Tezo’s NFTs keep pace for fourth consecutive quarter as XTZ…

- Tezo’s NFT traders kept blockchain’s digital collectibles alive with an all-time high per volume

- The XTZ price has been impeccable of late and may remain so as the broader market recovers

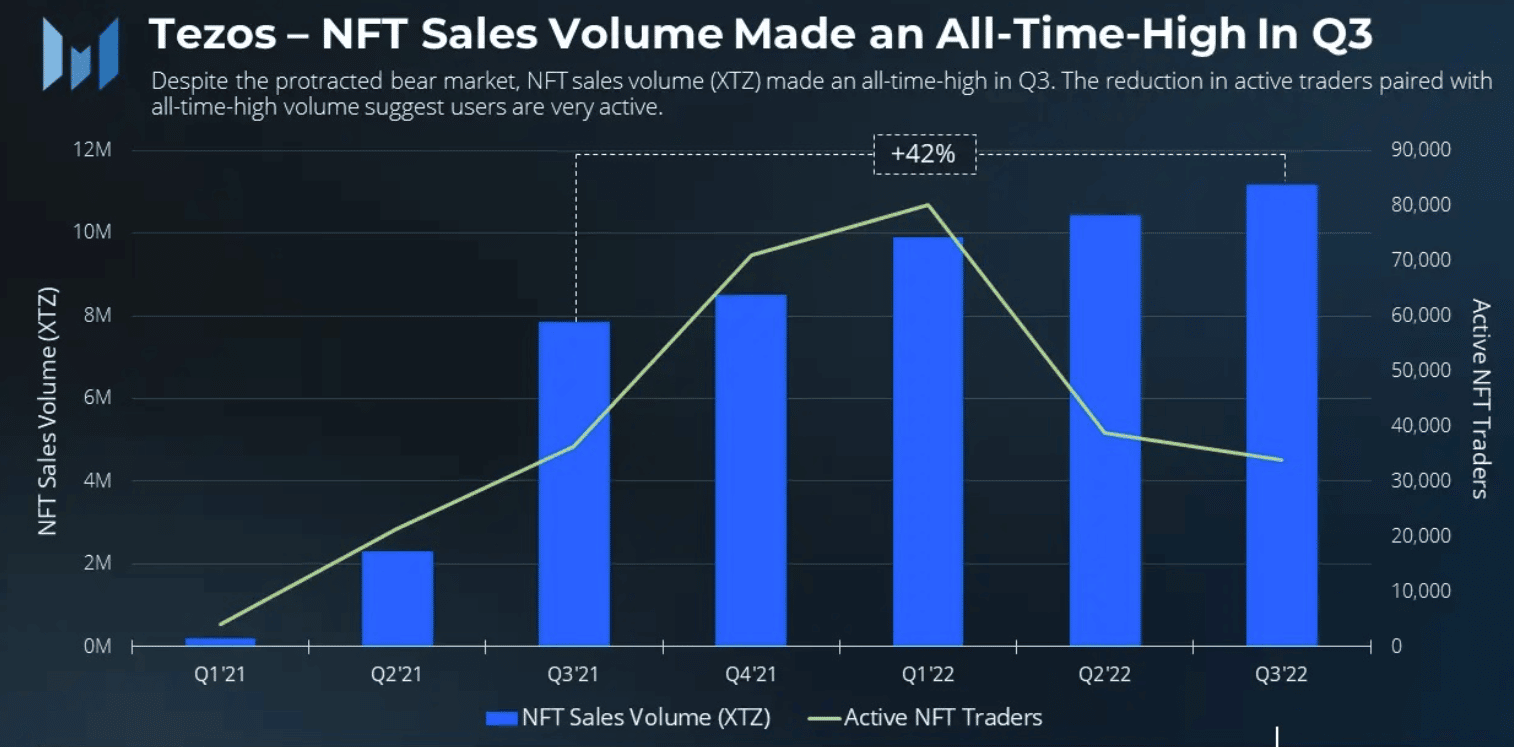

Tezos [XZT] NFTs have maintained their excellent performance despite the decline experienced by the overall digital collectibles market. In accordance Messarithe third quarter (Q3) of 2022 was the sixth quarter in a row that Tezos had a great show.

In fact, NFTs traders using the Tezoz blockchain drove sales volume to an all-time high of over 80,000 during the period. Furthermore, another interesting fact was that this increase in volume took the activity of fewer traders.

Spurce: Messari

Read Tezos [XTZ] price prediction 2023-2024

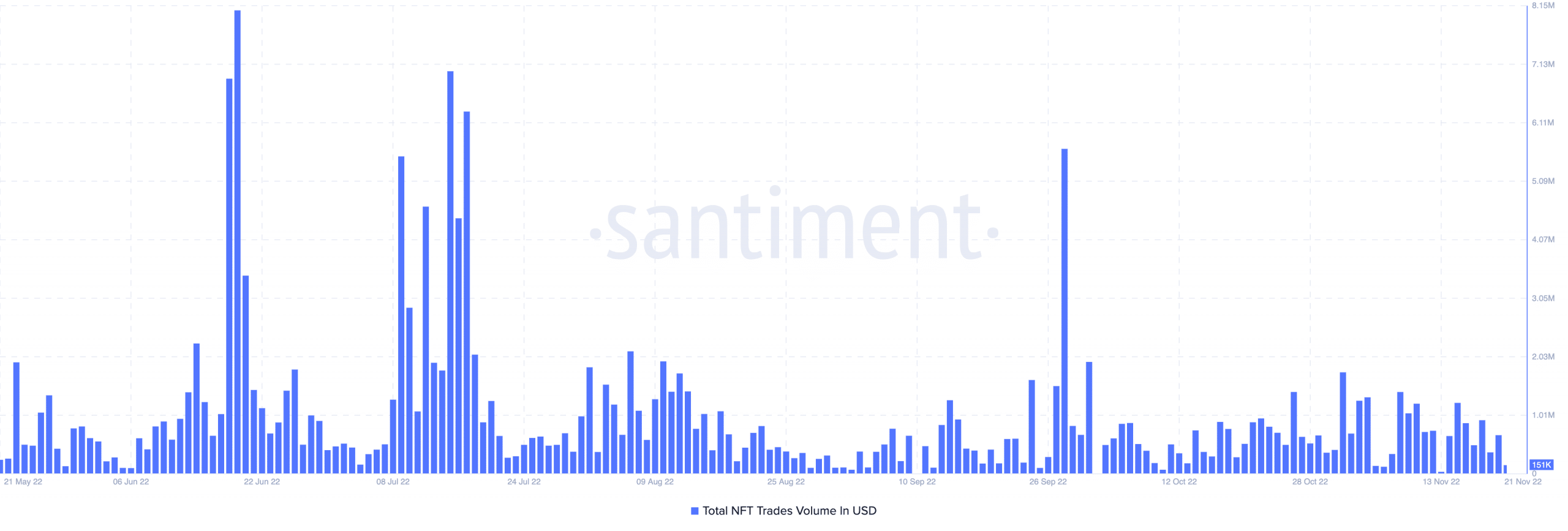

However, a recent trend shown by Tezos reflected a reduced interest in non-fungible assets via the blockchain. At press time, total NFT trading volume was $151,000.

This value was a monumental one decrease from the highs recorded on September 29 when volume reached $5.64 million. This suggested there was a possibility of not matching the results of the last six quarters with XTZ trading at $0.948.

Source: Sentiment

What is the state of the XTZ price?

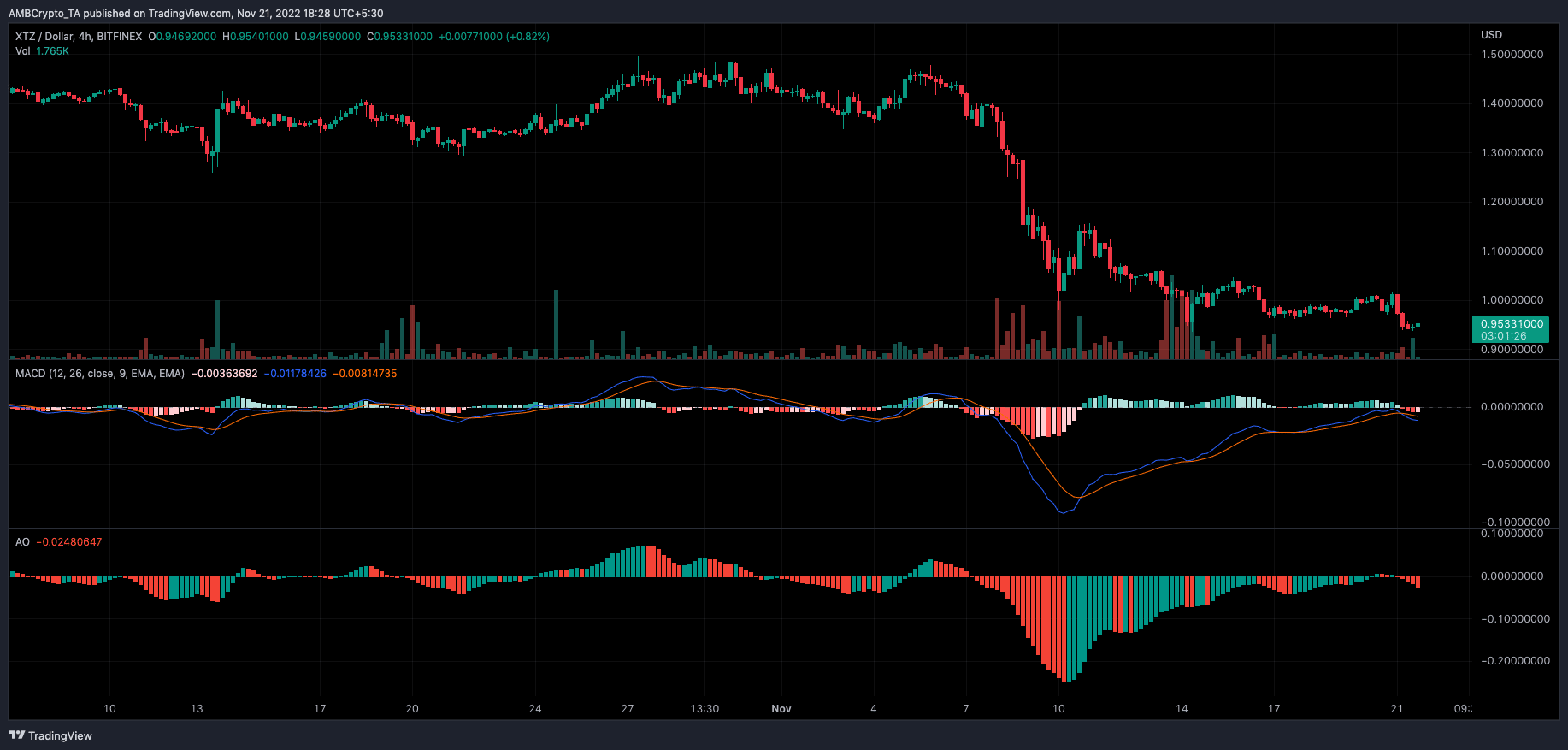

Although Tezos maintained a quarter-on-quarter (QoQ) NFT increase, the same was not the case for the price of XTZ. In accordance CoinMarketCap, XTZ’s value had decreased 15.65% in the last thirty days. More recently, it has also failed to improve over the past 24 hours, following the broader market decline.

The four hour XTZ/USD chart showed that there was almost no recovery in the short term. This inference was due to the positions shown by the Moving Average Convergence Divergence (MACD). Furthermore, At the time of writing, both buyers (blue) and sellers (orange) of momentum were below the zero histogram point.

In addition, sellers appeared to have more control than buyers. Therefore, XTZ could possibly lose more of its current value as this reflected a bearish momentum. Additionally, the Awesome Oscillator (AO) signaled a similar condition at 0.024. Since the AO was also below zero, it meant that XTZ’s edge was bearish.

Source: TradingView

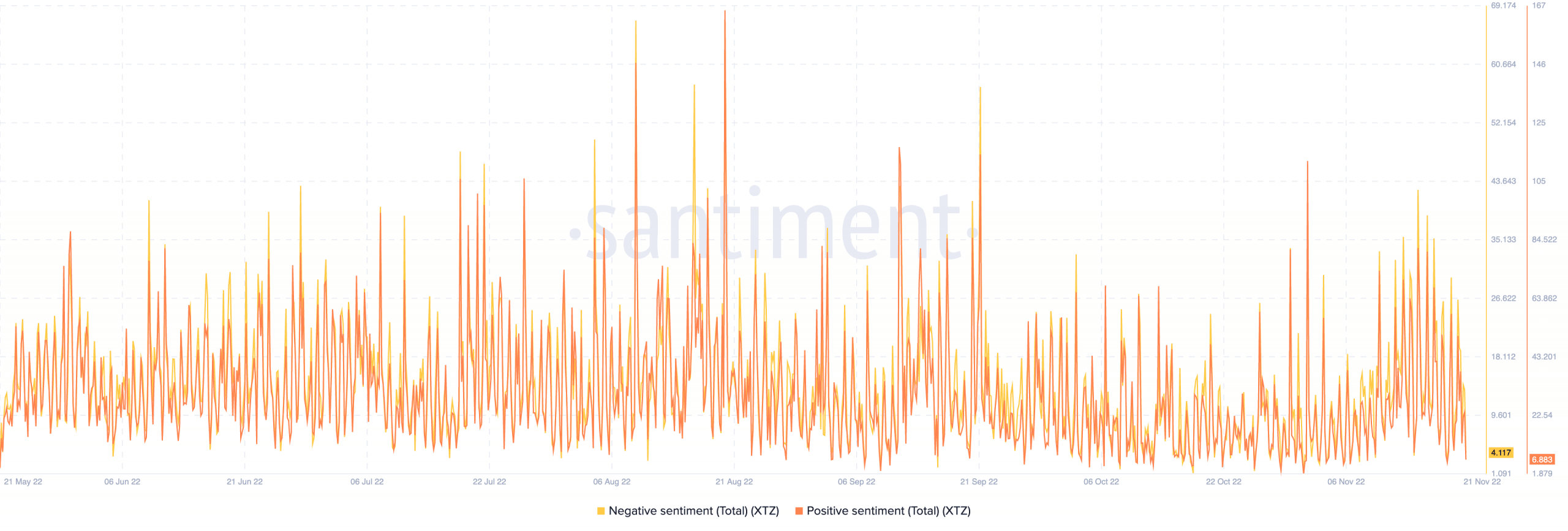

Confidence abounds, fear out

Despite the ongoing price decline, XTZ investors appeared to remain bullish. This was shown by the emotions shown by the community. According to Santiment, the XTZ’s positive feel offset the negative with a ratio of 2.125 to 1.875.

Therefore, this suggested that investors’ perception was optimistic about XTZ. This status is also reflected in its social dominance which had increased to 0.298%. This position meant that Tezos made up a good portion of the discussion and search volumes.

Thus, regardless of the price, XTZ may still have a good chance for massive accumulation.

Source: Sentiment