The Fed lies about the US economy: Blockchain will fix this

[gpt3]rewrite

The US central bank has often been accused of obscuring economic truths and manipulating data for political purposes. This question is becoming increasingly relevant as economists become pessimistic about inflation and the International Monetary Fund (IMF) raises concerns about global economic stability. Can blockchain technology fix things?

Blockchain technology can solve these problems, enabling transparent, tamper-proof financial data and reducing the potential for manipulation.

Fed’s track record: questionable economic reporting

In recent years, the Federal Reserve has been accused of withholding important financial information from the public. Recently, The Hill reported that the central bank often played politics by presenting biased economic data. This manipulation of information influences public perception and policy decisions, and undermines trust in the institution.

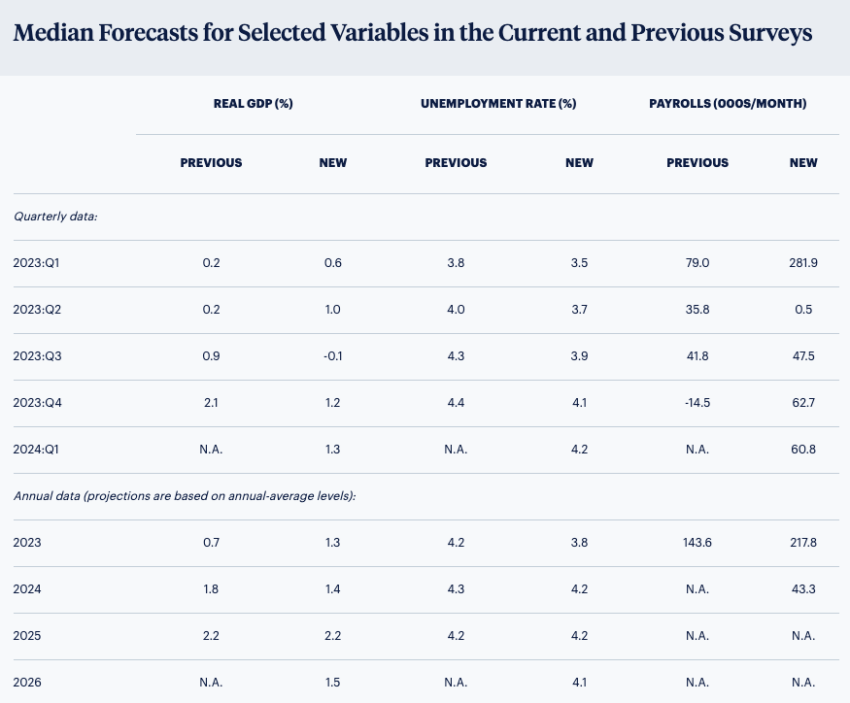

The Wall Street Journal also reported that economists have become more pessimistic about inflation. The Philadelphia Federal Reserve’s Survey of Professional Forecasters estimated inflation to be higher than previously expected.

Even the Fed’s staff predicted an increased likelihood that a banking crisis would lead to a recession within the year. This contradicts Chairman Jerome Powell’s public statements, which have painted a more optimistic picture of the economy.

“Given their assessment of the potential economic effects of recent developments in the banking sector, the staff’s projections at the time of the March meeting included a mild recession starting later this year, with a recovery over the following two years,” according to the public. published minutes from the meeting.

The discrepancy highlights the potential inaccuracy and unreliability of the Federal Reserve’s economic reporting.

The IMF’s World Economic Outlook raises concerns about global economic stability. It cites rising geopolitical tensions, inflationary pressures and rising debt levels as significant risks to global economic stability.

Meanwhile, US Treasury Secretary Janet Yellen issued a warning that the government could be exhausted by June 1 if Congress fails to raise or temporarily suspend the debt ceiling.

These questions underscore the importance of accurate, transparent economic data to inform policy decisions and maintain public trust.

Blockchain: A solution to financial transparency

Blockchain technology, a decentralized digital ledger, offers the potential to revolutionize the way financial data is recorded and shared. By storing information in a transparent, tamper-proof and accessible way, blockchain can help eliminate the possibility of manipulation and provide a clearer picture of the economy.

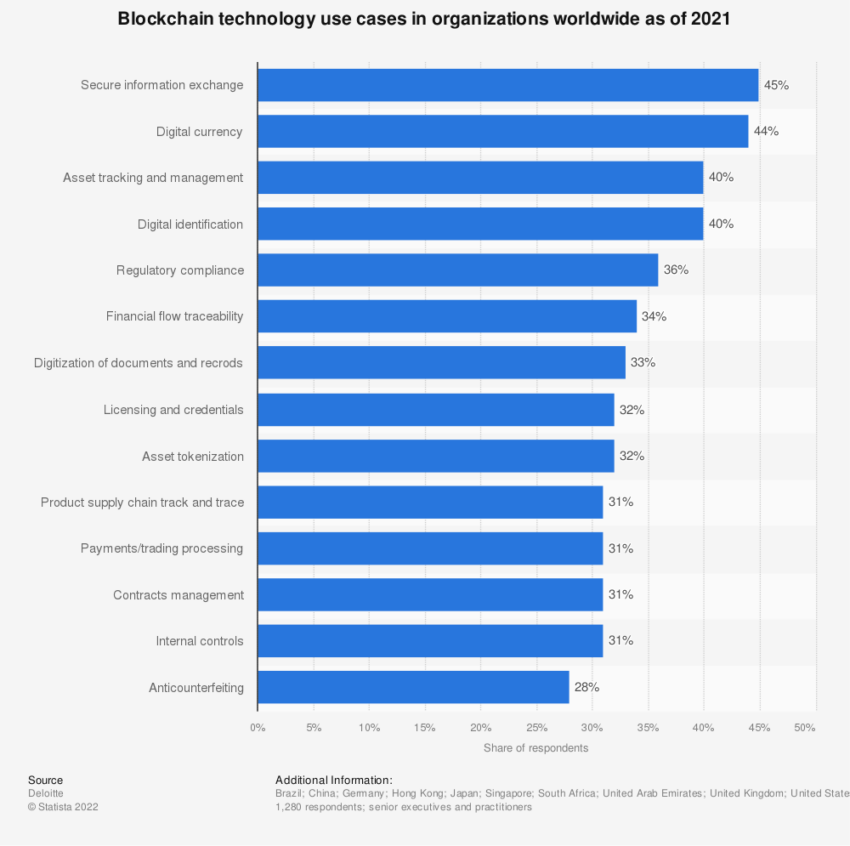

This technology already plays an important role in various industries, such as finance, supply chain management and healthcare, and shows the potential for widespread use.

The Federal Reserve can create a more transparent and accountable system for reporting financial data using blockchain technology.

In fact, with all transactions recorded on the blockchain, it becomes virtually impossible for a single entity to manipulate the data. This will help to reduce the potential for politically motivated manipulation of financial information in periods of economic turbulence or uncertainty.

As a result, central bank financial reporting will be more credible and reliable, promoting greater public confidence and informed decision-making. Blockchain’s decentralized nature can enable real-time access to financial data, enabling more timely and accurate analysis.

Blockchain Implementation: Overcoming Challenges

Implementing blockchain technology in financial data reporting has challenges, including privacy and security concerns.

To ensure the protection of sensitive financial data, robust encryption and security protocols must be in place. This will involve collaboration between the Fed, blockchain developers and cybersecurity experts to develop solutions that address these concerns while maintaining system transparency and integrity.

For blockchain technology to revolutionize financial data reporting, widespread use and collaboration between different stakeholders is also essential. This includes the Federal Reserve, government agencies, financial institutions and private sector organizations.

These entities can establish standardized protocols and processes by working together. The goal is to ensure seamless integration of blockchain-based systems into existing economic infrastructure.

Although blockchain technology has shown promise in various industries, it has limits. Scalability, energy consumption and transaction speed are among the challenges.

As blockchain technology continues to evolve, developers and researchers must find innovative solutions to these problems to ensure that blockchain can effectively support the demands of the modern economy.

A future of trust and openness

The US central bank’s history of questionable economic reporting has undermined public confidence and raised concerns about the accuracy of its data. Blockchain technology offers a potential solution to this problem, providing a transparent, tamper-proof and accessible platform for recording and sharing financial information.

By embracing this technology and overcoming its inherent challenges, the Fed and other financial institutions can pave the way for a more transparent, accountable and reliable financial reporting system.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.

[gpt3]