The Next Bitcoin Halving is Just Over a Year Away – Here’s What Could Happen to the BTC Price

The next Bitcoin halving, where the BTC reward distributed to network validators per mined block will be halved, is coming in just over a year, and this could become a central theme in the Bitcoin market in the coming quarters. That’s because previous halvings have consistently had a huge price impact.

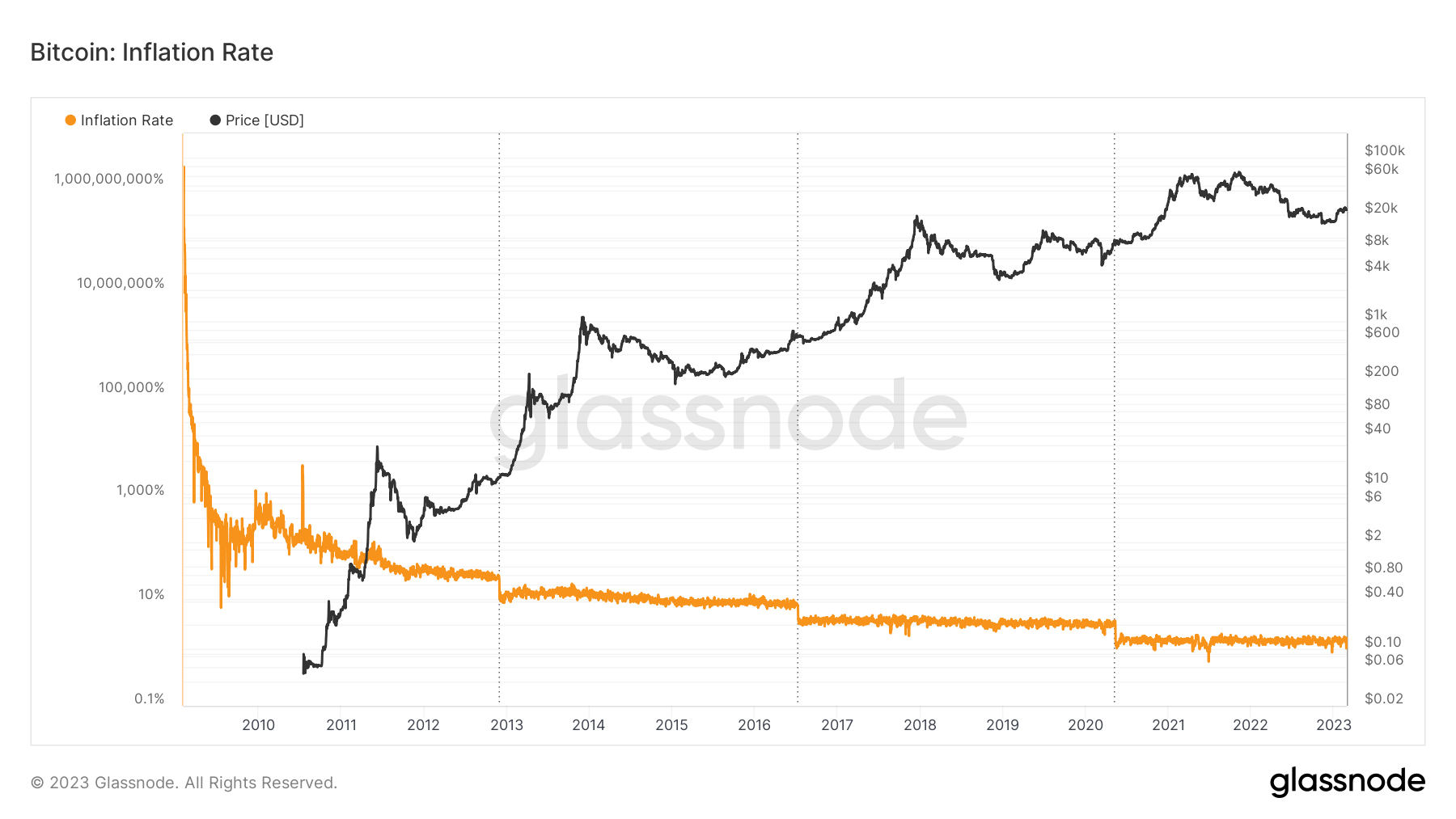

For reference, the current Bitcoin block reward is around 6.25 BTC, with blocks taking an average of around 10 minutes to mine. In April 2024, this block reward will decrease to 3.125 BTC, slowing Bitcoin’s inflation rate from around 2.0% to around 1.0%. Bitcoin’s inflation rate is designed to continue to fall and tend towards zero to ensure that the BTC supply never exceeds 21 million.

Halvings normally proceed with a violent rally

There have been three Bitcoin halving events so far, the first in November 2012, the second in July 2016 and the last in April 2020. All three have made massive gains in the Bitcoin price. At the time of the halving in 2012, Bitcoin was trading around $12. Within about a year, it had increased to over $1,000.

The second halving took place when Bitcoin’s price was around $650. In less than a year and a half, Bitcoin’s price had reached $19,000. Finally, in 2020 the halving took place when Bitcoin’s price was below $9,000. Prices then went on to reach an all-time high in November 2021 of $69,000.

Bitcoin has thus delivered gains from the date of the halving to the next market peak of approximately 83x, 29x and 8x. Not surprisingly, with Bitcoin maturing as an asset class and seeing significant growth in market capitalization, the rate of post-halving gains has slowed and may yet slow further.

Perhaps the halving in 2024 could result in a more modest 2-3x gain when looking at Bitcoin’s peak price in the post-2024 halving period. With a number of chain and technical indicators all screaming that 2022’s bear market is over and 2023 is off to a good start for the world’s largest cryptocurrency by market capitalization, a continued gradual recovery in 2023 and into 2024 may well be on the cards, despite ongoing macro/liquidity headwinds from the Fed’s tightening measures.

Say Bitcoin is able to recover to the $30-40K region by the next halving. Then we may well be looking at a post-halving rally north of $100K.

Other models point to long-term Bitcoin upside

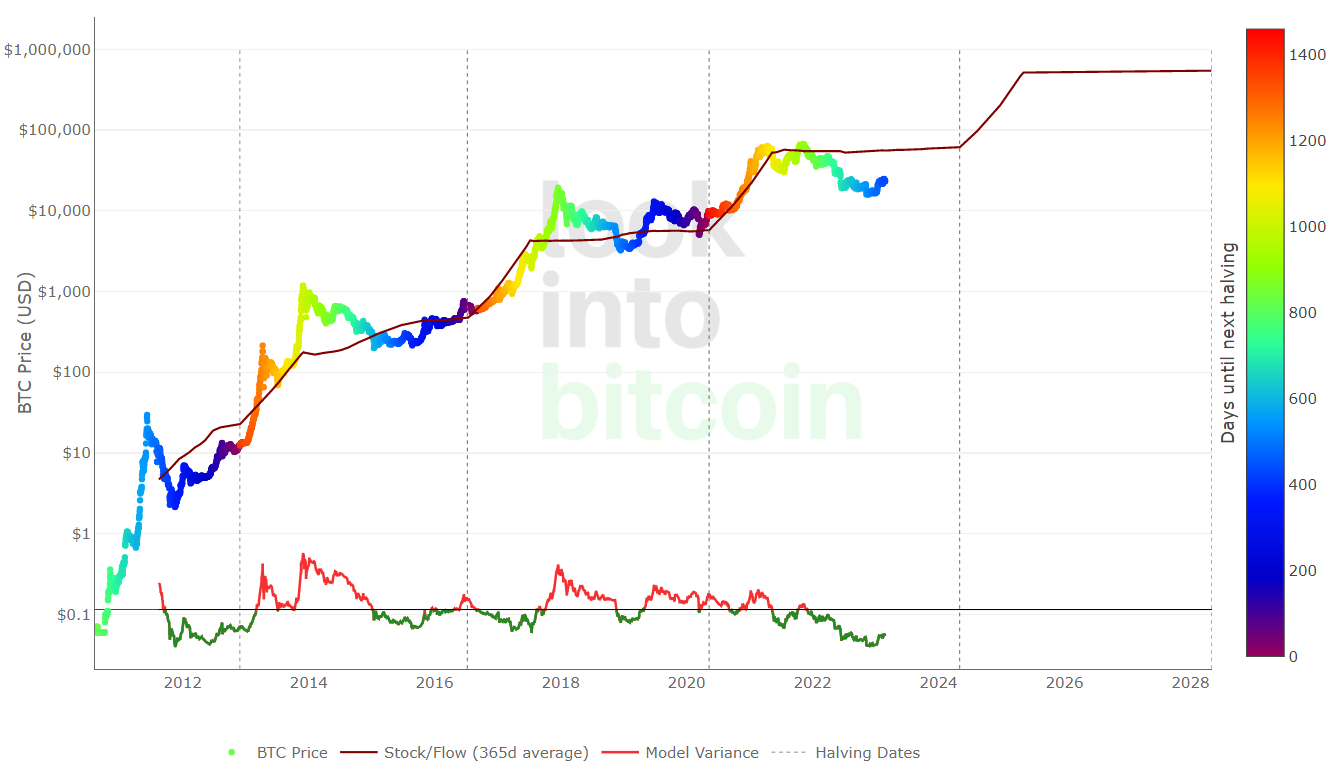

A number of widely followed long-term Bitcoin pricing models/forecasting tools are much more bullish on Bitcoin than the flip side above in the trade box analysis. According to the widely followed stock-to-flow, which shows an estimated price level based on the number of BTC available in the market compared to the amount mined each year, Bitcoin’s fair price right now is around $55K and could rise above $500K in the next market cycle after halving. That is around 20 times the gain from today’s level.

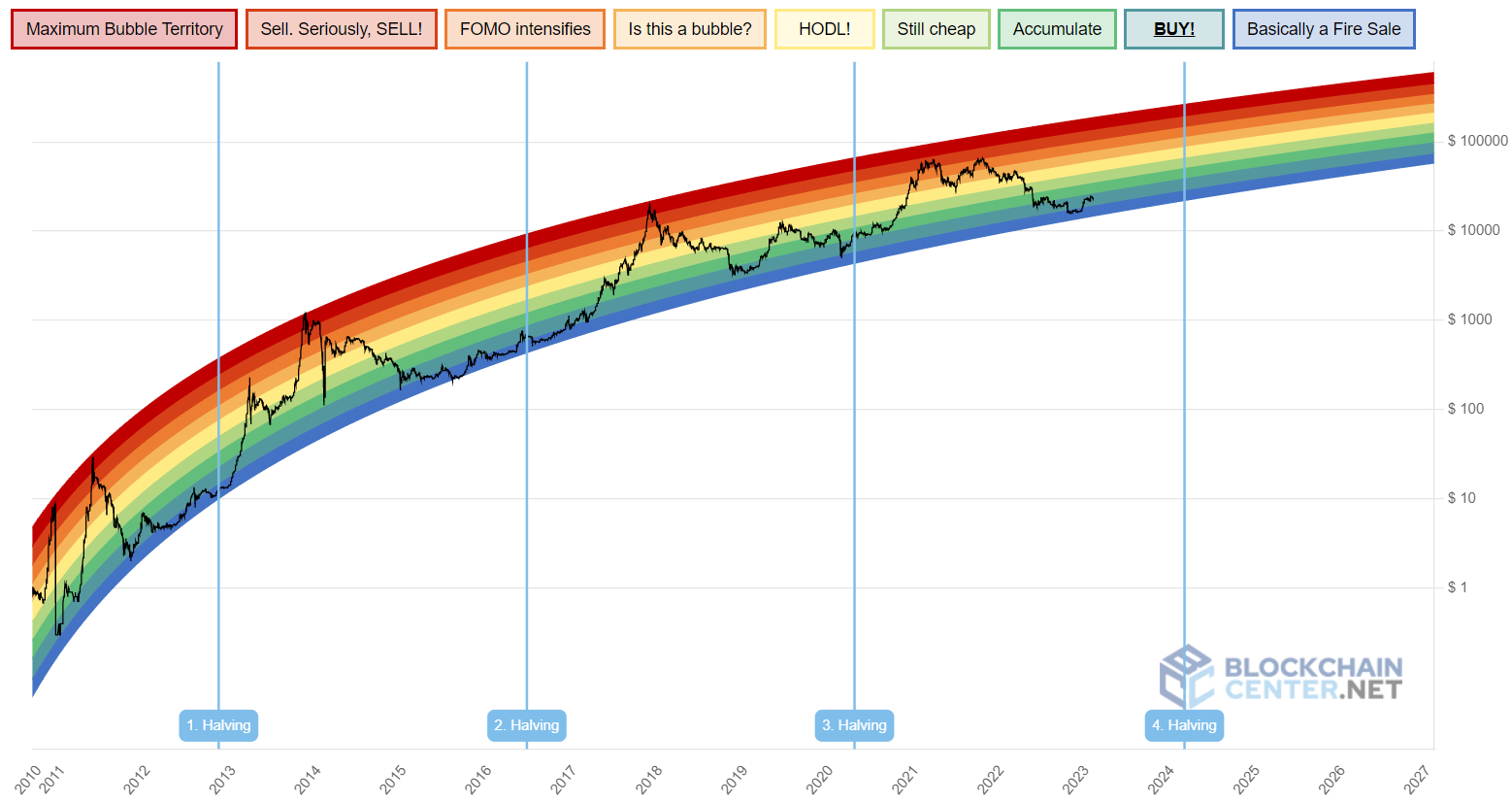

Meanwhile, Blockchaincenter.net’s popular Bitcoin Rainbow Chart shows that at current levels, Bitcoin is in “BUY!” zone, after recovering from the “Basically a Fire Sale” zone at the end of 2022. In other words, the model suggests that Bitcoin is gradually recovering from being heavily oversold. During the last bull run, Bitcoin was able to reach “Sell. Seriously, SELL!” zone. If it can repeat this feat in the next post-halving market cycle within, say, one to one and a half years after the next halving, the model suggests a possible Bitcoin price in the $200-$300K region. That is around 8-13 times the gain from today’s levels.