The Untold Secret of Bitcoin 4-Year Cycle: Fortune-Making Patterns

The buzz surrounding the Bitcoin 4-year cycle has grown louder in recent years, becoming a much-discussed topic among crypto enthusiasts and market analysts. The cycle, characterized by significant events and trends in the crypto market, has aroused curiosity and intrigue among both experienced participants and newcomers.

However, the causes and implications of the Bitcoin 4-year cycle are often misunderstood or oversimplified. Examining the factors shaping it, including halving, macroeconomic influences and human behavior, can benefit investors.

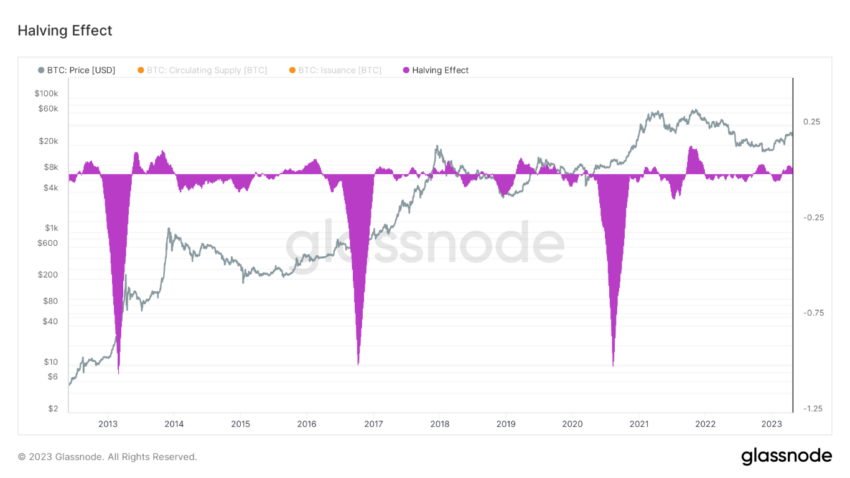

Bitcoin Halving: A Crucial Catalyst or a Self-Fulfilling Prophecy?

One of the most intriguing aspects of Bitcoin’s behavior is the “halving.” This is a predetermined event where the number of new BTC generated and distributed by the network is halved.

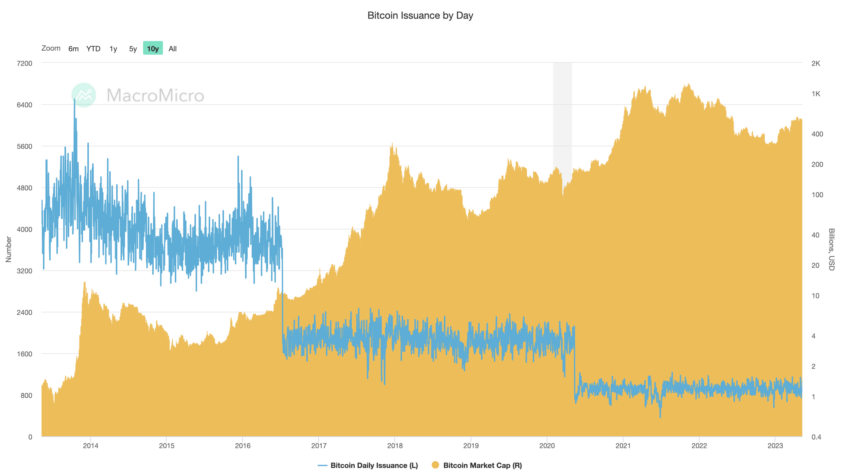

Currently, around 900 Bitcoins are produced daily. In the upcoming halving, scheduled for late Q1 or early Q2 next year, this number will be reduced to 450. The previous halvings in 2012, 2016 and 2020 have marked significant turning points in Bitcoin.

The halving affects Bitcoin’s price due to a simple supply-demand principle.

When the halving happens, even if Bitcoin demand remains stable, the reduction in supply can create an imbalance, pushing prices up. This price momentum could trigger a multi-year bull market in Bitcoin.

As the cycle progresses, the initial impulse from the halving fades, but the momentum continues, carrying the market forward.

The ripple effect: liquidity spread in the crypto market

As the bull market matures, liquidity spreads from Bitcoin to other cryptos, such as Ethereum, and eventually to riskier, long-tail assets.

This spread continues until the influx of new funds into the crypto market cannot sustain the growing number of assets driven by correlation with the major cryptocurrencies and the new projects being created.

When this unsustainable point is reached, the market collapses, reversing the spread of liquidity. Funds flow from long-tail assets back into Bitcoin and Ethereum, providing a reset point for the liquidity cycle.

This liquidity flow pattern is not unique to the crypto market, but is characteristic of traditional financial markets.

The human factor: behavioral dynamics and market psychology

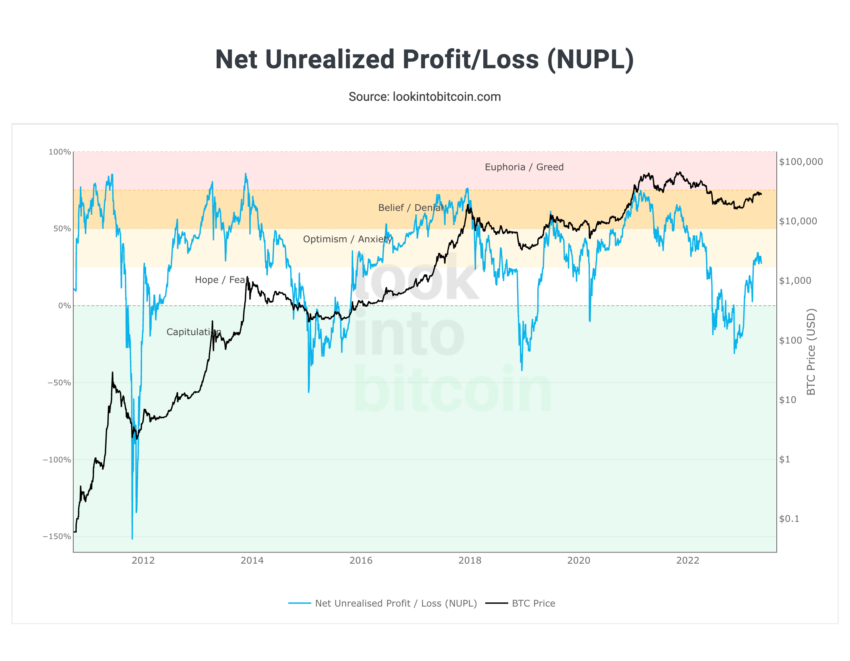

Beyond halving and liquidity cycles, another important factor shaping Bitcoin’s market behavior is the psychological dynamics of market participants. To understand this better, one must delve into Bitcoin’s on-chain data.

Bitcoin’s price and the profitability of active network participants significantly affect market dynamics. In fact, market participants who have made significant unrealized profits are more likely to sell during market downturns, fearing the loss of those gains.

Also, individuals who enter the market after a significant price increase are usually less experienced or less convinced of the asset’s long-term value. These factors result in a more volatile base of holders than the stable base seen during the bear market bottoms.

Profitability and holder base: the key drivers behind

When discussing profitability, one often refers to a number of calculations categorized under cost basis. These include realized price, a proxy for the network’s aggregate cost base, and short- and long-term owner realized price.

These metrics help in understanding the state of the market – whether in unrealized losses or gains.

The change between the market price and the aggregate cost base can be measured using the Market-Value-to-Realized-Value (MVRV) ratio.

High readings of MVRV, indicating large amounts of unrealized profit, have historically marked the peak of Bitcoin 4-year cycles.

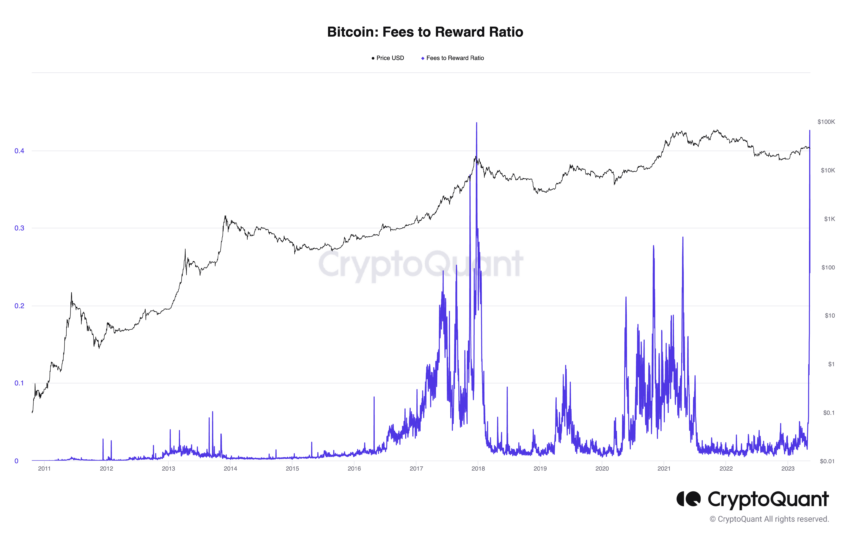

Miner Influence: A Diminishing Force in Bitcoin 4-Year Cycle

Historically, Bitcoin miners have significantly influenced the market, acting as pro-cyclical forces.

Miners collect Bitcoin when it is profitable during bull markets and are forced to sell during bear markets.

However, the term capitalization shows that their influence on the market has decreased.

The Global Macro Picture: A Rising Influence

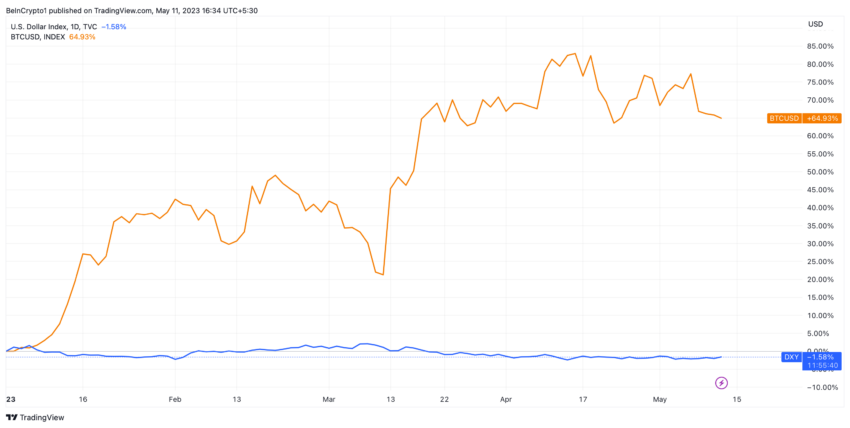

Historically, Bitcoin has maintained some insulation from global macroeconomic factors. However, it becomes more susceptible to these influences as it integrates more with the traditional financial system and gains more adoption by institutional investors.

For example, fluctuations in the strength of the US dollar, changes in monetary policy and geopolitical tensions can now directly affect Bitcoin’s market behavior.

People often consider Bitcoin, much like gold, as a safe haven during economic crises or unstable financial markets.

In periods of increased risk or uncertainty in the global economy, one can therefore see an increase in demand for Bitcoin, which can push the price upwards.

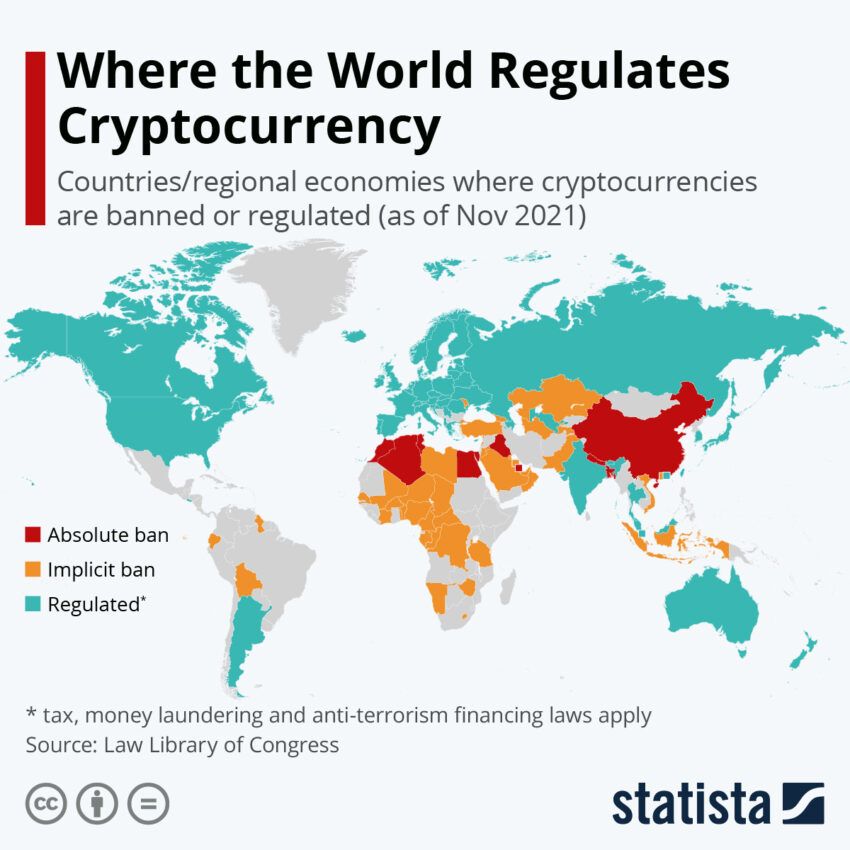

Regulation: Wild Card

The role of regulatory factors in shaping Bitcoin’s market behavior is significant and can often be unpredictable. While some countries have embraced Bitcoin and other cryptocurrencies, others have imposed strict regulations or outright bans.

Positive regulatory news can drive Bitcoin’s price higher, while negative news can trigger steep falls.

For example, when countries like Japan and South Korea recognized Bitcoin as a legal payment method, the price had a significant positive impact.

Conversely, when China announced a crackdown on Bitcoin mining and trading, it led to a sharp market decline.

Preparing for the next Bitcoin 4-year cycle

A complex interplay of factors shapes Bitcoin’s market behavior. These include its built-in halving mechanism, liquidity cycles, the psychology and behavior of market participants, the influence of miners, global macroeconomic factors and regulatory developments.

Understanding these factors can provide investors and market participants with valuable insight into Bitcoin’s potential price movements.

Despite this, one should not consider these factors as definitive predictors due to the highly volatile and unpredictable nature of the crypto market. Instead, they should be used as tools to assess probabilities and manage risk.

As Bitcoin continues to develop and mature, the factors influencing market behavior may also change. That’s why it’s crucial to stay up-to-date with the latest developments in Bitcoin and the broader cryptocurrency market.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.