The Bitcoin financing rate will be very positive, long hug along the way?

Data show that the Bitcoin financing rate has increased to a relatively high positive value recently, which may lead to a long squeeze in the market.

The Bitcoin financing rate becomes positive when open interest rises

As pointed out by an analyst in a CryptoQuant post, the BTC funding rate has a positive value at the moment.

“Open interest” is an indicator that measures the total number of positions currently open in the Bitcoin futures market.

When the value of this calculation is high, it means that there is a large amount of influence involved in the market right now. Excessive influence usually leads to the cryptocurrency becoming more volatile.

Related reading | When will the extended stretch of extreme fear in crypto end?

On the other hand, low values of open interest may result in less volatility in the BTC market, as there is not much influence involved in the futures market.

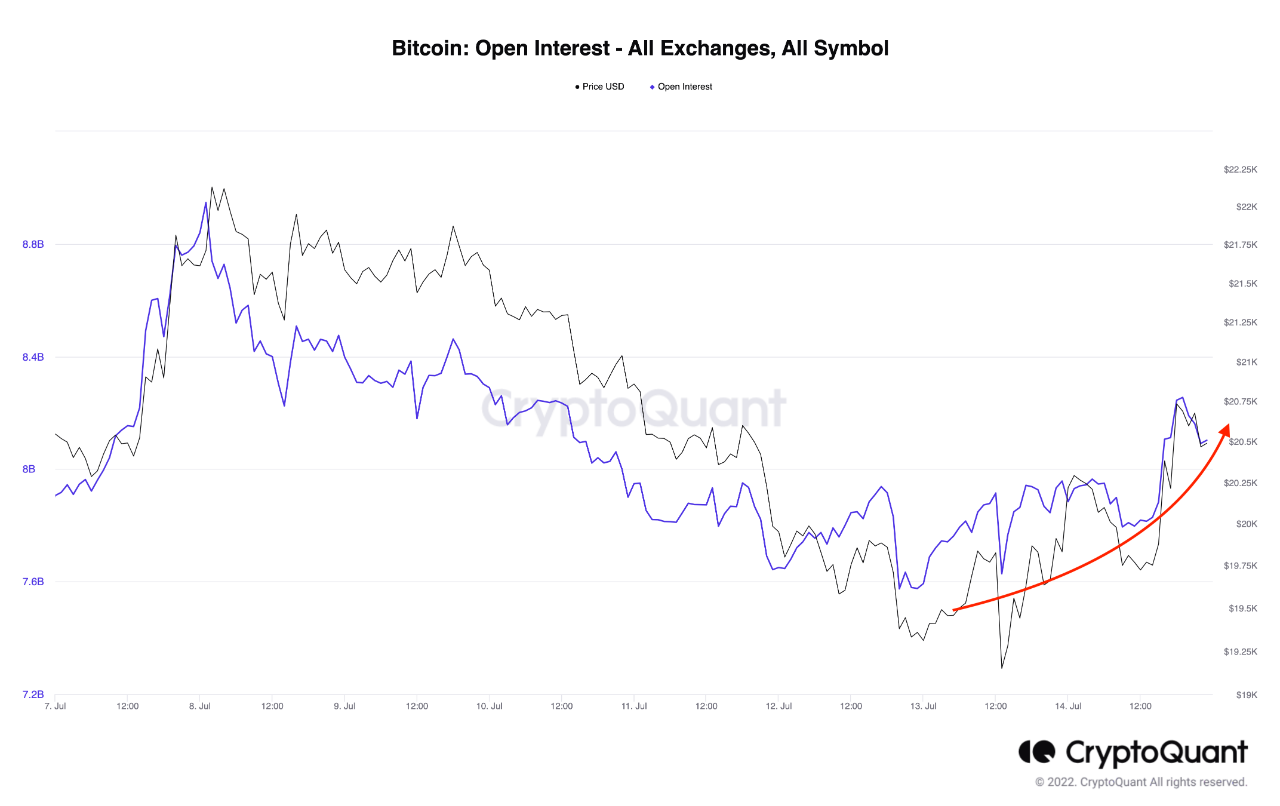

Now, here’s a chart showing the trend in open interest rates over the last week:

Looks like the metric's value has increased recently | Source: CryptoQuant

As you can see in the graph above, Bitcoin open interest has seen an increase in recent days. This may mean that the crypto may face higher volatility in the coming days.

Another indicator, the “financing rate”, measures the periodic fee that derivatives exchange traders pay each other to hold their positions. This calculation tells us how the open interest is distributed between the long and short traders at the moment.

Related reading | Bitcoin manages to hold on when Wall Street opens with losses, analysts weigh in on the bottom

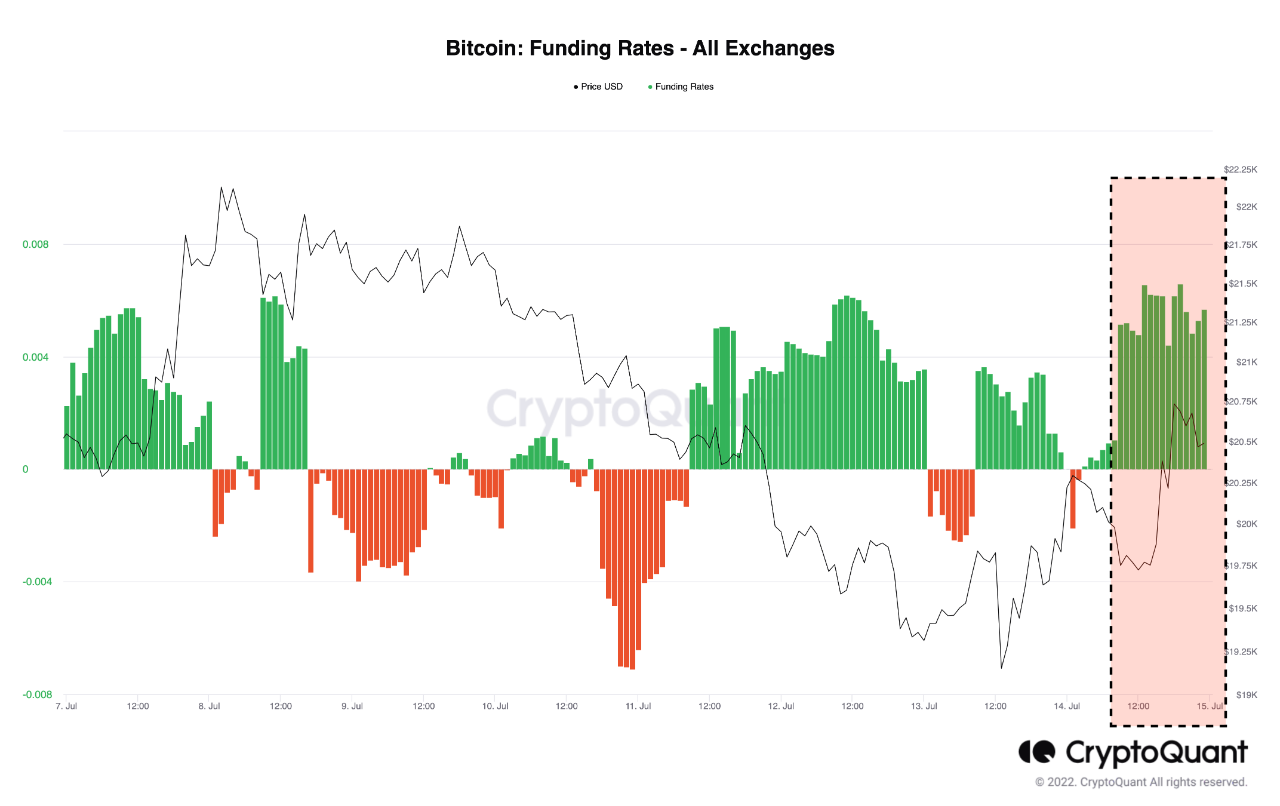

The chart below shows how the value of this indicator has changed over the last seven days.

The value of the indicator seems to have been green recently | Source: CryptoQuant

From the graph, it is clear that the Bitcoin financing rate has a relatively high positive value at the moment. This means that there are a higher number of longs on the market right now.

Since long traders pay a premium to keep their positions (that’s why the price is positive), the general market sentiment leans towards bullish.

But with the high open interest rates, it is possible that any large fluctuation in the price can cause what is called a “long squeeze”, which is an event where mass liquidations of long positions collapse and push the price further down.

BTC price

At the time of writing, Bitcoin’s price is floating around $ 20.9k, down 2% in the last week. Over the past month, the crypto has lost 5% in value.

The price of BTC has climbed up over the past couple of days | Source: BTCUSD on TradingView

Featured image from Aleksi Räisä on Unsplash.com, charts from TradingView.com, CryptoQuant.com