The demand for talent in this sector is expected to intensify, as the majority of fintech companies (72%) expect sector-based growth this year.

Singapore remains one of the fintech leaders in Asia and the world, despite a turbulent year for the industry in 2022. The macroeconomic outlook remains volatile as the industry experiences the impact of inflation, growing interest rates, geopolitical tension and threats of economic decline.

Singapore’s competitiveness i world economy, market stability and strong regulatory support, have allowed it be this storm.

According to Global Financial Centers The Index 32 report, Singapore ranked third in the world’s overall index as a global financial center behind New York, London, surpassing Hong Kong to take the lead in the Asia-Pacific region.

But with opportunities come challenges and The COVID-19 pandemic has spotlighted and reshaped the talent agenda in Singapore’s fintech industry expectations between employees and employers.

The fourth edition of Fintech Talent Report by Singapore FinTech Association (SFA) and Accenture Singapore proven the nation’s attractiveness as fintech hub, with 84% of respondents indicating their its headquarters are in Singapore.

For the survey, links were sent to 1,637 fintech executives in Singapore, returning 122 valid responses, which includes 12 responses coming from six businesses with multiple co-founders. Input from interviews with fintech managers and HR representatives, as well as social media and news scanning was also considered.

For fintech leaders to continue to drive business growth, it is critical to do so prioritizing the talent agenda, as a thriving and skilled workforce is essential to enable one sustainable and forward-looking organization. Companies must strengthen their commitment across different stages of the talent lifecycle – to continuously attract, develop and retain best talent in Singapore.

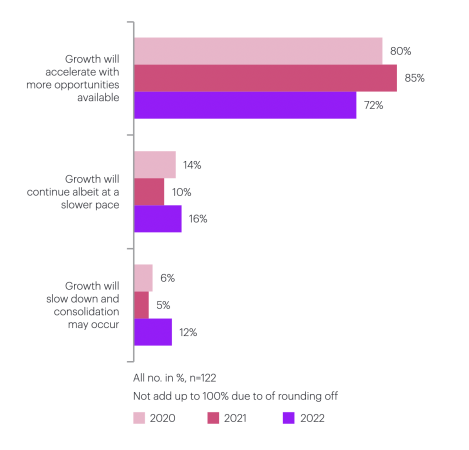

Growth in the fintech sector is expected to intensify demand for talent. According to the survey, a majority of fintech companies (72%) expect it sectorally growth will continue and accelerate with more opportunities available. Although this number was less than in 2021, where 85% of respondents said the same.

As a result, the majority (95%) of fintech companies surveyed say they expect an increase in their workforce over in the next one to two years compared to 2021 (84%). With an estimated 14,000 employees in Singapore fintech industry, the workforce is estimated to grow by an average of 45%, translated into an increase of 6,000 employees over the next two years.

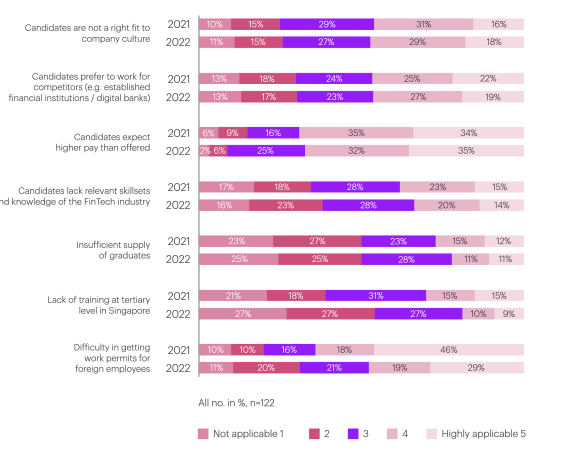

With a relatively small pool of talent available in Singapore, fintech talent is in demand continues to exceed local supply and is further intensified by several factors, such as:

- “candidates expect a higher salary than offered” (67%),

- ‘difficulties in obtaining a work permit for foreign employees (48%),

- “candidates do not fit company culture” (47%), and

- “graduates prefer to work for competitors” (46%).

When asked about proposals to take up the talent gap, ‘makes it easier for foreigners employees to obtain a work permit’ (57%) and ‘establish more partnerships within wider ecosystem’ (55%) was named top two solutions. Meanwhile, “offers higher pay packages” (38%) were ranked as least effective alternative, indicating that it is not sustainable long-term solution for fintechs to close talent gap.

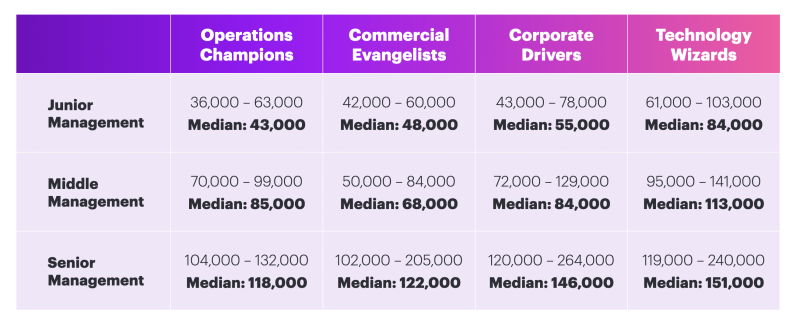

However, companies may have no choice as a tight labor market has made it more difficult to secure talent. Fintech companies compete not only with financial institutions (FIs) for tech-savvy talent but also across other industries. Those in senior management roles can earn a median annual salary of over S$100,000.

According to the survey results, employee referrals (90%), online job portals (81%), and headhunters and employment agencies (52%) are the top three channels fintechs use to recruit talent. But with such high demand, fintechs adapts the hiring strategy and invest in alternative ways of acquiring talent, such as partnerships with others organisations, make use of gaming marketplaces and invest in young talent via the campus recruitment and internship programs.

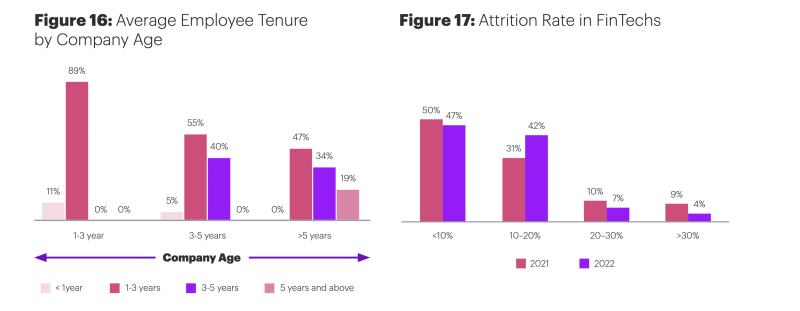

Attrition rates are, however, at a record high, and more than half of the fintech companies in the report indicated a average tenure of less than three years. While potential candidates are looking to join fintechs for opportunities to develop and improve their careers, they leave for the same reasons, indicating that they may not get the continued growth they desire.

On average, 53% of survey respondents reported a burnout rate of 10% or higher, a slight increase compared to the results in 2021. This indicates that the attrition rate has increased in the past year, which is supported by how 42% of companies have experienced a decline rate of between 10-20% this year, an increase of 11% compared to 31% in 2021.

According to the survey results, 50% of fintechs spend less than $500 on learning and development per employee, against 28% in 2021. In addition, the most common learning and development media are on-the-job training, coaching and mentoring, and e.goral training (in-house).

However, there appears to be a lack of awareness of national grants available to fintech companies in Singapore. According to the survey results, the majority (88%) of the companies has not utilized Institute of Banking and Finance (IBF) funding to second staff refresher courses in the last 12 months, primarily due to a lack of awareness (87%).

While the pandemic has seen fintechs increase their use of flexible working arrangements and becoming more aware of mental health, they are only scratching the surface when it comes to build a truly human workforce. There is an opportunity here for fintechs to expand their definition of holistic employee well-being to include the full range of employee needs.

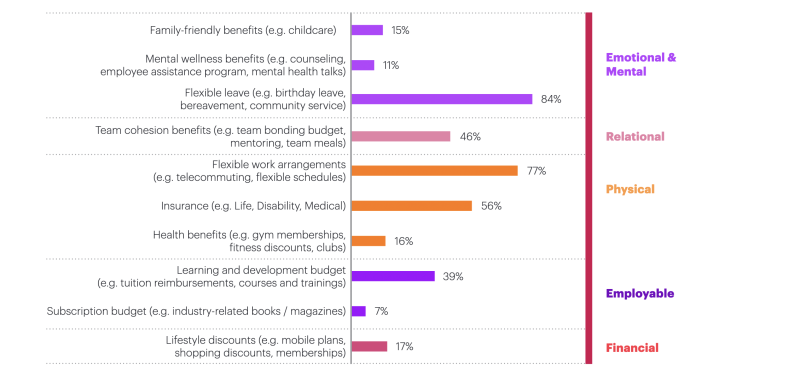

The top three employee benefits offered by most fintechs are flexible leave (84%), flexible working aschemes (77%) and insurance (56%). However, only a minority of the investigated fintechs offer e.gfamily-friendly benefits (15%), psychological benefits (11%) and subscription budgets (7%).

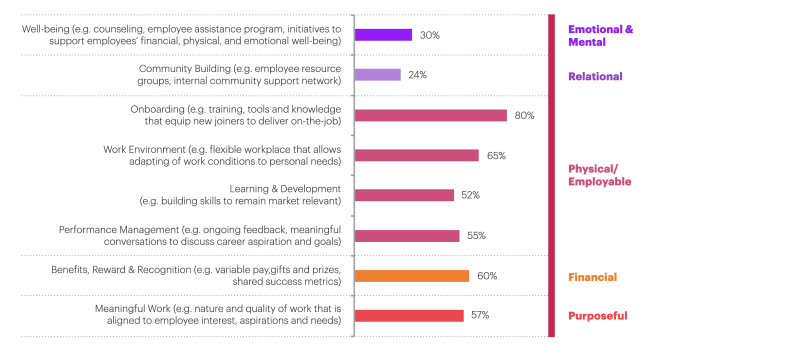

When asked about the practices fintechs use for employee engagement, the top three practices were onboarding (80%), flexible working environment (65%) and benefits, rewards and recognitions (60%). Meanwhile, the least used practices were wellness (30%) and community bbuilding (24%) practice.

Lack of talent and skills continues to be the single biggest threat to inflation and cyber security issues. Organizations are going through deep change on compressed timelines and traditional working methods must be developed. This places new demands on workforce at a time when people are fundamentally reassessing their relationship to work.

Images / Fintech Talent Report 2022 (citing the most in-demand roles in the fintech sector)

Follow us on Telegram and on Instagram @humanresourcesonline for all the latest HR and workforce news from across the region!