The relationship between Bitcoin NFTs and mining

These days, the vogue for NFTs on the Ordinals protocol and fungible BRC-20 tokens is exploding, and together they increase Bitcoin mining activity and make the business more profitable.

What does this mean for the Bitcoin network and what are the advantages/disadvantages for the end user?

Let’s analyze the situation in detail.

What are Ordinal NFTs and why can they boost bitcoin mining?

The Taproot update to the Bitcoin protocol, published in November 2021, was a complete game changer for Satoshi Nakamoto’s network, increasing transaction privacy for users and improve scalability and Safety.

Progress has been made since this implementation two years ago, thanks in part to the introduction of Ordinals, a protocol which allows NFTs and native tokens issued directly on the bitcoin blockchain.

Although these functions are generally feasible using smart contracts, as is the case on the Ethereum network, in this case the conditions are very different.

The basic idea behind Ordinals, a protocol prepared by Casey Rodarmorthe developer of Bitcoin Core, must allow data such as images, videos and text to be ”enrolled” on individual satoshi, making each sat to which this information is added “unique”.

In this way, the problem of the lack of smart contracts on the Bitcoin network was overcome, prompting many users to create NFT-style digital objects and fungible tokens.

The result was astonishing: millions of bits of data were transcribed into individual minimum units of BTC (satoshi), increasing the fees paid to use Bitcoin’s infrastructure and increase the average block size published on the chain.

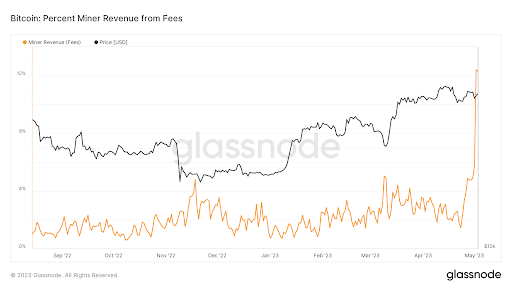

Miners are grateful to Casey Rodarmor, as the percentage of revenue from transaction fees now amounts to around 12% of the total income earned by those in this business: this is 8 times more than April 23rd, the day the Ordinals trend broke out.

Let us remember that bitcoin mining earns money in two ways: first, from block rewards, which are fixed but vary according to predefined mechanisms such as halving or difficulty adjustment, and second, from the fees paid by users to have priority in completing transactions and to include additional data on each block generated.

We don’t know if the ordinals craze is a passing fad or if the crypto community will continue to modify the satoshi by adding data of some kind.

But if this trend continues, it will create a big incentive for miners to continue its activities and ensure the security of the network by increasing the total hashrate of the blockchain.

A look at bitcoin mining revenue: is the advent of NFTs and BRC-20 tokens really a game changer?

Let’s take a closer look at the mining side effects of the advent of Ordinals and the fungible BRC-20 NFTs and tokens that have been created on the Bitcoin blockchain so far.

The increase in average transaction fees has been a random event for miners, who need support now more than ever, given the threat of new threats from USA.

Tim Frost, CEO of Yield App, said that bitcoin miners could be taxed by the US government due to the energy impact and CO2 emissions generated by the hardware used in the activity.

“Bitcoin miners are facing new threats in the US in the form of a new proposal from the White House to tax the equivalent of 30% of their energy costs to cover ‘the damage they cause to society'”.

Also, with bitcoin’s next halving expected on April 27, 2024 (or rather at the top of the 840,000 block), miners will soon earn half the coins currently mined every 10 minutes or so.

The explosion of the Ordinals trend and the increase in Fess to enter Satoshi data, which costs about $50 per million bytes added, has been a boon to the mining industry and can greatly increase the income of those working in it, if only this craze continues in the coming months.

Consider that since the Ordinals Protocol was published, some $9 million in fees have been paid just to create NFTs and BRC-20 tokensa truly remarkable profit.

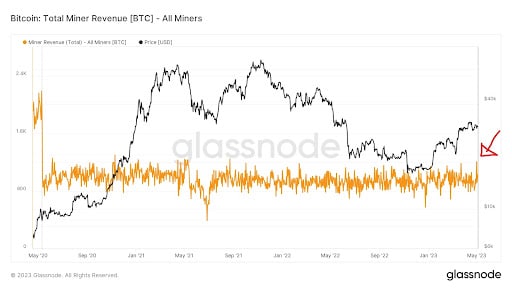

The very profitability of the companies in this industry has, until recently, been heavily dependent on the price of bitcoin and the amount of coins issued for each block added to the chain, with transaction fees having little impact on the overall income of the miners.

If registrations continue at this pace, and the price of BTC does not drop significantly, we may finally see a reversal in the coming months of a trend which has seen miners’ incomes remain more or less stable, in the range of 600 to 1200 coins per day.

The level to watch to see if the use of NFTs and BRC-20 tokens on the bitcoin blockchain is truly a game changer is the 1200 BTC level: if it is breached, a new era of heavier blocks and richer miners could begin.

Chart of bitcoin miners profit in BTC

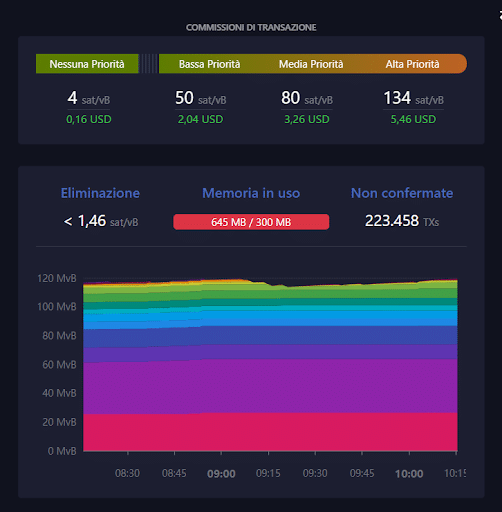

However, from a user experience perspective, this trend can be viewed negatively: Although miners make money from this situation, users see their transactions cost more and more and sometimes get stuck in the mempool as the rest of the world competes to pay higher fees and get priority for execution.

It is currently around 220,000 transactions are fixed in the mempool, waiting to be added to a block and executed once and for all.

Who knows if another digital artifact in the future will be able to solve this problem using the zkrollups philosophy and the scalability achievable with off-chain transaction processing.

For now, users are really angry with Ordinals and those speculating on this trend.

How does the price of bitcoin react to the Ordinals trend: buying opportunities?

Bitcoin does not seem to have reacted particularly well to the explosion in the Ordinals NFT trend and the increase in mining profitability.

The cryptocurrency is currently traded around $29,000 on the chart, with a market cap of $563 billion and a volume of $16.7 billion in the last 24 hours.

The bullish price phase started well before the NFT and BRC-20 token mania broke out, early January 2023and in recent days we have seen small price gains.

The result is quite obvious when we consider that only one satoshi, or one hundred millionth of a BITcoin, is used for each token, so the markets are not deprived of large amounts of coins.

The positive effects on the price can be seen in the futurethanks to the increase in requests to use the network and more generally thanks to the increase in the utility of the infrastructure.

In fact, if the blockchain becomes more similar to Ethereum, as a “global computer for the world”, bitcoin will certainly begin to benefit from the increased functionality that exists.

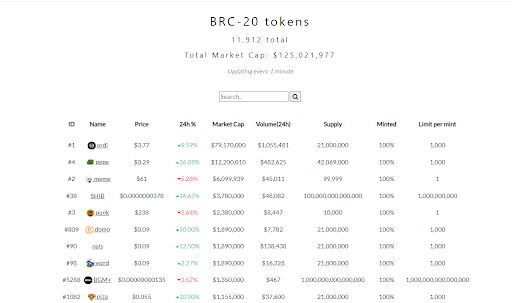

For now, speculative activity is focused elsewhere, mainly on the new BRC-20 fungible tokens, whose market capitalization has exceeded $125 million.

The buying opportunity here could be in this niche market or, in a more traditional financial view, in the shares of listed companies involved in industrial mining.