The Future of Blockchain Adoption in the Philippines Discussed at the First Philippine Fintech Festival

The Philippines is one of the largest adopters of blockchain technology in the Southeast Asian region – second only to Vietnam. And Digital Pilipinas capitalizes on this by creating a week-long event full of discussions, festivities and workshops on the future of fintech, digital currencies and blockchain in the country via the first Philippine FinTech Festival held at the Green Sun Hotel, Makati.

The second day of the Philippine Fintech Festival addressed the ideas of the future of blockchain, non-fungible tokens (NFT), metaverse, Web 3 and fintech.

DAY 2 HIGHLIGHTS!

Watch the highlights of the Philippine Fintech Festival and World Fintech Festival Philippines from Day 2!

Design an anti-fragile world powered by Digital! Let’s shape Asia’s economy together! pic.twitter.com/zBAM1nHjWC

— Philippine Fintech Festival (@PFFestival2022) 20 October 2022

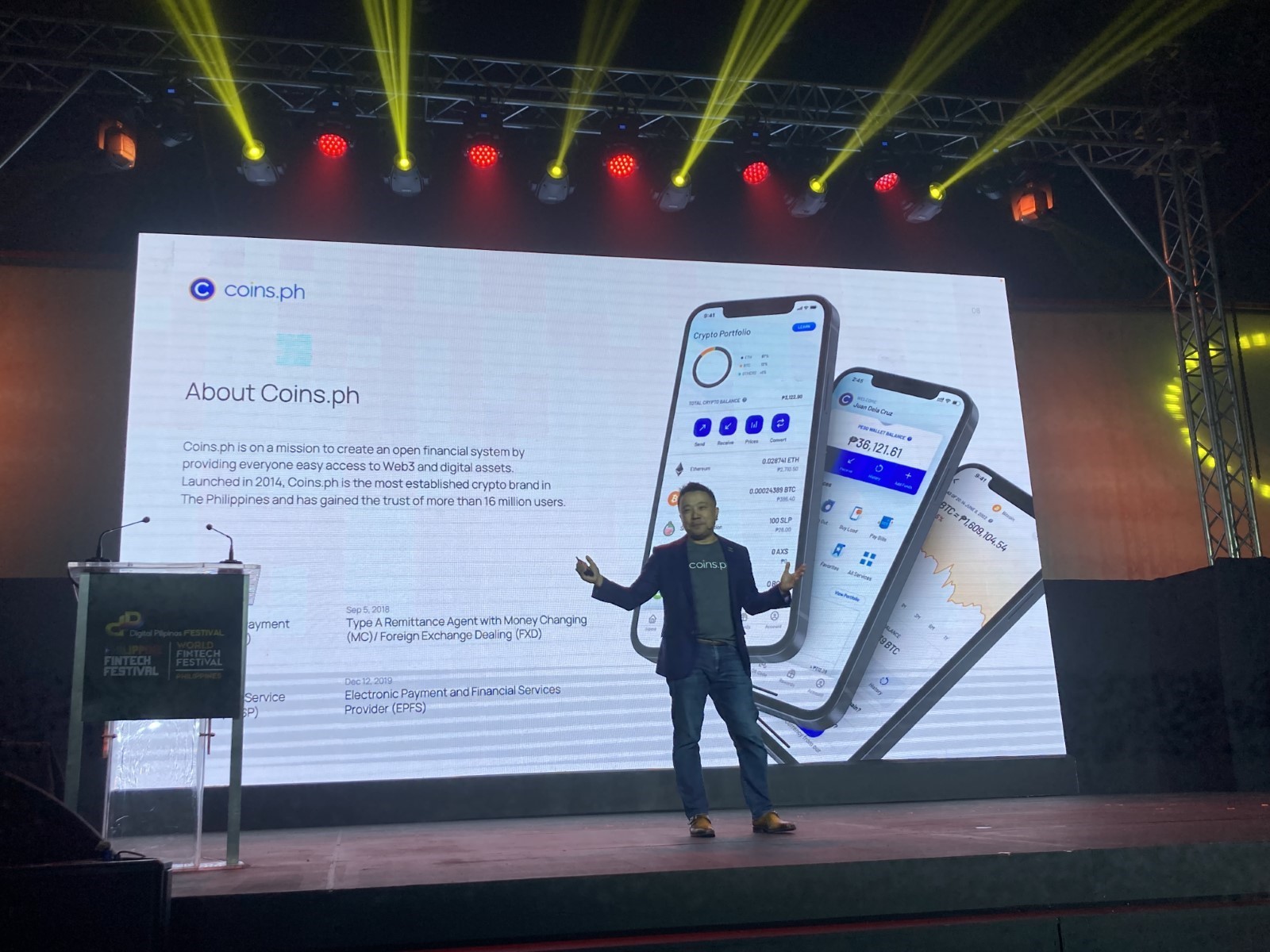

Coins.ph Wei Zhou takes center stage

First on the list of presenters is Coins.ph CEO Wei Zhou, who spoke about the state of digital currencies and NFTs in the Philippines and how they can radically and positively change the way Filipinos do business, make money and live.

According to Zhou, the Philippines has the greatest advantage in adopting blockchain in the ASEAN region because Filipinos know how to speak English.

“The future of digital assets is language and culture… And the language of web3 and the language of blockchain is English, right? And it’s very different when you use it in your native language,” he said.

According to his research, the Philippines also has the highest penetration of NFTs thanks to trending play-to-earn (P2E) games like Axie Infinity. About 25% of Filipinos have played P2E games, while 32% of the population have NFTs, 9.5% plan to buy some, and the forecast is at 41.5%, according to Finder.

“What’s going on here with the invention of the blockchain? You can now have what you call digital assets, which record your ownership of a digital property in a public ledger that is both immutable and transferable, and you can use it. It’s yours. You own it,” Zhou explained.

With all these coins.ph – the leading Bitcoin wallet in the country – is on a mission to create “an open financial system” that will provide easy access to web3 and digital assets.

Blockchain technology – the foundation of digital assets

Another immersive discussion about the endless possibilities in the space took place at the event’s first blockchain panel. Zhou was again present on stage, where he is joined by Cryptopop Art Guild (CPAG) Luis Buenaventura, BlockchainSpace founder Peter Ing, Chief Marketing Officer of BlockchainHub Inc. Chief Marketing Officer Ken Masuda, Asosiasi Blockchain Indonesia Chairwoman Asih Karnengsih, and Tamas Czegledi , a professional Lead 1 Hungarian Blockchain Coalition Digitális Jólét Program.

The panelists answered the questions on how blockchain, ‘crypto’, NFTs and other digital assets can drive the Philippine digital economy, its obstacles, the need for regulation and more.

“People are building businesses in this metaverse, and they’re running it like a traditional business, and they need the same support. Now, to actually make it a real business, you have to legitimize those revenues,” Ing noted when asked what regulatory guidelines you should establish to build a solid metaverse space.

“That’s the point that we need to lobby now with regulators is that you legitimize these revenues,” he added.

The discussion continued, with Karnengsih talking about the status of blockchain in Indonesia, and Masuda discussing the most suitable industries that blockchain technology unlocks in the Japanese market, followed by several questions on what strategies to make digital assets more usable and understandable for ordinary citizens .

For Buenaventura, the biggest indicator of why he thinks digital currency hasn’t fully entered the mainstream yet is because he keeps talking about it on stage.

“There are many things that are barriers to this: one of them is the fact that the software itself is inscrutable – there’s so much jargon you have to learn,” he pointed out. – The scope of the technology is also not quite there yet. I’m afraid of what would happen if 100 million Filipinos started using the same blockchain. That sounds like a scary transition. It takes time.”

As for Ing, one of the best developments happening in the space right now is that they’re not just telling people about digital assets like Bitcoin. Instead, they are here to teach it.

Zhou concluded by saying that “Money in the banks is not safe. The thing about Bitcoin is that I get to own my own assets.”

“Circumstances make our case for us. With the macroeconomic situation, people are trying to look for alternatives. With COVID-19, they are looking at other options. This is where people find crypto as another option,” Buenaventura added.

Several discussions and ideas took place

A rettch and cyber security panel moderated by Amor Maclang, the conference chair of Digital Pilipinas and World Fintech Festival, took place after the amazing discussion on digital assets and the future of blockchain.

While Etiqa Philippines CEO Rico Bautista, continued with their mission and goals for the brand in the country. The second day of Digital Pilipinas’ Philippine Fintech Festival panel discussions concluded with a panel of insuretech and healthcare technology experts in the Philippines.

See: BSV Global Blockchain Convention panel, The Future World with Blockchain

width=”562″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – originally envisioned by Satoshi Nakamoto – and blockchain.