The key to meeting the UN’s goal of reducing money transfer costs to less than 3% by 2030 – Op-Ed Bitcoin News

The costs for African migrants or foreigners when they send funds via the so-called formal corridors are still far above the UN target of less than three percent, the latest data from the World Bank has shown. On the other hand, the cost is much lower than the target when cryptocurrencies are used.

Global average higher than the SDG target

According to the latest remittance data from the World Bank (WB), sub-Saharan Africa has once again emerged as the most expensive region to send funds to. With an average cost of 7.8% for every $200 sent, the region, which received $49 billion in remittances in 2021, only improved the 2020s by 0.4%.

Nigeria, which accounts for the largest share of the region’s remittances, saw inflows increase by 11.2 percent. According to the WB, the growth in the value of remittances sent to Nigeria through formal channels can be attributed to the country’s policies that encourage recipients to withdraw money on regulated platforms. Other countries from the region that saw significant growth in inflows include Cabo Verde, whose incoming remittances increased by 23.3%, The Gambia (31%) and Kenya (20.1%).

Globally, the average cost of transferring funds across borders was 6% in the same period. According to the World Bank, both sub-Saharan Africa and global average transaction costs are still much higher than the Sustainable Development Goal (SDG) 10.3 of less than 3%.

Yet, despite ongoing efforts to lower this figure, the cost of moving funds across borders remains simply high and has been for years. This means that the goal of achieving the UN’s SDG 10.3 target of reducing the transaction costs of migrant transfers to less than 3% by 2030 is unlikely to be achieved. Similarly, the UN’s mission to eliminate money transfer corridors with costs of more than 5 percent appears unattainable.

Why migrants are turning to crypto

Meanwhile, the high cost of sending remittances through formal channels and the accompanying strict KYC standards used often force migrants to look for more convenient and less cumbersome channels. Couriers, cross-border trucks or bus drivers are some of the informal ways migrants use to send money to their loved ones. However, such informal methods have their own challenges, the most important of which is the security of the funds.

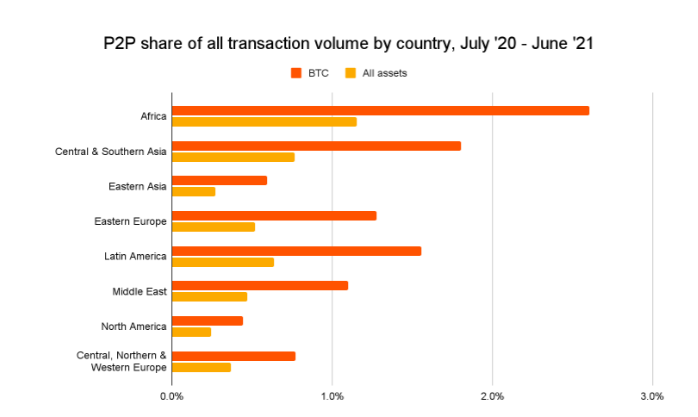

So while cryptocurrencies were not initially created to solve this dilemma, their growing use by migrants sending money to loved ones shows that they can be part of the solution. As the 2021 Geography of Cryptocurrency report from blockchain intelligence firm Chainalysis will confirm, a growing number of African migrants can now use peer-to-peer crypto exchange platforms when sending money home.

To illustrate, the intelligence firm’s data suggests that between July 2020 and June 2021, a total of $105.6 billion in cryptocurrency was sent to recipients on the African continent. Of this sum, transfers across regions accounted for almost 96%.

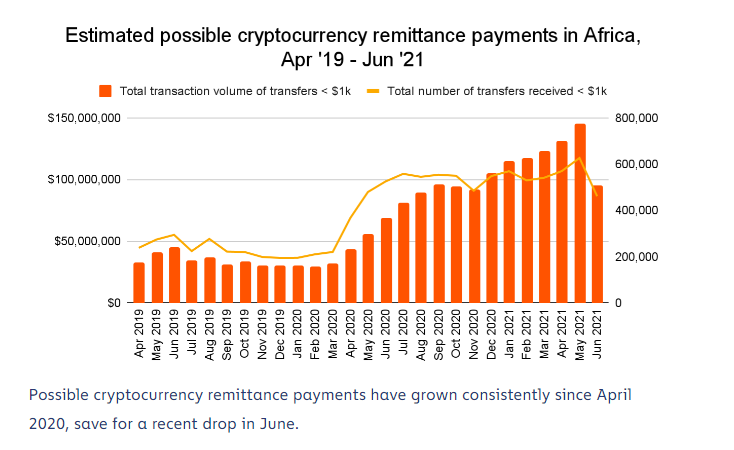

The number of incoming transfers that are under $1,000 is the second metric used in the report, which again supports the claim that African migrants are using digital currencies to transfer money. According to Chainalysis, the number of such transfers passed the 200,000 mark for the first time in May 2020 and has remained above this level ever since. In fact, by May 2021, the number of transfers under $1,000 was just under 800,000.

Besides being a faster and perhaps safer way to send money, cryptocurrencies are noticeably much cheaper compared to the so-called formal channels. While it can cost as much as $10 (10%) to move $100 from South Africa to Zimbabwe when using regular corridors, it costs about $0.01 to send $200 via the BCH network or less than one percent, for example. It even costs much less than one cent to transfer the same value on the Stellar network. Besides these two examples, there are several examples that prove that cryptocurrencies can be a better alternative to regular remittance channels.

Regulators must not limit the use of functional innovation

Therefore, while critics – especially those based in advanced economies – are eager to highlight the flaws of cryptocurrencies, migrants from not only Africa but all over the world are proving that cryptos are better than traditional channels. If cryptocurrencies were to suddenly become the widely used means of transferring funds across different jurisdictions, then the achievement of the SDG 10.3 target of achieving remittance costs lower than three percent could happen well before the 2030 deadline.

It is therefore natural that regulators should be guided more by facts and not malice when dealing with cryptocurrencies. Regulation of cryptocurrencies should not be about limiting their use, as the United Nations Conference on Trade and Development (UNCTAD) recommended in a recent policy brief.

Instead, regulators should promote or encourage increased use of cryptocurrencies where they prove useful. An innovation that liberates the poor or one that attempts to level the playing field should be protected and not ostracized.

Register your email here to get a weekly African news update delivered to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.