There are several crypto trading platforms out there, but choosing which one to use can be challenging. It can even be more challenging for beginners, but depending on what they want to achieve, they can easily filter through and get the kind of exchange they need.

If the goal is to learn crypto trading while making some money, social trading can be an excellent option to consider. Not all exchanges offer this service, but we list the best ones you can use here.

What is crypto social trading?

Social trading or copy trading is a type of crypto trading that allows less experienced traders to copy the trades of more experienced traders. This will enable them to make money if the people they copy also make a trade. But if the people they follow lose on a trade, they lose too.

If you are a brand new crypto trader, learn more about what crypto social trading is and how it works before proceeding. That being said, the following are the best social crypto trading platforms you should check out.

For anyone who has been in crypto for a while, the name eToro should be familiar. It is the leading social trading platform for crypto traders and remains unsurpassed to this day. Headquartered in Israel, the exchange allows traders from all over the world to use its platform for trading crypto in various ways.

By using the exchange’s CopyTrader feature, you can replicate the trades of other traders in real time, thereby reducing your chances of losing a trade and increasing your chances of winning. You basically trade like a top trader with this feature and then learn how to trade in the process.

This feature is for both beginners who have just entered the space and experienced traders who may not have time to watch the markets themselves and are willing to pay others to be their eyes.

You will not be charged any additional fees and there are no hidden costs for copying other people’s trades. eToro’s popular investor program pays the copied traders directly.

CopyMe is another top social commerce platform. Unlike eToro, it is solely dedicated to social crypto trading. You can copy the trades of more than one person at a time and split your portfolio into multiple chunks to copy each trader.

This diversification feature allows you to spread your trades and reduce the chances of losing a lot in a single trade.

Orders are executed in split seconds and you retain full control over your money on your exchange. CopyMe only connects to the exchange’s API and executes orders with the funds you already have on the exchange.

After creating an account on the platform, you just need to set up your exchange keys, assign the percentage you want to each trader if there are more than one, and enter Live trading to genuine. You don’t need to use codes or manually enter signals, so this is suitable for people with zero coding knowledge.

The platform executes trades automatically, although you can stop the follow-up and switch traders at any time. Each expert trader has a profile page that you can read before choosing who to copy, although all selected experts must have a track record of successful trading to qualify.

MoonXBT bills itself as the first ever social trading platform. It also allows copy traders to copy more than one trader at a time by splitting their portfolio. If you copy an expert trader and end up with a successful and profitable trade, part of your profit will be used to reward the person whose trade you copied.

You can change your copy trade settings and close positions whenever you want. The traders you copy can get up to 10% of your profits as a reward since, unlike eToro, MoonXBT does not pay them directly.

MoonXBT also allows you to trade with leverage, depending on the trading pair. Maximum leverage is for BTC pairs and is 150x. The exchange is based in Cambodia and regulated by the Securities and Exchange Regulator of Cambodia (SERC).

Coinmatics is another platform dedicated exclusively to copy trading. You can copy traders on Coinmatics when they link their accounts on exchanges and make their crypto trading strategy available for copying. Investors who wish to copy trades are charged a fixed rate determined solely by the trader, who may also decide to offer their strategies for free.

Apart from copying trades automatically in this way, investors can also receive signals through the telegram group and then enter them manually to execute trades on their exchanges. Supported exchanges include Binance, OKX, Bybit and FTX.

Traders earn directly from subscriptions to their strategies and signals, and Coinmatics takes a commission that varies based on each profit a trader makes from subscriptions. Apart from the traders’ subscriptions, Coinmatics also has subscription plans that are either monthly or yearly.

The first paid plan is Lite, which costs $15 per month for a monthly subscription and $10.50 per month for annual payments. The other paid plan is Premium, which costs $30 per month for a monthly subscription and $21 per month for annual subscriptions.

Coinmatics is headquartered in the British Virgin Islands, but anyone from around the world can use it for copy trading.

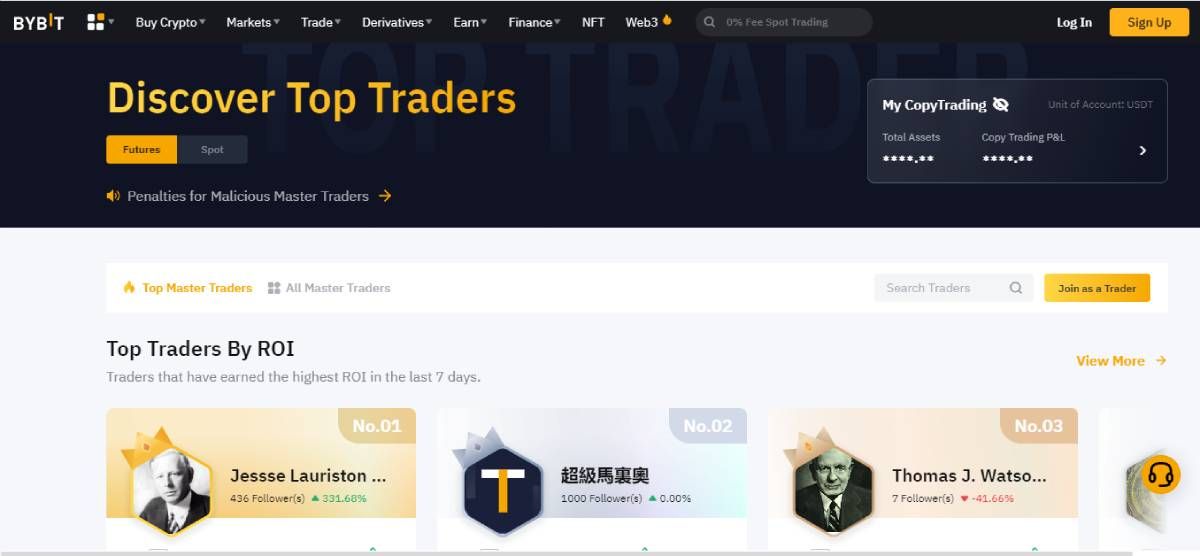

Bybit, like eToro, is a regular crypto exchange that also offers copy trading services. You can automatically copy the trades of professional traders and make money on autopilot. In return, the traders get 10% of your trading profit as compensation.

There are up to 15 trading pairs for copy traders to trade, consisting of highly liquid assets. Once you’ve identified a trader you want to copy, you just need to set your trading preferences, such as the leverage you want to use, which can be up to 100X, and how much you intend to invest.

Trades are then executed automatically immediately after your chosen trader has placed their trade and you will make money if they do too. Bybit is a global exchange located in Singapore and investors from most countries can access their services.

You can start social trading today

Now that you know the best social trading platforms, you can start using any number of them immediately. It doesn’t matter how experienced you are as a trader or if you don’t know how to code.

If you want to maximize your trading gains and perhaps learn how to trade in the process by observing the pros, any of these platforms will serve you well.