The third quarter has done a pretty good job so far of debunking the old Wall Street advice to “sell in May and walk away,” as anyone doing so would have locked in some big losses and missed out on a very healthy start to current quarter. While most of the year was dominated by energy names, there is a new boss on the block, and by block I mean blockchain.

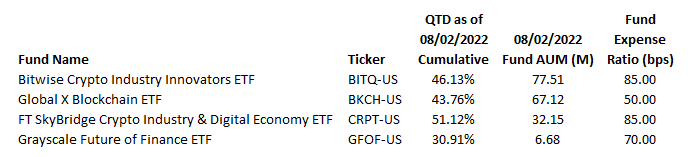

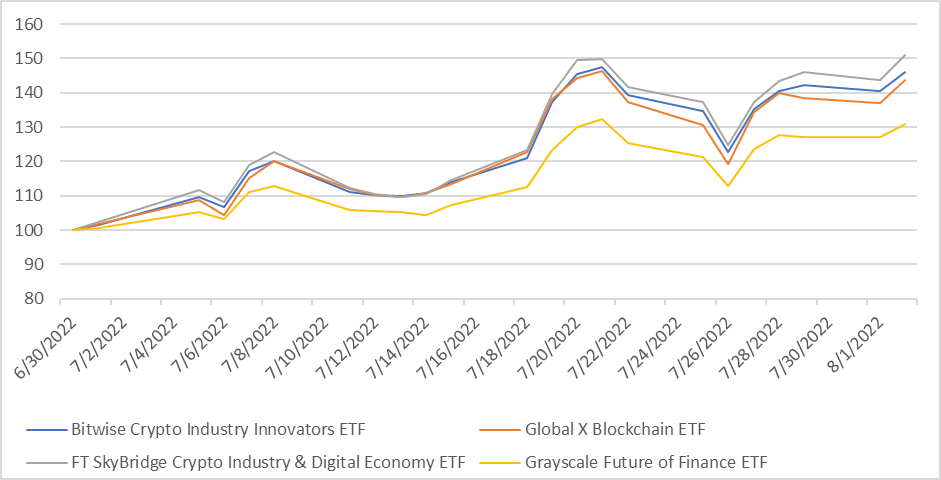

Of the top 25 non-leveraged exchange-traded funds so far this quarter, all but five are crypto- or blockchain-focused. Returns range from the top dog, the ProShares Bitcoin Strategy ETF (BITO), which is up 25.2% for the quarter so far, First Trust Skybridge Crypto Industry & Digital Economy ETF (CRPT) and its 51.12% gain.

But funds that sound like they provide the same or similar exposures will often provide different results for investors, and this is a good example. So I pulled four funds from this list and ran some attribution so we can get a better understanding of what drove returns for each product.

The funds

The other top winning funds are Bitwise Crypto Industry Innovators ETF (BITQ) (with 46.13% gain), the Global X Blockchain ETF (BKCH) (43.76%), and Grayscale Future of Finance ETF (GFOF) (30.91%).

CRPT is the only actively managed portfolio of the bunch. Index methodology for the other funds can be found via these links: BITQ (Bitwise Crypto Innovators 30 Index), BKCH (Solactive Blockchain Index), and GFOF (Bloomberg Grayscale Future of Finance Index). From what I can tell, the ETF issuers developed the intellectual property behind the indices and have contracts with various index providers for calculation services, as opposed to the index providers creating these indices and pitching them to the issuers to launch products.

However, the Bitwise index is the only one that has selection criteria that I can stand behind, meaning that the index has set a 75% “Tier 1” threshold for income exposure to crypto-related services or net asset exposure directly to cryptocurrencies. “Tier 2” names can be lower, but only 20% of the index can be weighted in Tier 2 names. The Solactive index tracked by BKCH has a similar “Pure Play” and “Diversified” approach, but the threshold there is set at only 50%. The Bloomberg the index tracked by GFOF has a multi-factor qualification process, but the income factor also classifies exposures above 50% as “High”. Although there is no index methodology for CRPT prospectus outlines that income exposure of over 50% in a current activity is enough to pass.

The results

Before I get into what drove the quarterly returns for these funds, I want to mention overlap between them, which is what percentage of holdings are held in common across all the funds. Looking at CRPT and its 31 holdings, it has 39% overlap with BKCH and GFOF, and 58% overlap with BITQ, meaning if you own CRPT it’s like having a 58% exposure to BITQ.

One thing that struck me was that in all four funds, the bottom 10 contributors to performance over the period were net additive to returns, and in fact, apart from BKCH, each fund had only one name that lost ground over the period, including BITQ: CME Group (CME) (-3.51%), First Trust SkyBridge Crypto Ind and Digi Econ (CRPT): Meta Platforms (META) (-0.66%); and, GFOF: BC Technology Group (BTCCF) (-23.71%). Downers in BKCH include Bigg Digital Assets (BBKCF) (-7.64%), Greenbox (GBOX) (-25.54%) and SOS Ltd. (SOS) (-37.74%).

In the 40 potential slots that make up the top 10 contributors to returns for these funds, there are only 17 unique tickers, and some funds that own both US and Canadian-listed stocks drop to 14. Of those 14, the five. names that had the biggest positive impact on average across all four funds are Marathon Digital Holdings (MARA), Riot Blockchain (RIOT), Coinbase (COIN), Silvergate Capital (SI), and Galaxy Digital Holdings (GLXY). All five names are held in all funds and across the board are among the top five or six contributors to return.

Finish

These results are all impressive. I like how all of these funds seem to draw within the lines of crypto and the crypto industry, although I’m not crazy about names like Interactive Brokers ( IBRK ), Alphabet ( GOOGL ) ( GOOG ), and Meta popping up on CRPT. Much like another gold rush from 1849, selling picks and shovels appears to be a better long-term approach than gaining exposure to the actual commodity, as evidenced by BITO’s quarter-to-date returns compared to these funds. If I had to pick a fund out of these for crypto and crypto industry exposure, I’d have to go with the Bitwise Crypto Industry Innovators ETF, if only for the focus on income exposure. If you think this trend is likely to continue in the near to medium term, BITQ might be worth a closer look.

(GOOGL is an Action Alerts PLUS member club company. Want to be notified before AAP buys or sells stock? Learn more now.)