The decline of the pound paves the way for Bitcoin adoption in the UK

Global cryptocurrency adoption continues to reach around 750 million users by the end of 2023, according to Triple-A.

According to the report, the top five countries by estimated number of holders are the USA, India, Pakistan, Nigeria and Vietnam with 46 million, 27 million, 26 million, 22 million and 20 million respectively. Vietnam’s ownership rate came in at 26% of the population, with the US’s at 13.2%.

The UK ranked low, with only 3.7 million estimated holders, representing 5.5% of the population. But despite falling short on cryptocurrency adoption metrics compared to other countries, Britain’s ruling Conservative Party has signaled its intention to incorporate digital assets into its economic plans.

In January, despite the fallout from the FTX collapse continuing to linger, Finance Minister Andrew Griffith spoke of championing cryptocurrency and blockchain technology to deliver future economic benefits.

Griffith said he fully intends to make the UK an advanced financial centre, which “absolutely [has] room” for cryptocurrency and blockchain technology.

The wording used by Griffith suggested that cryptocurrency will play second fiddle to the pound. But reading between the lines, could Griffith be deliberately downplaying the importance of digital assets to the UK? Especially considering the pound’s decline.

The British pound

Historians noted that during Anglo-Saxon times, from AD 410-1066, one pound was equivalent to one weight (454 grams) of silver, a considerable fortune at the time.

However, it was not until 1815–1920 and the rise of the British East India Company, a trading body for English merchants, that the pound rose among global currency rankings to assume the role of reserve currency.

Although the pound lost its reserve currency status to the dollar under the Bretton Woods Agreement, it was not until the 1970s, when US President Nixon “suspended” the dollar’s convertibility to gold, that the pound’s decline became undeniably evident.

In 1976, faced with a financial crisis, the British government was forced to apply for an IMF loan of $4 billion. Contributing factors to the situation include a growing balance of payments deficit, excessive government spending and the quadrupling of oil prices.

Adjusted for inflation, $4 billion in 1976 is equivalent to $21.03 billion in today’s money—a cumulative increase of 426% over 47 years.

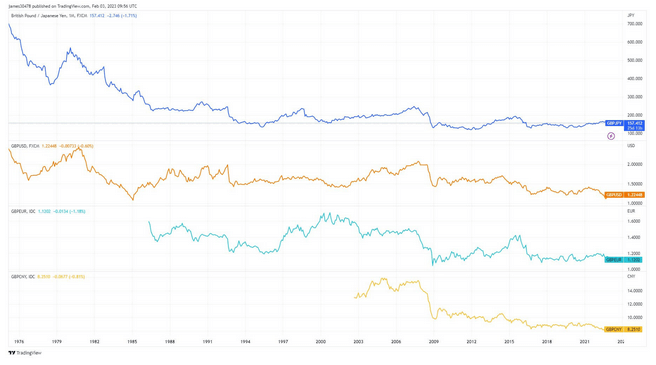

The chart below shows a dollar valued at around £2.60 in 1972. By the mid-1980s this had fallen to as low as £1.10, spurred in part by a general decline in British industry, including the end of the coal mining sector, and dollar strength as a result of significant tax cuts by President Regan.

Declining global influence

The late 80s saw a reversal of the downward pressure on the pound as the country redefined itself as a service economy – particularly with regard to financial services. But the macro downward trend became apparent after the start of the last recession in 2006.

Further pressure came in 2016, when Britain left the EU during the Brexit vote and, more recently, via the economic naivety of former Prime Minister Liz Truss, who sparked market panic over her “mini-budget” of unfunded tax cuts, causing the pound to fall to near the 1985 lows.

Far from being an isolated trend against the dollar, since the 70s, the pound’s value against other major currencies, such as the yen, euro and yuan, has also collapsed. For example, in 1976 one pound could buy 700 yen. Today, the rate is close to 150 yen – a drop in value of almost 80%.

The pound’s decline coincides with Britain’s waning influence on the global stage. To call Britain and the pound a shadow of their former selves would be a polite way of framing the situation – something the Westminster is fully aware of.

Why is the UK looking for digital assets?

More recently, the UK government has signaled its intention to regulate cryptocurrencies, thus sanctioning their legitimacy within its jurisdiction.

A Finance Ministry post dated February 1 highlighted proposals to regulate financial intermediaries, including crypto exchanges, laying the foundation for a friendly regulatory landscape.

“These steps will help deliver a robust world-first regime that strengthens the rules around crypto-asset lending, while improving consumer protection and businesses’ operational resilience.”

But to what extent are these actions guided by a sincere belief in cryptocurrency principles? After all, Bitcoin is the antithesis of centralization and is ideologically incompatible with control structures outside of personal sovereignty.

The Treasury is likely willing to cede some of its monetary monopoly in exchange for the potential economic benefits of national cryptocurrency adoption. This conversation is likely driven by an understanding that cryptocurrency usage will increase over time.

As such, far from espousing cryptocurrency principles, the UK is more likely to position itself favorably in readiness for mass adoption.

People are not happy with the financial system

While cracks in the old system began to show as far back as 1976, the past year saw an acceleration in the pound’s decline as fun money policies in response to the health crisis came into effect.

UK households are experiencing a significant drop in disposable income and ordinary people are struggling amid the cost of living crisis – making it increasingly clear that the system is broken, even to lay people who may not be tax-savvy.

In the past, Britons bought property to counter inflation and currency depreciation. But with house prices 11 times the average wage for Londoners, affordability is now well beyond sustainable levels.

The lack of (traditional) options to park money in an environment of declining purchasing power has led to more dissatisfaction with the financial system. Under such circumstances, people will seek new alternatives, including cryptocurrencies. For that reason, the worse things get, the more cryptocurrency adoption will advance.

It is very telling that developing countries, where financial inclusion and financial stability are typically low, thus creating financial discontent, account for four of the top five spots for the estimated number of cryptocurrency owners.

In rubber-stamping cryptocurrencies, the UK Treasury has inadvertently admitted that people are losing faith in the pound and the old economic system.

But in fairness, waning confidence in the local currency is a problem that all countries face, not just the UK. As the global legacy system continues to grin, expect cryptocurrency usage trends to accelerate.

CBDCs – the elephant in the room

The Deputy Governor of the Bank of England (BoE), Sir Jon Cunliffe, told the Treasury Select Committee that the UK is 70% likely to launch a digital pound Central Bank Digital Currency (CBDC).

Critics argue that CBDCs pose a risk to privacy and can be used for economic manipulation by governments and central banks, especially when it comes to restricting transactions and taking away people’s right to trade freely.

The commitment to both private cryptocurrencies and a digital pound raises questions about the UK government’s vision of an advanced financial center – as the two are philosophically incompatible.

It remains to be seen how the Treasury will blend its crypto hub vision with the digital pound, should it see the light of day.