The way forward for cryptocurrency

Just_Super

I recently had the opportunity to attend a two-day conference in Sarasota, Florida, hosted by the Global Interdependence Center. The theme was Cryptocurrency and the Future of Global Finance. Given that it included some of the leading research and analysts on cryptocurrencies along with an address from Federal Reserve Board of Governors member Christopher Waller, the event provided a comprehensive education on a burgeoning segment of capital markets that is otherwise overrun with noise and conjecture. It was a valuable and enlightening experience.

My own basic views on cryptocurrencies up to this point have been the following. The advent of the blockchain and the supported cryptocurrency systems is almost undoubtedly transformative. The fact that cryptocurrencies have experienced two consecutive major asset price bubbles first in 2017 and again in 2021 is evidence of meaningful future potential in the same way that dot com bubble of the late 1990s foreshadowed how the Internet would change the way we live our lives more than two decades ago. But from where we stand today, several key questions remain. How exactly will cryptocurrencies be transformative, and over what future time horizon will such changes play out? Also, how will the winners and losers be determined along the way?

The following were some of the key points from the conference:

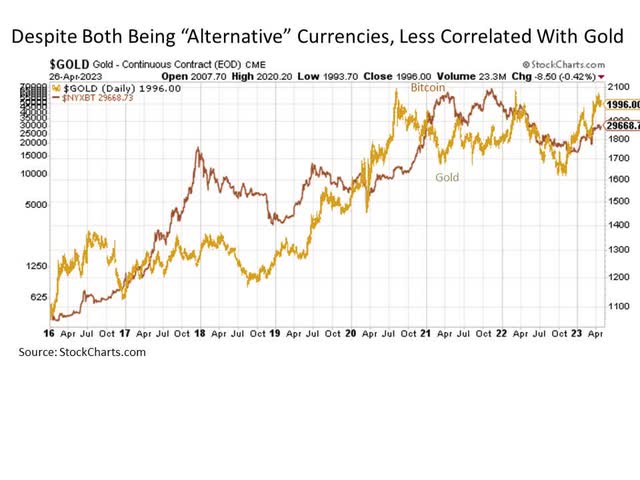

Moves like Apple. While cryptocurrencies are often perceived as potentially viable alternatives to the fiat currencies such as the US dollar and Japanese yen among many others that we have come to know so well over the years, they are not behaving as such at least to date. This also applies to the traditional global alternative reserve currencies such as gold, as the historical price relationship is generally weak.

StockCharts.com

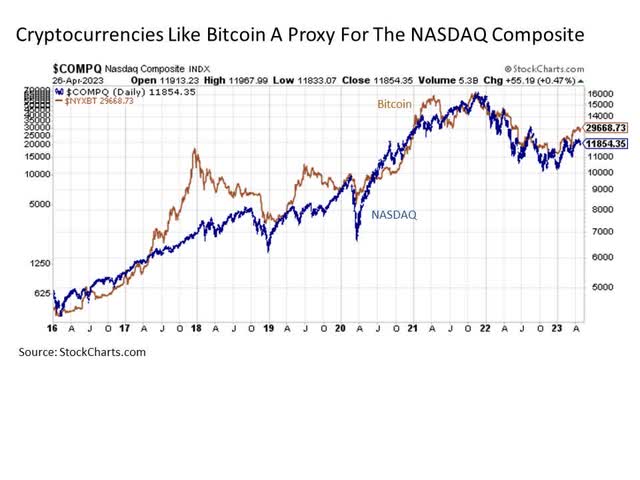

Instead, cryptocurrencies such as Bitcoin (BTC-USD) move with a very high correlation to the tech-heavy NASDAQ Composite Index (QQQ).

StockCharts.com

So instead of owning something that many may perceive will give them a differentiated and more diversified return experience for their broader “asset” portfolio, those who have added cryptocurrencies like Bitcoin are taking on a risk that effectively doubles down on the exposures they likely already maintain through holdings in technology stocks.

This is true even for those investors who may perceive that they are getting something else to complement their S&P 500 allocation, as a historically high percentage of more than a third of the headline benchmark is weighted to information technology or technology-adjacent sectors such as communications (which contain former technical juggernauts Alphabet (nee Google) and Meta Platforms (nee Facebook)) and Consumer Discretionary (which includes heavy dollops of Amazon and Tesla).

Simply put, the investors who are crypto-curious are often the ones who tilt toward greater risk and more aggressive stock allocations. And for those who follow through and allocate to crypto, they effectively end up with more of the same piece from a portfolio allocation perspective.

Disruptive innovation. In many respects, cryptocurrency remains an instrument for speculators looking to ride the waves of liquidity that have flooded the capital markets in recent years. After all, it’s not widely used as a medium of exchange, and it doesn’t represent a reliable store of value in any meaningful way. But as we move into the future, it’s reasonable to wonder about the path of disruptive innovation for cryptocurrencies to eventually achieve this more widespread viability and acceptance. In other words, what should we really be looking at when monitoring cryptocurrency progress?

First, the path to long-term viability is unlikely to occur at the high end of the market. What does this mean? It is not likely that we will wake up one day and Bitcoin replaces the US dollar as the way we buy groceries at the market here in America. Why? Because we in the US are already taken care of in many ways. We have the global reserve currency and an overall market system that works fairly smoothly, with no occasional hiccups. Sure, we’ve had high inflation lately, but it’s not like it’s resulted in a sense of chaos or chronic uncertainty.

The same applies to a more moderate case like El Salvador. Here’s a frontier market that made the bold move to adopt Bitcoin as legal tender in 2021. However, in an unfortunate but classic market spike, the launch of the Chivo electric wallet in October 2021 took place almost to the date Bitcoin peaked over $68,000. Since then, of course, the cryptocurrency has fallen in value by more than -75%. In short, too big a move too soon.

So where does cryptocurrency find its way to legitimacy? In the same way that almost all disruptive innovations have, gaining more widespread use and acceptance in lower segments of the largely overlooked global marketplace where profitability is least and where the need for new ways of doing things such as transaction systems is. largest. It is in these low-end segments where the opportunity is greatest for cryptocurrencies to gain wide acceptance and essentially figure out the kinks in expanding actual implementation. As they stabilize and improve, these cryptocurrencies can begin to work their way up the market to more established and developed economies to expand their presence.

This is the most likely path for cryptocurrencies going forward, and it is disruptive innovative transformation that is not going to happen overnight. Instead, it is a gradual development that will likely take a good deal of time measured in many years if not a decade or more to play out.

Like Amazon and Priceline. We have more than 24,000 cryptocurrencies in existence today. And just like the many dot com stocks that came and went in the late 1990s and early 2000s, it is likely that the vast majority of these cryptocurrencies will follow the same path into extinction in the coming years. Which cryptocurrencies are the likely long-term survivors in the same way that we still use the services of big companies like Amazon and Booking Holdings (nee Priceline) today?

The consensus view of the experts at the conference is that while others may continue forward into the future, two cryptocurrencies are likely to be the primary long-term survivors. The first is Bitcoin due to its size dominance as well as its applicability from a transaction system point of view. The other is Ethereum (ETH-USD) due to its applicability to more specialized applications and contracts.

As a result, these two cryptocurrencies are useful leading proxies for monitoring the broader space for those who may wish to incorporate monitoring of these assets into their broader asset allocation research.

The bottom line. From an investment perspective, we are probably still several years away from realistically even beginning to consider including cryptocurrencies in the context of broader asset allocation modeling. Nevertheless, cryptocurrencies have been evolving for more than a decade now, and this evolution is likely to continue going forward as this cutting-edge market segment increasingly finds its footing and path towards long-term viability. What that looks like at the end of the day remains to be seen, but it’s still worth monitoring as it develops to identify the associated opportunities when that day arrives. And the insights from the recent Global Interdependence Center conference in Sarasota, Florida, were ideal for better understanding and focusing this monitoring process going forward.