The Bitcoin market realized on-chain losses for the first time in over two weeks – what this means for the BTC price

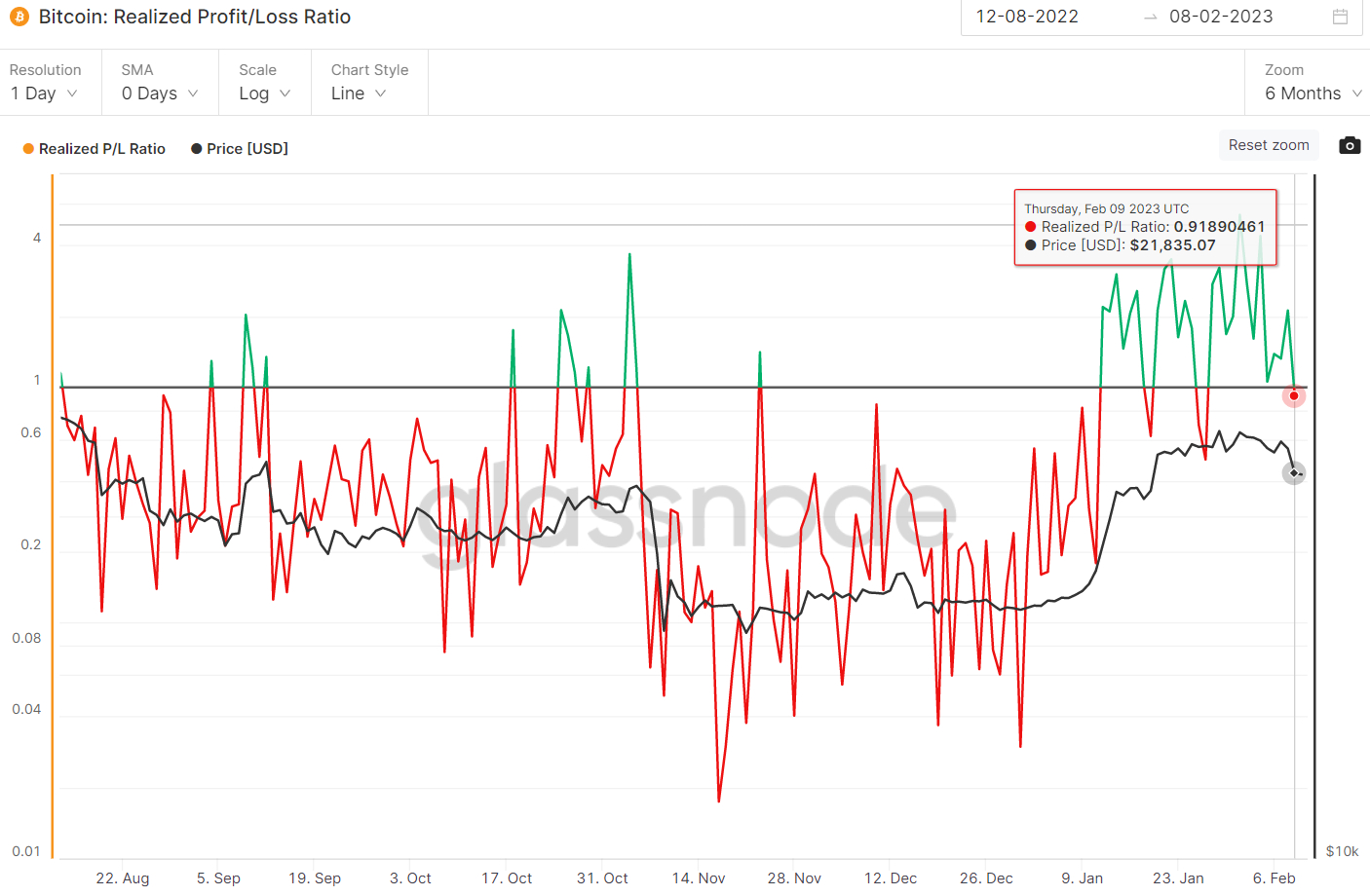

The ratio of all Bitcoins moved with gains to losses fell below 1 for the first time in more than two weeks on Thursday 9.th February, according to data from cryptoanalysis firm Glassnode. The so-called Bitcoin Realized Profit/Loss ratio fell to 0.9189 as Bitcoin’s price fell to a new nearly three-week low below $22,000 on concerns of 1) a US regulatory crackdown currently focused on US-based providers of crypto betting services , but may soon spread to other parts of the industry and 2) concerns that the Fed may end up raising interest rates more than expected this year.

This means that on Thursday the Bitcoin market realized a greater share of losses in USD than profits. Before Thursday’s 5% one-day drop, Bitcoin had already retreated 5% from its previous monthly highs in the $24,000s, but the realized profit/loss ratio had remained positive. It indicated that the downside was likely a result of profit taking by those who had bought earlier in the year, before/during Bitcoin’s big rally.

However, the realized profit/loss ratio that turned negative on Thursday suggests that a larger share of the selling pressure was likely a result of traders who had gone long over the past few weeks being stopped. Future liquidation data from crypto derivatives analytics firm coinglass paints a similar picture. Liquidations of long Bitcoin positions rose to a more than three-month high of $64.6 million on Thursday.

What next for BTC?

As the week draws to a close, Bitcoin price is consolidating just above the key $21,500 resistance-turned-support area, and traders are wondering if all short-term “weak-handed” investors have been wiped out. Anyone who placed their stop in the low-$22,000s is now safely gone.

But while the bulk of the short-term speculators who bought in the mid-$22,000s and above are now out of the market, profit-taking by those who bought below $20,000 earlier this year could continue to weigh on prices. If Bitcoin’s price continues to fall this weekend/next week, but the Realized Profit/Loss ratio returns above 1.0, it will indicate increased profit taking from this cohort.

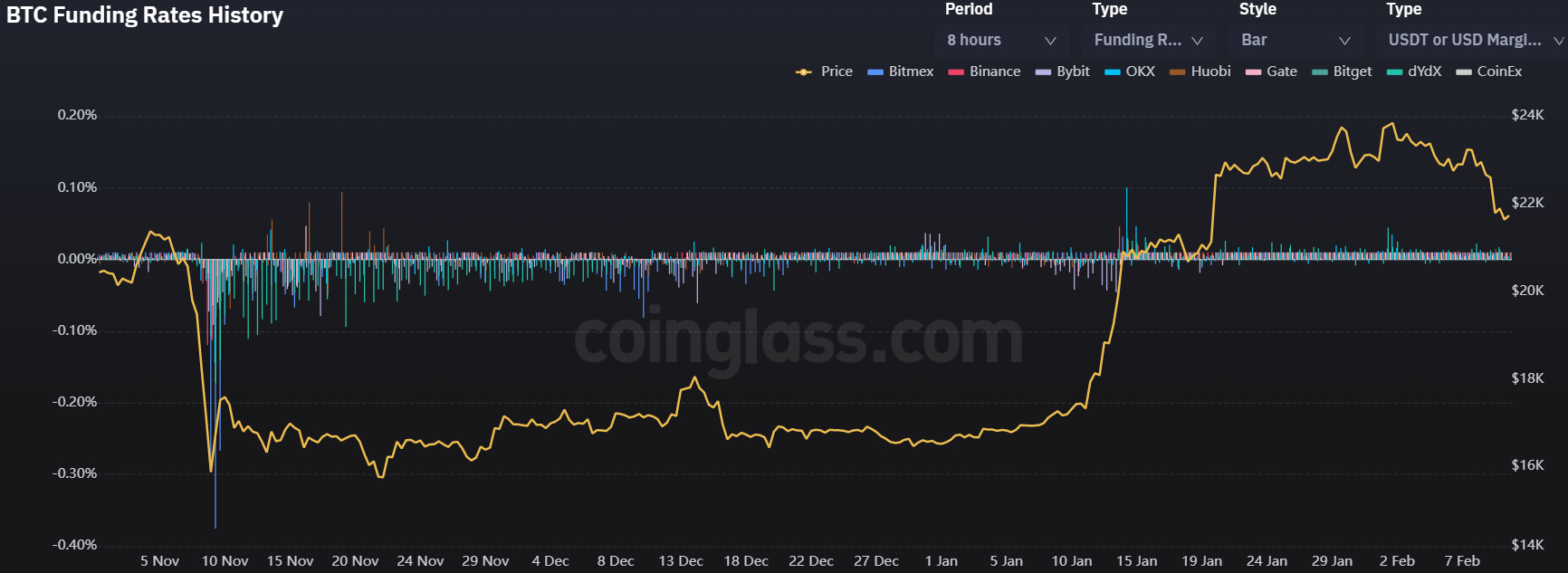

It can arguably be taken as a bearish signal, given it is evidence of doubt from potentially long-term holders in the sustainability of the 2023 rally. But for now, Bitcoin bulls shouldn’t panic. Coinglass data shows that despite Thursday’s drop, there hasn’t been a shift in Bitcoin leveraged funding rates, which remains modestly positive. According to coinglass, “positive funding rates suggest that speculators are bullish and long traders are paying funding to short traders”.

While options markets have shifted into position for a slightly increased short-term downside risk over the next seven days, many traders remain confident that the latest pullback is not the start of a fall back to the 2022 lows. Indeed, options markets continue to send positive signals regarding Bitcoin’s long-term outlook, as captured by the fact that Bitcoin’s 180-day 25% delta bias remains above zero and near recent highs.

Given the growing list of chain and technical indicators that are all now screaming that the 2022 bear market is likely over, and the fact that even if the Fed makes a few additional rate hikes, the end of tightening still remains. in view, expecting a positive bias for the year continues to make sense. But if next week’s US consumer price index data delivers an upside surprise, Bitcoin could certainly be in for some more near-term pain.

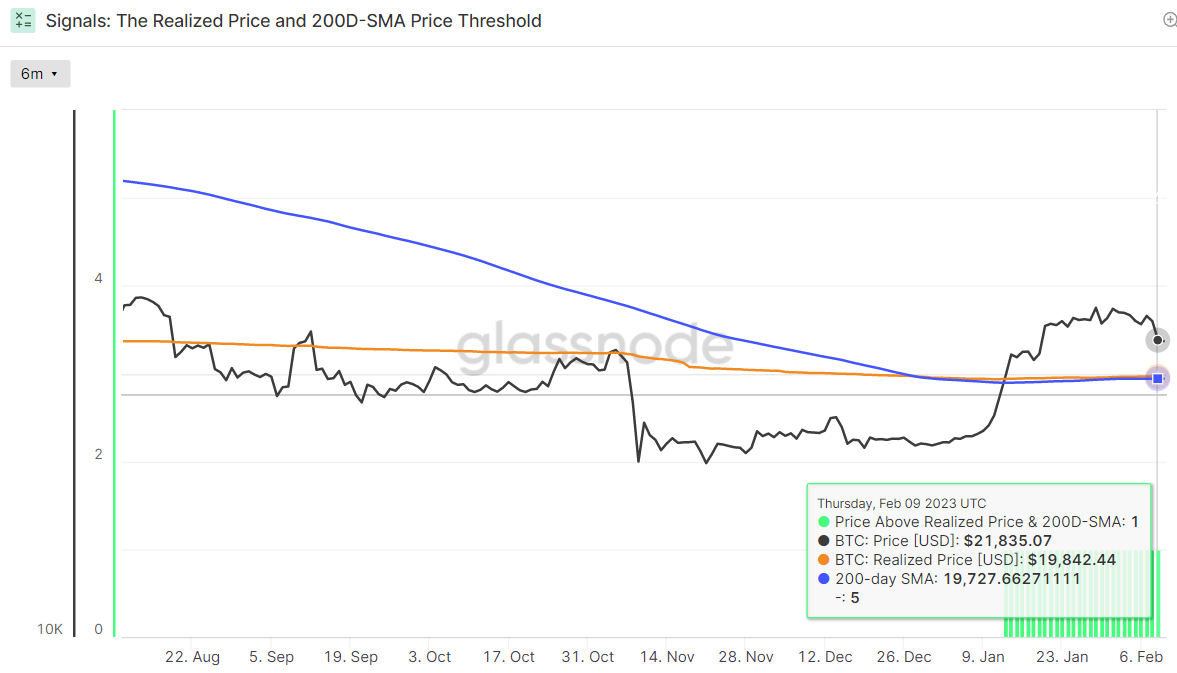

A drop to levels below $20,000 could be on the cards, which is likely to trigger another stop-run on short-term speculators who went long in the $20,500-$21,500 supply area. However, expect dip buyers to be anxiously awaiting to acquire a good amount of Bitcoin when it is approaching the 200-day moving average and realized price, both of which are in the $19,700/800 range.