The future of retail cryptocurrency investing looks promising

Retail investors have played an important role in the rise of cryptocurrencies. Despite many collapses and risks, traders continue to hold crypto. But sometimes, at a high cost and loss.

“Retail investors” refers to individual investors who buy and sell cryptocurrencies for their investment portfolios. In traditional finance (TradFi), retail investors are called ‘Main Street’. In comparison, professional and institutional investors are known as ‘Wall Street’.

In cryptocurrency, retail investors have been instrumental in driving demand, often lured by the seduction of “moonshot” returns from crypto’s decentralized freedom of access for anyone with an internet connection.

This has led to increased adoption and acceptance helping to establish crypto as a viable alternative asset class to traditional currencies. Taking into account, the supply of Bitcoin retail increased by 17 percent, approximately 3.57 million in December 2022. Last year, the market witnessed several collapses, such as FTX. Nevertheless, the dealers were not deterred. According to the chain analysis company Glassnode, this is shared by an analyst.

At the same time, the percentage of female crypto investors increased from 24% in the first quarter of 2022 to 34% in the fourth quarter of 2022. These cases show traders’ faith in the cryptocurrency sector.

In addition, retail investors have played a significant role in the development of the crypto ecosystem. Many retail investors are also developers, entrepreneurs and enthusiasts, actively involved in building new blockchain-based applications and services. Their contributions have helped expand the use of cryptocurrencies and created new opportunities for investment and innovation.

Retailers have suffered over the years

However, it is important to note that the involvement of retail investors has also led to criticism. In particular, increased volatility and risk for the cryptocurrency market. As more people have become involved in cryptocurrency trading, there have been more significant price fluctuations and increased vulnerability to fraud.

Said cohort faced challenges and losses earlier due to the collapses of various financial institutions and markets. A notable example is the global financial crisis of 2008, which destroyed several major financial institutions and caused significant losses to many private investors. Many investors lost their life savings and pension funds as the stock market plummeted, and the value of many securities and financial products fell sharply.

Other examples of financial collapses that have affected retail investors include Enron’s bankruptcy in 2001 and the failure of Lehman Brothers in 2008. These events demonstrated the risks and potential pitfalls of investing in the financial markets. Most notable are those who need a deeper understanding of the complex financial products and strategies involved. Despite the challenges, retail investors continue to play an important role in the development of cryptocurrencies and the wider blockchain ecosystem.

Gracy Chen, CEO of Bitget, spoke exclusively to BeInCrypto at the Dubai Blockchain Life 2023 event. Here, she highlighted retail investors’ involvement in crypto and shared a few narratives to cater to the cohort.

Current trends for retailers

Chen argued that the retail investment trend had evolved from where it was eight years ago. “Updates at the product level are critical to shaping today’s trends for retail investors. First, the rise of stablecoins has added an anchor to fiat currencies, which are also the cornerstone of various derivative products. The rise of perpetual contracts has further increased the stability and liquidity of crypto prices,” she said.

Further added:

“For traders, perpetual contracts are an easy way to take a leveraged position in a given market without an expiration date. In addition, investors can take advantage of the perpetual funding rate to earn interest while minimizing the risk to the underlying asset. The lowering of the investment threshold and the simplification of the products allow more investors to participate in crypto trading, something the market could not offer eight years ago.”

In addition, crypto exchanges play a role in protecting and educating traders. Bitget is no different. Platforms like Bitget Academy offer blockchain, crypto and trading training through in-depth tutorials, practical tips and market updates. Similarly, BeInCrypto also offers an educational resource.

Protect customer funds and cryptos

While the space and holders have become relatively mature, hacks and collapses lead to losses of millions. Therefore, crypto exchanges must have a system to protect users’ funds. This can come in various measures. For example, Bitget launched a $5 million building fund to help affected partners, increased the Bitget Protection Fund to $300 million with transparent wallet addresses, and guaranteed no withdrawals for three years.

“The next thing we worked on was our Proof-of-Reserves. We have developed an internal verification tool, “Merklevalidator”, with free access to open source code on GitHub. Not only shows the reserve status of the company as a whole, users can also verify the account’s proof of reserves with the tool. Proving our currency reserve to users’ assets is at least 1:1.”

On a more general front, Crypto exchanges should have several safeguards in place to protect users’ funds and cryptocurrencies.

Standard security measures

- Two-factor authentication (2FA): Two-factor authentication adds an extra layer of security to user accounts by requiring users to provide another factor, such as a unique code sent to their phone or generated by a specialized app, in addition to their login information.

- SSL encryption: SSL (Secure Sockets Layer) is a protocol for encrypting the communication between the user’s device and the exchange’s servers. This prevents unauthorized access to the user’s information and reduces the risk of data breaches.

- Cold Storage: Most crypto exchanges store the majority of user funds in offline wallets, which are not connected to the internet. This makes it difficult for hackers to gain access to users’ funds remotely.

- Multi-signature wallets: Multi-signature wallets require multiple signatures from different individuals to initiate a transaction. This adds an extra layer of security and makes it more difficult for hackers to gain access to users’ funds.

- Regular Audits and Penetration Testing: Crypto exchanges typically hire third-party security firms to conduct regular audits and penetration testing of their systems. This helps to identify vulnerabilities and ensure that the stock exchange’s security measures are effective.

- Insurance: Some exchanges may offer insurance to their users to protect against losses due to theft or hacking.

- Regulatory Compliance: Many crypto exchanges are subject to regulatory oversight, which requires them to implement specific security measures to protect users’ funds and data.

What does the future look like?

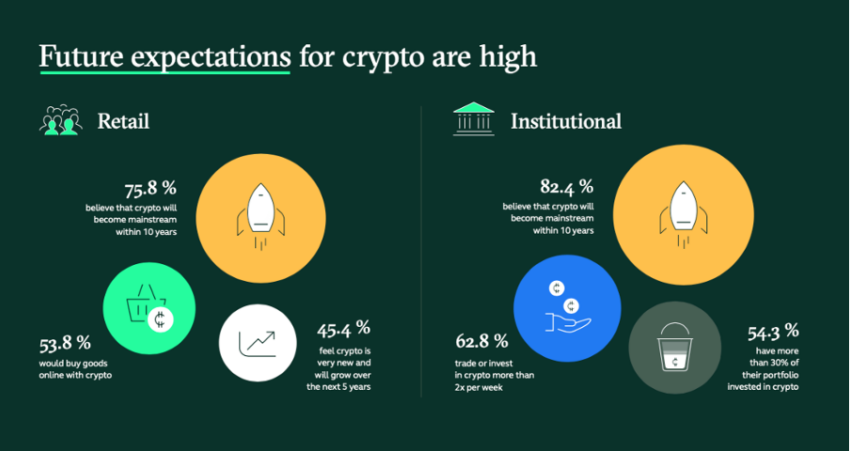

Retailers have an important role to play in the crypto domain. It is important for retail investors to carefully assess the risks and potential rewards of any investment opportunity and seek professional advice if necessary. Diversification and a long-term investment strategy can also help reduce some of the risks associated with investing in the financial markets.

Global cryptocurrency holders make up approximately 4.20% of the population, with over 400 million cryptocurrency users in total. The total market size is still relatively small. On the contrary, the infrastructure of the cryptocurrency market has been continuously improving, with increasing centralized and decentralized platforms providing users with a wide range of investment, trading and usage options for cryptocurrency. Use of Dapps (decentralized apps), including DeFi, NFT, gaming and social media is becoming increasingly diverse with more industries getting involved in the web3.

The underlying performance of existing chains is also improving, and more and more retail investors will be inclined to participate in the cryptocurrency market. “Over the next 5-10 years, we expect exponential growth in the number of retail investors in the Web3 space,” Chen concluded.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.