The 2022 IRS income tax form includes NFT gains as a source of income

The United States Internal Revenue Service (IRS), which is set to receive $80 billion in federal funding, has released draft individual tax return Forms 1040 and 1040-SR for fiscal year 2022 that suggest taxable NFT gains.

In the 2022 Form 1040 draft, the IRS requires individual US taxpayers to declare ownership of or gains from cryptographically secure digital representations of value, including non-fungible tokens, stablecoins and virtual currencies.

Taxpayers must answer affirmatively if they have received digital assets such as prizes, rewards or payments for property or services. These include receiving cryptocurrencies through hard forks, mining and other transaction validation methods such as staking. Furthermore, taxpayers must say yes if they got rid of any digital assets that were fixed assets. First, they must use Form 8949 to calculate that asset’s associated capital gains or losses. Afterwards, they must record the capital gain or loss on Schedule D of Form 1040.

Any digital assets received from customers for services, or sold to customers to generate revenue, must be reported. The reporting is similar to how income or loss from an individual is reported using IRS Schedule C.

The good news for taxpayers is that they don’t have to say yes if they held or moved crypto assets between their own wallets that they bought with fiat currency during 2022.

IRS rules around crypto and NFT gains

The Internal Revenue Service considers crypto-assets and NFTs’ property for tax purposes.

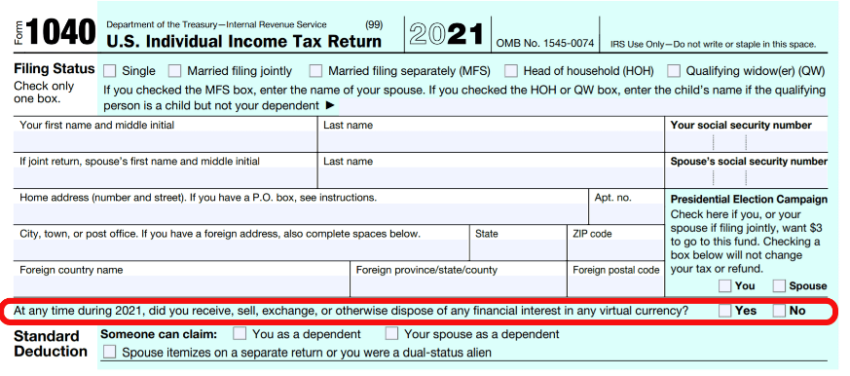

The question of taxable crypto-activity has appeared on tax return forms since 2019. Accordingly, the 2021 form contained the crypto-asset question:

“If you check yes, you flag yourself and the IRS is going to look for some kind of capital gain or loss on Schedule D,” said Tommy Lucas, a certified financial planner.

Breeders can benefit from long-term capital gains tax of 0-20%. Traders who enter and exit faster can pay up to 37% tax. If crypto firms don’t keep detailed records, traders could be in trouble. Incomplete records make it difficult for traders to determine the cost basis of their crypto purchases, including NFTs. Figuring out the cost basis is a critical step in determining crypto or NFT gains or losses.

The IRS is ramping up enforcement thanks to federal funding

If a taxpayer doesn’t answer the crypto question on Form 1040, the IRS can audit them. After that, the tax authorities can fine the taxpayer, or accuse them of tax evasion.

Under the new Inflation Reduction Act, the IRS will receive $46 billion from the US federal government for tax crime enforcement. This includes cracking down on cryptocurrency-related tax evasion.

Recently, the IRS issued a “John Doe” subpoena to New York-based MY Safra Bank for providing transaction records to clients of a crypto brokerage that used the bank’s services. After this, they intended to use these records to expose non-compliant tax practices among the brokerage’s clients.

“The government is committed to using all tools at its disposal, including John Doe subpoenas, to identify taxpayers who have understated their tax obligations by not reporting cryptocurrency transactions, and to ensure that everyone pays their fair share,” said U.S. lawyer. Damian Williams at the time.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.