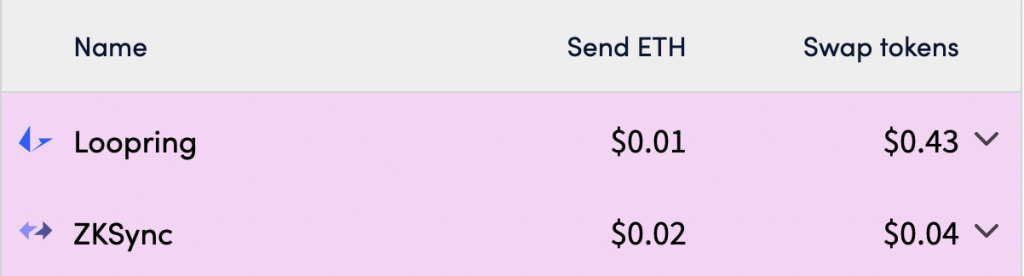

CoinTelegraph quoted Buterin during the ongoing Korea Blockchain Week [KBW], adding that blockchain data compression is the final hurdle to bringing down gas taxes. Although layer-1 is slowly working to reduce gas fees, the real wonders of the Ethereum ecosystem were observed on layer-2 scaling solutions. For example, the cheapest L2 options were Loopring and ZKSync. Loopring charged $0.01 per transaction, while the cost of a single transaction on ZKSync was $0.02.

During his talk, Butering pointed to Optimism’s layer-2 solution, which has worked to reduce the size and cost of data in blockchain transactions by introducing zero-byte compression. He noted,

“So today with roll-ups, transaction fees are usually somewhere between $0.25, sometimes $0.10, and in the future with roll-ups with all the efficiency improvements that I talked about, transaction costs could go down to $0.05, or maybe as low as $0.02. So much cheaper, much more affordable and a complete game changer.”

While Ethereum was at the center of the “high transaction fee” claims, Buterin pointed to Bitcoin, noting that its “peer-to-peer electronic cash system” had become expensive over time. Until 2013, it was cheaper than traditional payment methods; however, blockchain transactions have become expensive given its adoption.

Buterin stated,

“It’s a vision that, I think, has been kind of forgotten, and I think one of the reasons it’s been forgotten is basically because it was priced out of the market.”

Nevertheless, Bitcoin’s layer-2 Lightning network has been working to solve this problem and may eventually reduce the cost to fractions of a cent.

Ethereum and other Crypto use cases

Buterin set his sights on “countries with lower incomes or places where the existing financial system is not very efficient” to solve the problem. With the cheap crypto transactions, citizens will gain access to important payment structures over the internet, which have already seen massive adoption despite the cost of international money transfers.

But if we zoom out, Ripple was already working to connect many such countries through its On-Demand Liquidity technology. Using XRP, Ripple offers payment solutions to crypto users and the world. Through its On-Demand Liquidity [ODL] services, Ripple has largely bridged financial gaps by offering remittance services. Recently, Ripple signed a partnership with FOMO Pay, one of the leading payment institutions in Singapore, to improve its treasury payments by leveraging ODL.

Nevertheless, his vision for Ethereum was to make transaction costs cheaper and help increase the use of non-financial applications such as the domain name system [DNS] servers, human proof of attendance protocols and Web3 account management services.

“You actually have to send a transaction to create a DNS name, you actually have to send a transaction to restore your account, you actually have to send a transaction to fulfill any of these customizations. If each of these operations costs like $11, then people don’t go into it.”

While many have repeatedly questioned Ethereum’s scalability plan, Butering noted that it wasn’t “just like a boring thing that you need when the cost numbers go down. scalability, I think, actually enables and unlocks whole new classes of applications.”