This chain indicator suggests that Bitcoin is still only one-third into the bear market

Bitcoin’s long-term holder SOPR may suggest that the crypto is still only a third of the way through the latest bear market.

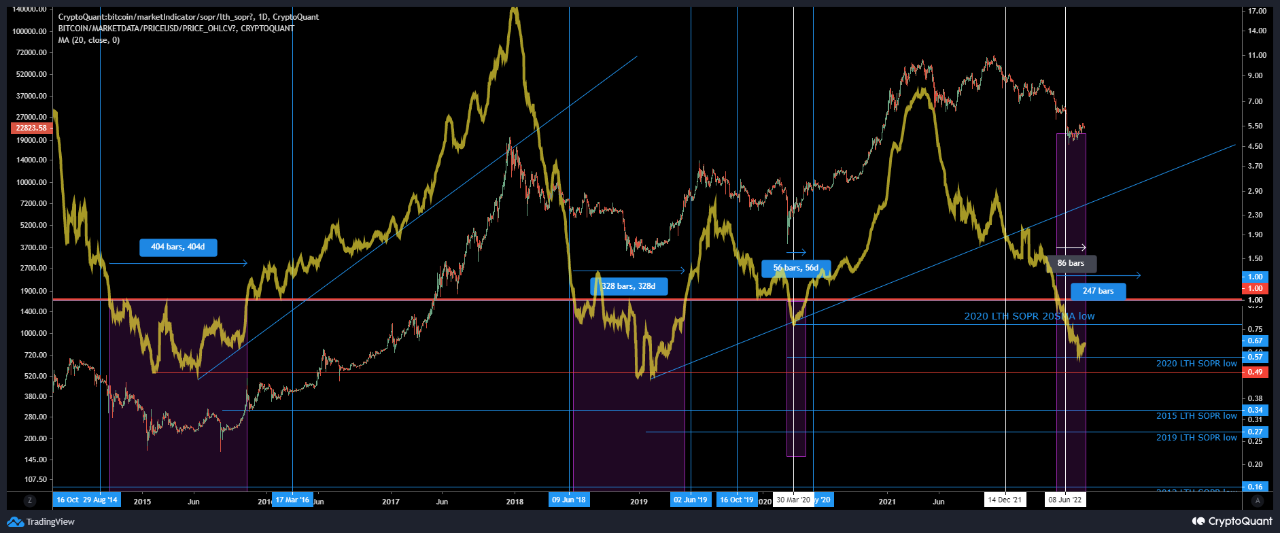

Bitcoin 20-day SMA long-term holder SOPR has only been 86 days in the bottom zone

As pointed out by an analyst in a CryptoQuant post, the crypto is still only 1/3 of the way into its average historical bottom period of 260 days.

The relevant indicator here is the “Spent Output Profit Ratio” (or SOPR for short), which tells us whether the average Bitcoin investor is selling at a profit or at a loss right now.

The metric works by looking at the history of each coin sold on the chain to see what price it was last moved to. If this previous sale price was less than the last BTC value, the coin has just been sold at a profit. Whereas if the last value was more than the current one then that particular coin lost.

When the value of SOPR is greater than one, it means that the market as a whole is selling at a profit right now.

On the other hand, the indicator being less than one suggests that the average holder is currently moving coins at a loss.

The “long-term holders” (LTHs) are the Bitcoin cohort that includes all investors who have held their coins for at least 155 days without selling or moving them.

Now, here is a chart showing the trend of the BTC SOPR (20-day MA) specifically for these LTHs over the past few years:

Looks like the value of the metric has been pretty low recently | Source: CryptoQuant

As you can see in the graph above, the Bitcoin LTH SOPR (20-day SMA) dipped below the “one” mark a while back.

In the diagram, the quant has also marked all relevant trend zones for the indicator in relation to the bear market.

It seems that historical bottom periods have lasted every time the metric has been stuck below the breakeven point.

On average, past bear markets have lasted around 260 days based on LTH SOPR. In the current cycle, the coin has so far spent 86 days in the bottom zone.

This suggests that if Bitcoin ends this bear market around the same time as the average, then the crypto is still only a third of the way there.

BTC price

At the time of writing, Bitcoin’s price is hovering around $23k, down 2% in the past week. Over the past month, the coin has risen 13% in value.

The value of the crypto seems to have been moving sideways during the last few days | Source: BTCUSD on TradingView

Featured image from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com