The resilient revolution of the world’s largest digital resource

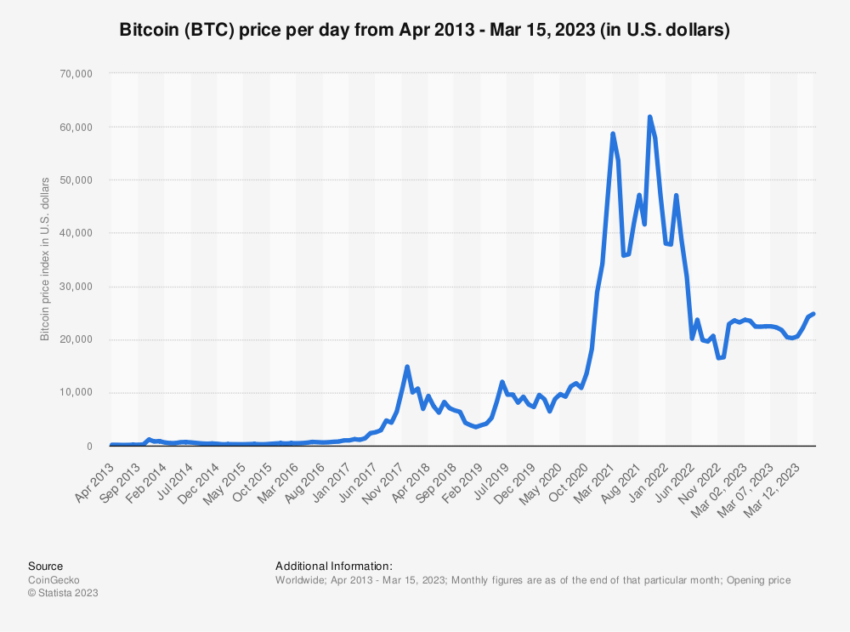

The story of Bitcoin (BTC) is one of resilience. It has faced derision and skepticism, booms and busts, but continues to thrive. Recent bank collapses and a struggling Federal Reserve have accelerated their impact on global finance.

Bitcoin is now a serious challenge to conventional financial systems. Its decentralized nature and strong performance have attracted interest from investors and advocates alike, who seek a more stable and fair monetary policy framework. As Bitcoin continues to gain traction, it highlights the weaknesses inherent in traditional financial systems. This shift in perception is causing many to reconsider the very basis of money and explore alternative solutions.

The Fragile Foundation of Fiat Currencies

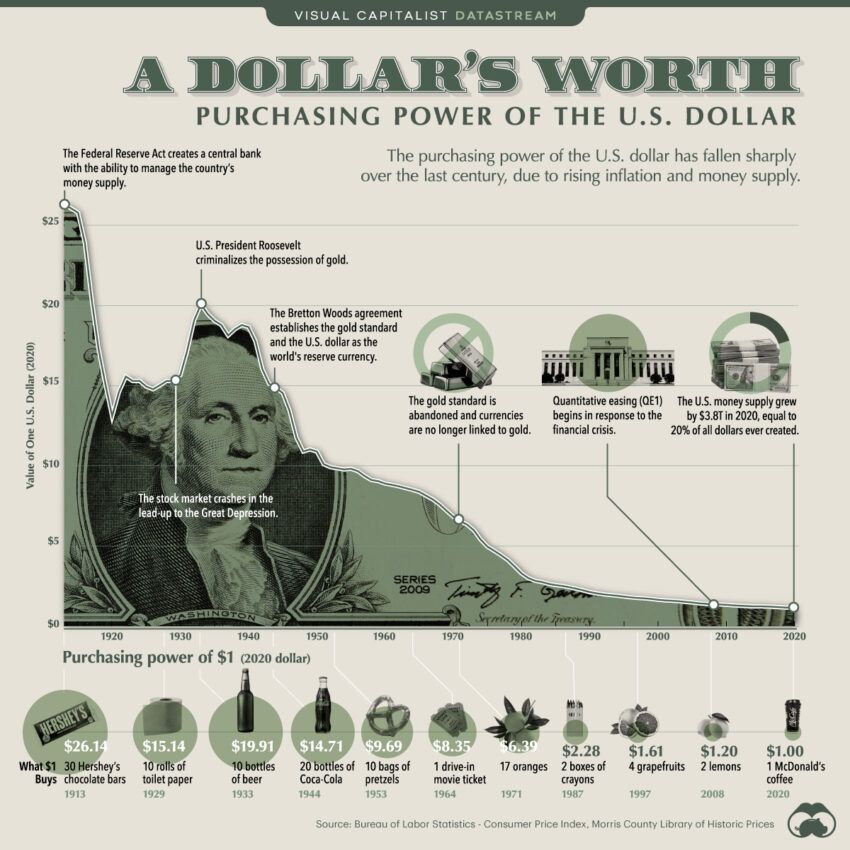

Fiat currencies face many challenges. Inflation, economic crises and political interference are just a few. Over the past decade, the US dollar has experienced a significant decline in purchasing power.

In contrast, Bitcoin has increased in value, with its price skyrocketing from a few cents in 2010 to tens of thousands of dollars in recent years.

Historically, traditional assets such as stocks, bonds, gold and real estate have been considered safe havens. However, Bitcoin’s performance has outperformed these assets over the past decade, making it an attractive alternative investment. As the world increasingly sees Bitcoin’s potential, it is paving the way for a new era in finance, redefining the concept of value and investment.

The dark side of centralized finance

Central banks and governments have not been immune to corruption. Bad management also plagues these institutions. Bitcoin’s decentralized nature offers an alternative. It provides transparency, efficiency and logic.

While no system is immune to bad actors, Bitcoin’s decentralized structure reduces the potential for corruption. The network relies on consensus and cryptography, which ensures that participants follow the rules and that transactions remain secure.

As we explore the potential of Bitcoin to disrupt traditional finance, it is critical to examine the ways in which centralized systems have failed us in the past. By doing so, we can better understand the driving forces behind the use of decentralized digital currencies like Bitcoin.

War and Fiat Currency Depreciation

Fiat currencies have historically played a significant role in financing wars. Governments often resort to money printing to finance military conflicts, leading to currency depreciation and inflation. This devaluation of money enriches the printer – typically the central bank – at the expense of the citizens, whose purchasing power declines.

For example, during World War I and World War II, many countries, including the United States, Germany, and Great Britain, experienced high rates of inflation due to extensive money printing to finance the war effort. In more extreme cases, such as the Weimar Republic in the early 1920s or Zimbabwe in the late 2000s, hyperinflation occurred due to uncontrolled currency printing, leading to devastating economic consequences for citizens.

Bitcoin’s decentralized nature and limited supply offer an alternative to this inflationary spiral. As a deflationary currency, it is not subject to the whims of a central authority that can arbitrarily create multiple units. This characteristic provides a degree of insulation against the degradation that often accompanies war finance and other instances of government monetary expansion.

As the world recognizes Bitcoin’s potential benefits, it is important to consider the backlash it faces from powerful entities. This opposition highlights the struggle between central control and decentralized economic freedom.

Governments and central banks

Despite Bitcoin’s potential, central banks and governments are trying to dampen its adoption. Through regulation and restrictions, they try to maintain control. However, Bitcoin’s resilience shines through as it continues to grow and prosper.

Some governments have even launched their own digital currencies. Central Bank Digital Currencies (CBDCs) aim to replicate some of Bitcoin’s functions. However, they lack true decentralization. Control remains with the central banks, perpetuating the same problems that traditional finance faces.

Bitcoin’s value: More than a unit of exchange

Bitcoin’s limited supply and resistance to censorship make it a valuable asset. Its decentralized nature and cryptographic security allow users to trade freely without interference. For many, Bitcoin represents more than a currency – it is an expression of freedom.

As the global financial landscape evolves, Bitcoin’s role in it becomes increasingly important. The decentralized structure and freedom it offers make it an attractive alternative to the current system, especially for those concerned with privacy and autonomy.

Bitcoin’s Proponents: Voices on Decentralization and Empowerment

Several influential individuals have become vocal proponents of Bitcoin, advocating its potential to empower individuals and challenge the status quo. Some of the most prominent include Michael Saylor, Erik Voorhees and Max Keiser.

- Michael Saylor, CEO of MicroStrategy, has been a significant proponent of Bitcoin. Under his leadership, MicroStrategy has invested heavily in the cryptocurrency, viewing it as a superior store of value compared to traditional assets. Saylor emphasizes Bitcoin’s potential as a hedge against inflation and the risks associated with centralized financial systems.

- Erik Voorhees, the founder and CEO of ShapeShift, has long been a proponent of Bitcoin and cryptocurrencies in general. Voorhees emphasizes the importance of financial privacy and the potential for cryptocurrencies to disrupt the traditional banking system, giving greater control and autonomy to individuals.

- Max Keiser, a financial broadcaster and host of the “Keiser Report”, has been an outspoken supporter of Bitcoin for years. Keiser’s advocate focuses on Bitcoin’s role in challenging central banks and governments, which he believes engage in destructive monetary policies that erode citizens’ wealth. Keizer advises the president of El Salvador on the country’s Bitcoin use policies.

The philosophy of Bitcoin: Empowering the individual

Many believe that the solution to questions surrounding government-controlled money lies in a new form of non-government currency: cryptocurrencies. Bitcoin, the first and largest of these, emerged after the financial crisis of 2007-2008, and became operational in January 2009.

Created by the pseudonymous Satoshi Nakamoto in a 2008 white paper, Bitcoin is a digital currency with a fixed supply, in stark contrast to fiat currencies. It has no central owner or governing body; rather, it operates on a voluntary, global network using open source software.

It is important that this structure sets it apart both states and banks.

At its core, Bitcoin’s philosophy revolves around decentralization, individual sovereignty and resistance to censorship. It seeks to empower individuals by giving them greater control over their own financial resources, free from the constraints and potential abuse of centralized financial systems.

However, these principles are in stark contrast to the traditional financial system, which prioritizes the interests of the state and large financial institutions over those of individual citizens. By offering an alternative means of storing and transacting value, Bitcoin has the potential to shift the balance of power, giving individuals greater control and autonomy in their financial lives.

“The number of industries, societies, habits, traditions and even human interactions that Bitcoin has the potential to revolutionize is enormous.” – Erik Voorhees

Unstoppable Bitcoin?

Bitcoin’s resilience has been tested time and time again. It has faced skepticism, regulation and fear. Nevertheless, it remains an influential force in the global financial landscape. Its decentralized nature, immunity from debasement and potential to fight corruption have set it apart.

Still, it’s important to approach Bitcoin with a balanced perspective, considering both its potential benefits and the challenges it faces. As the world navigates the crypto revolution, Bitcoin continues to play a significant role in shaping the future of finance.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.