The Everything Bubble: Markets At A Crossroads – Bitcoin Magazine

Below is an excerpt from a recent issue of Bitcoin Magazine Pro, Bitcoin Magazine premium market’s newsletter. To be among the first to receive this insight and other market analysis on the bitcoin chain straight to your inbox, Subscribe now.

Powell’s speech and contracting ISM PMI

We want to zoom out and look at the broader macroeconomic picture and analyze some of the latest data coming out this week that will greatly influence market direction in the coming months.

After Jerome Powell’s Brooking Institution speech, it is clear that markets are trying to move higher with all possible Federal Reserve narrative and pivot scenarios. It’s over hedging, short squeezes, options market dynamics and forced buying. It is beyond our expertise to say exactly why markets explode with volatility on any given data point or new Powell speech. However, these types of events and market movements have almost always been a sign of unhealthy and increased volatility in bear markets. Despite more talk from Powell with nothing really new said, markets perceived the speech as more “dovish” with his comment surrounding concerns about overdoing rate hikes. Still, if this is another bear market rally taking shape for the major indexes, we appear to be close to a rally reversal.

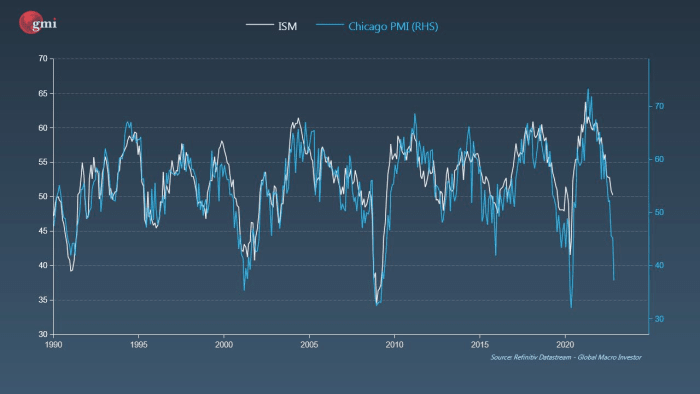

Also of concern and expected to continue is the trend of economic contraction as told by the ISM manufacturing index (PMI) data. Today’s latest release shows a print of 49.0 below market expectations of 49.7. New orders are shrinking, the order reserve is shrinking and prices are falling. By all measures and survey responses, this is a sign that demand is softening, conditions are worsening and the economy is moving into more cautious territory. The ISM PMI data correlates strongly with the less impactful Chicago PMI data which just recorded declines in 2000, 2008 and 2020. This is the sign of an economic recession starting in manufacturing.

Source: GMI, Julien Bittel

What does the economic downturn mean for the financial markets? It is usually bad news when there is a sustained downward trend with the ISM PMI below 50 and even below 40. It appears that we are in the early stages of a larger contractionary trend unfolding: the market despair phase.

The specific question for the bitcoin-macro relationship now is: Was this industry-exploited wipeout and capitulation event enough selling to dampen the potential likelihood and effects of an equity bear market meltdown? Will bitcoin flatline and form a bottom if shares are to follow similar previous bear market downtrend trajectories?

We still haven’t seen a real blowout in the stock market volatility that has always affected bitcoin. It has been a central part of our thesis this year that bitcoin will follow traditional stock markets to the downside.

The size of the long-term debt in real terms was, and still is, the biggest story here.

Furthermore, what does this mean going forward for valuations?

Relevant previous articles: