This Bitcoin Price Buy Signal Suggests the Start of a New Macro Bull Run, Should You Start Buying the Dip?

With the Bitcoin (BTC) price up 47% so far this year, things are looking pretty bullish after a bearish collapse of major crypto players in 2022. So this newsletter is focused on answering the questions that most retail investors are facing right now:

- Is this a bull run?

- Should I buy crypto now?

To answer these questions, I will take a look at Bitcoin and a reliable signal that has consistently indicated the start of a bull run. I want to take it a step further and find out which strategy is better – buy and hold, aka lumpsum investing, or buying dips.

Disclaimer: This strategy is from a purely technical point of view and does not take into account the calculations on the chain or other external factors such as macroeconomics. This newsletter is NOT financial advice.

Is this the Bitcoin bull run?

From a daily time perspective, the Bitcoin price appears to have put an end to its downtrend as it produced a higher high of $23,800 on January 30, versus the November 5 swing at $21,480.

Technically, a trend reversal is underway, indicating that the narrative is turning bullish, but further confirmation is needed. This signal will come if BTC produces a higher high above the last key swing formed on August 15 at $25,211 and manages to hold above the $20,000 psychological level.

Also Read: Bitcoin Whales Buy Dip Despite Sell Signals, And It Makes Sense

BTC/USD 1-Day Chart

Understand the strategy

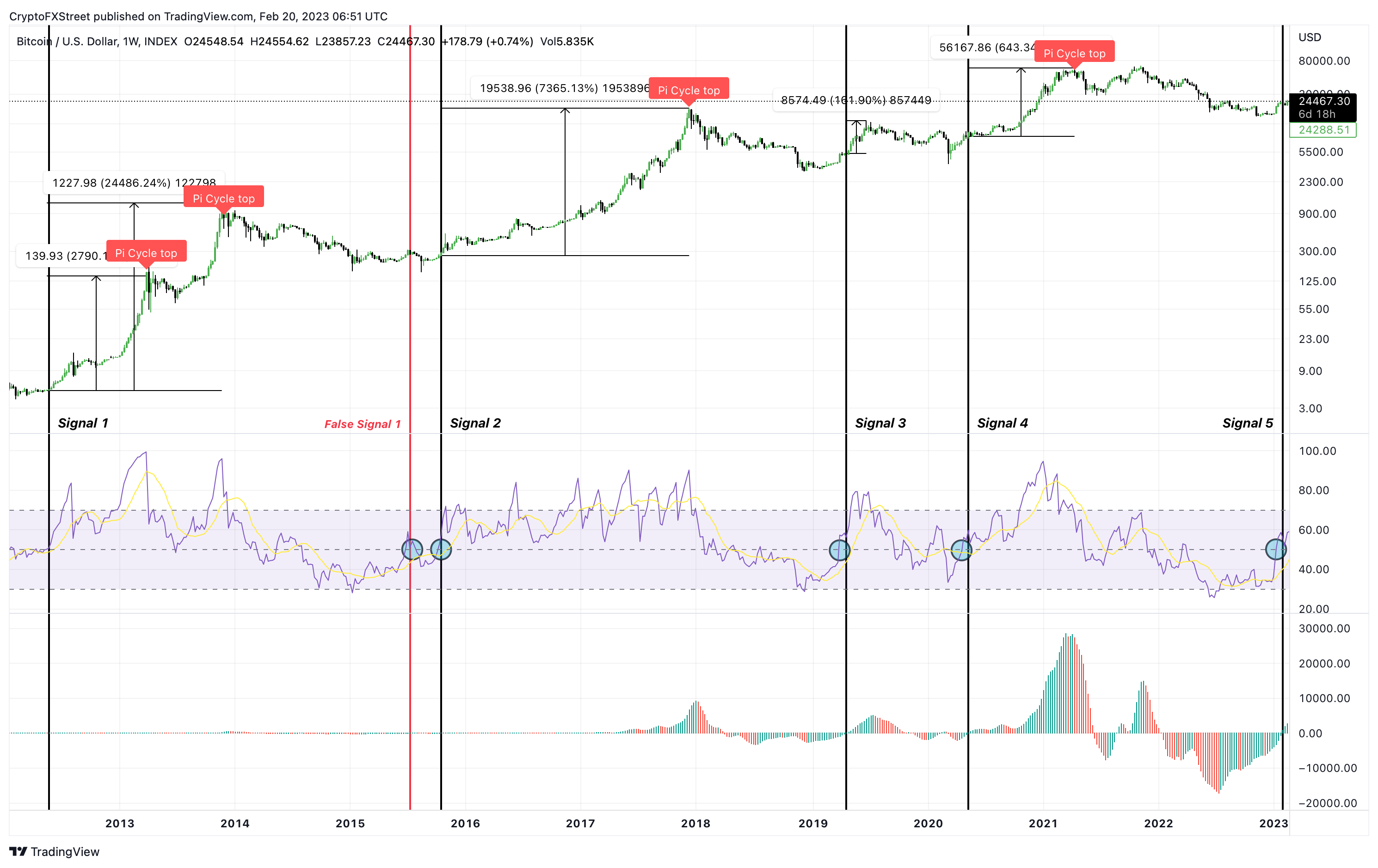

The strategy uses two popular momentum indicators, Relative Strength Index (RSI) and Awesome Oscillator (AO), for Bitcoin price on the weekly time frame. The main condition that produces a buy signal is that the RSI must be above 50, and the AO must be positive or above the zero line.

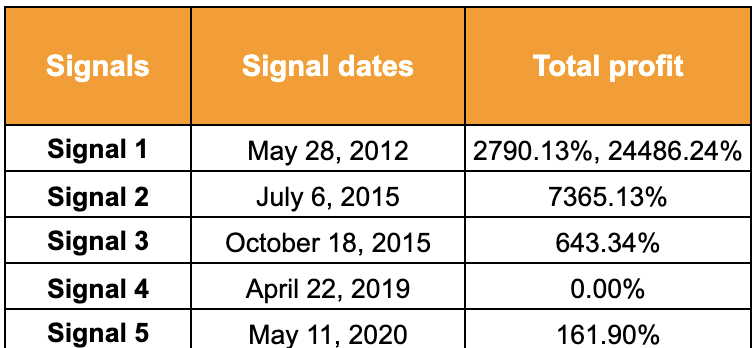

Since 2012, these conditions have produced five buy signals. July 6, 2015 was a false positive, where the RSI fell below 50 briefly.

The Pi Cycle Top Indicator available on TradingView is used to accurately determine Bitcoin bull run tops or sell signals. The following table shows the performance of the Bitcoin price based on this strategy.

BTC/USD 1-week chart

The first buy signal was on May 28, but the Pi Cycle top indicator gave two sell signals; one on 1 April 2013 and the other on 2 December 2013. Therefore there are two result percentage values in the table below.

In retrospect, the buy signal has proven to be extremely reliable and flashed the sixth buy signal on January 30, 2023. Since this time, BTC is up 3.10% and at the time of writing is trading at $24,486. The returns seen in the table are self-explanatory, but considering on the macro conditions, investors can choose a relatively risk-averse strategy based on these buy signals.

Buy-the-dip

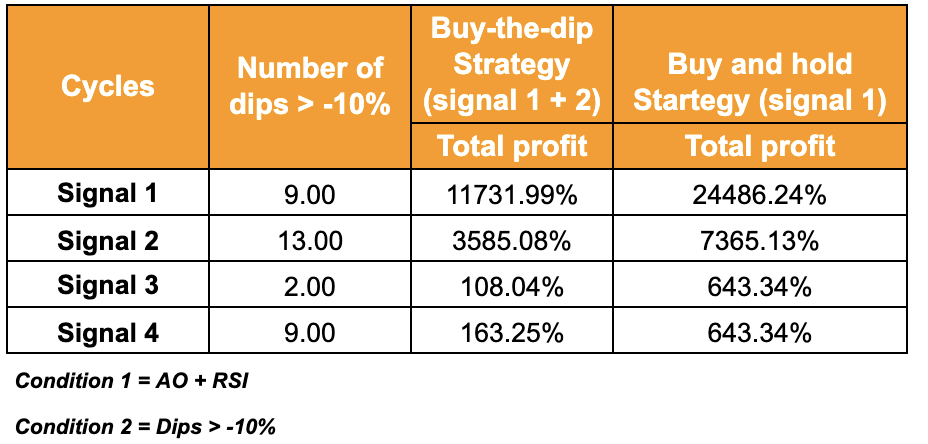

Instead of one-time investment BTC after the first buy signal, market participants can choose to distribute their capital in equal parts when the Bitcoin price goes back during the bull run. The only advantage this strategy has is that if the signal were to be a false positive, it would allow buyers to exit or double their decision, depending on the nature of the false positive signal.

After the main purchase conditions are met, interested participants may choose to purchase dips greater than -10%. After the first buy signal, the Bitcoin price had nine drops greater than -10%, indicating nine buying opportunities for investors.

The second buy signal had 13 drops. Signal three and four saw two and nine drops respectively. The table attached below shows a comparison of returns if investors stuck to the lumpsum strategy versus if they bought dips.

Should you start investing now?

The simple answer is yes. A rather complicated way of looking at this topic would involve paying close attention to the macroeconomic conditions and Bitcoin’s historical cycles to determine whether the current buy signal will lead to a bull run.

The macroeconomic outlook appears to be improving due to disinflation. But if the economy deviates from its current path, it will cause the US Federal Reserve to veer off course and implement strict plans to reduce inflation. Such a move could probably break the system and trigger a major recession.

Bitcoin price has spent approximately 462 days in a bear market and has dropped nearly 77% from its all-time high of $69,000. From a historical standpoint, a further pullback to $10,000 would not be surprising to many long-term investors, but the question of whether it will happen has not yet been answered.

Because of all these uncertainties, pragmatism is the best approach. Retail investors, especially millennials, typically don’t have a lot of money saved up. Therefore, participants like these are better