This Bitcoin cycle signal suggests that the bear market is coming to an end

A powerful new analytical tool in the chain has been launched – the Bitcoin Cycle Extremes indicator. It is designed to help find extreme conditions in the Bitcoin market. It tries to answer the ultimate question of the crypto overview when the market is peaking or bottoming.

Of course, there are many great tools and indicators that can be looked at individually or in combination. They provide guidance in looking for confluences on your own to determine extreme market conditions. However, there is a way to automate this confluence of several indicators and put them into a common calculation. Taking into account the many components and factors of the Bitcoin market aims to more accurately identify potential peaks and troughs.

Cycle Extremes, a new tool from Glassnode, aims precisely to create such an indicator that does not depend on a single data set in the chain, but combines several basic calculations into a synergistic whole. Thus, if an extreme ratio signal appeared on this combined metric, its strength would be much greater than the separate components.

A basic version of the Cycle Extremes indicator was recently presented by Glassnode’s lead analyst @_Checkmatey_ on his Twitter feed. On that occasion, he stated that “confluence is your friend.”

In addition to the basic version, there is also a second version with oscillators, which we will present below.

Cycle extremes: 4 indicators in 1

On-chain analysis is an attempt to quantify the behavior of Bitcoin investors. This can be done in the form of various criteria, categories and calculations, for example activity in the chain, profit and loss or coin holding period.

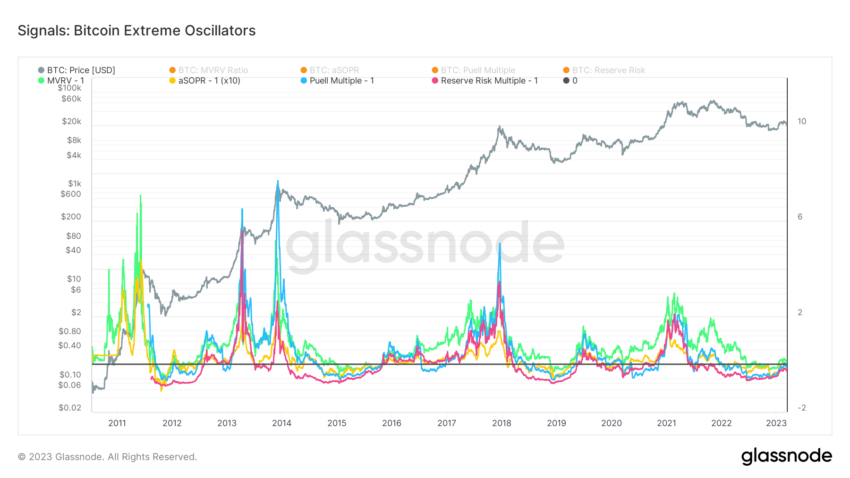

The Cycle Extremes indicator from Glassnode takes into account the four most popular metrics that have historically shown high accuracy in determining the peaks or troughs of BTC cycles. Specifically, it measures +/- 1 standard deviation from the extremes of the following oscillators:

- MVRV Ratio (green) – indicates unrealized gain/loss for the entire market

- aSOPR (yellow) – measures the extreme levels of realized profit/loss

- Puell Multiple (blue) – indicates the relative income and profitability of BTC miners

- Reserve Risk (red) – shows the degree of HODLing of coins

Bitcoin highs and lows

Each of the above calculations returns a binary value of 1 or -1 if it reaches an extremely high or low value. Meanwhile, the Cycle Extremes indicator aggregates these values for all four metrics. The indicator identifies a Bitcoin market top or bottom if a confluence of at least 3 of the 4 components appears.

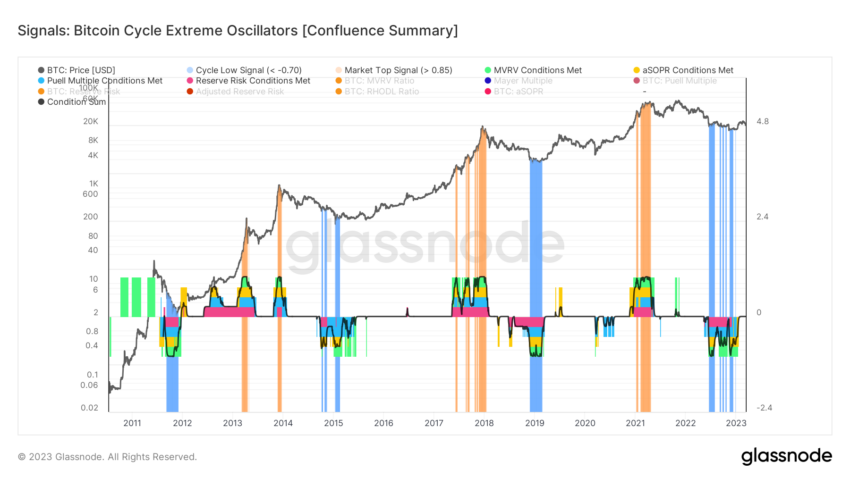

In such a situation, Cycle Extremes generate a blue signal for an extremely cooled market at the end of a bearish trend. In contrast, a yellow signal for an extremely overheated market usually appears at the end of a bullish trend.

The chart shows that the extremes of the ongoing bear market appeared between the middle of June and the end of December 2022. With the decline of the Bitcoin market and the rise to the top of $25,000 since the beginning of 2023, the blue signals of extreme downward deviation have disappeared.

It is worth mentioning that the ongoing decline below $20,000 has not generated enough of a signal on the indicator.

Is the worst of the bear market over?

However, the most important question remains: what is the chance that bearish signals can still return in the current cycle? In the chart above, we can see that no historical bear market has been followed by blue signals over such a long period of time, about 6 months.

On the other hand, in previous macro bottoms, the blue signals from Extreme Cycles were not so diffuse and spotty. Only the 2014-2015 bottoms bear any resemblance to the current cycle bottom structure. However, the current spread of signals is still at a record high.

Regardless of the future fate of Bitcoin, it is worth watching this new development of chain analysis from time to time. The increasing complexity of the cryptocurrency sector requires a global view and analytical innovation. At the same time, one should not give in to the illusion of a single, magical indicator that is never wrong.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

aSOPR

aSOPR Reserve risk

Reserve risk

(@_Checkmatey_)

(@_Checkmatey_)