This indicator suggests that US investors sold Bitcoin harder than others during the crash

The Bitcoin Coinbase Premium Index suggests that US investors have sold more than others during the latest crash in the crypto.

The Bitcoin Coinbase Premium Index has recently turned deep red

As pointed out by an analyst in a CryptoQuant post, whales on Coinbase Pro appear to have been behind the latest dump.

“Coinbase Premium Index” is an indicator that measures the percentage difference between the Bitcoin price listed on Coinbase Pro (USD pair) and that listed on Binance (USDT pair).

Coinbase Pro is popularly known to be used by investors based in the US (especially large institutions), while Binance gets a more global traffic.

Therefore, the price gaps listed on these two crypto exchanges can suggest which investors are selling or buying more.

When the calculation has a positive value, it means that the value of BTC on Coinbase is higher than on Binance right now, indicating that US investors have provided more buying pressure recently.

On the other hand, negative values of the premium suggest that US owners are dumping more than global investors at the moment.

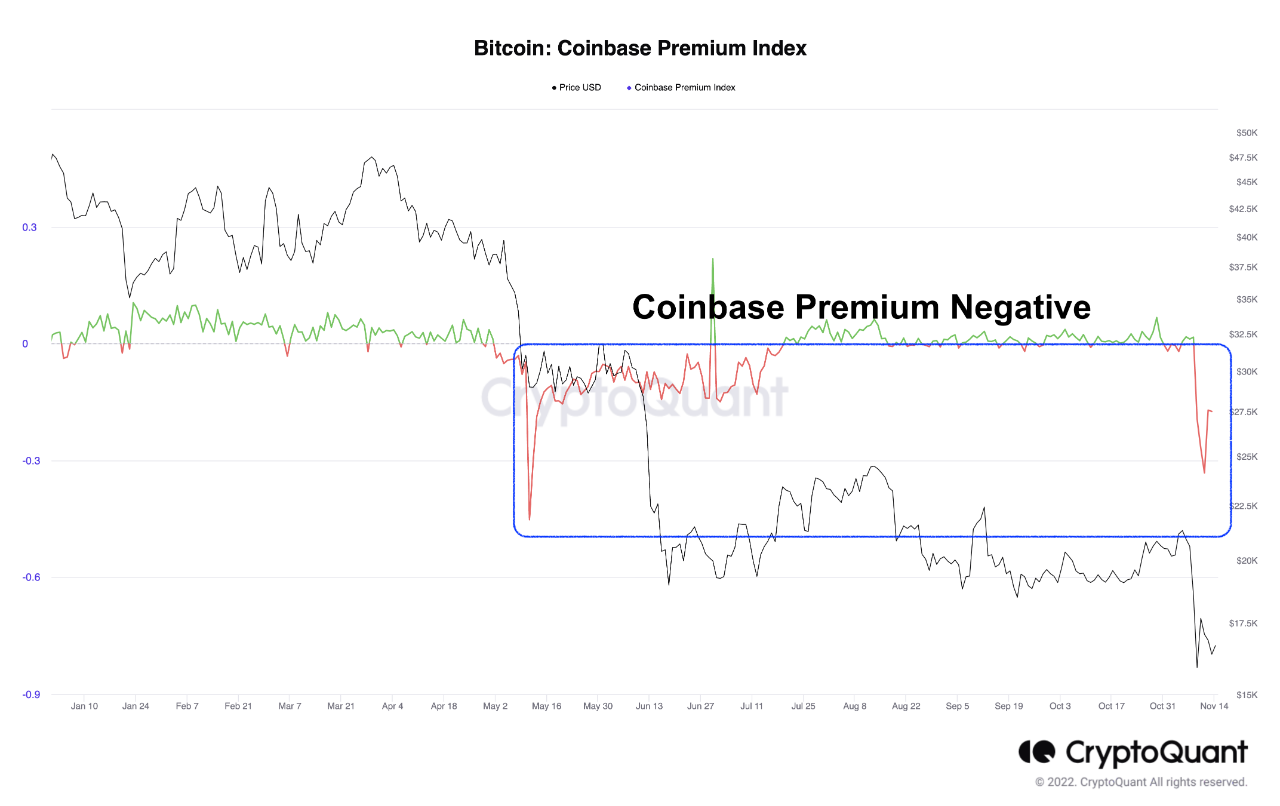

Now, here is a chart showing the trend of the Bitcoin Coinbase Premium Index over the past year:

The value of the metric seems to have been red in recent days | Source: CryptoQuant

As you can see in the graph above, the Bitcoin Coinbase Premium Index has plunged into negative values recently along with the crash.

This means that US investors have dumped more aggressively than investors from the rest of the world over the past week.

Also, as is clearly visible in the chart, a similar trend was also seen back in early May, when BTC’s price crashed from $40k to $30k.

Kvanten notes that while Coinbase was observing this selloff, the Bitcoin Korea Premium Index showed some interesting behavior. The chart below highlights this trend.

Looks like this metric had a green value recently | Source: CryptoQuant

The Korea Premium Index measures the gap between prices quoted on South Korean crypto exchanges and prices on other exchanges.

From the graph it is clear that during both the current crash and the one in May, the indicator showed positive peaks.

This implies that while the American investors dumped, the Korean investors focused on “buying the dip.”

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.8k, down 15% in the last week. Over the past month, the crypto has fallen 11% in value.

BTC has been stuck in consolidation under $17k in the last few days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com