Terra collapse triggered explosive growth in long-term Bitcoin supply

The Terra collapse, in which $60 billion in value evaporated, has already gone down as a defining moment in cryptocurrency history.

TerraForm Labs co-founder Do Kwon maintains the problem boiled down to weaknesses in the UST stablecoin protocol design. However, others have openly called out the project as a scam from the start.

The event triggered an exodus of capital, driving prices across the board from which the market has yet to recover.

Nevertheless, on-chain calculations show an interesting change in the dynamics of long-term Bitcoin holders as a result of the collapse.

Bitcoin supply held by long-term holders rose sharply

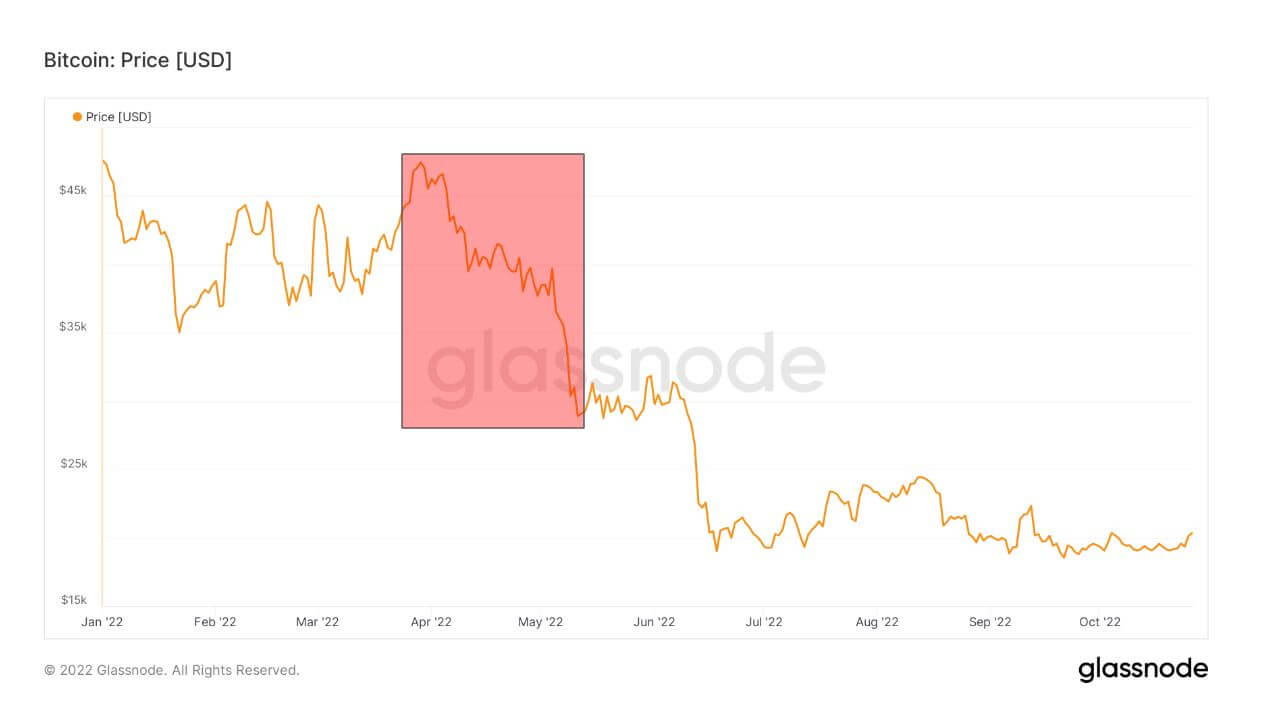

At the end of March, Bitcoin was priced at $47,000 and is ticking along despite early warnings of an inflationary spike and problems in Eastern Europe escalating further.

Entering May, BTC opened the month at $40,000. But on May 7, UST began to lose its dollar rate. By May 13, UST’s daily close was $0.13, after falling as low as $0.06 on the day.

As the crisis unfolded, the BTC effect was allowed to drop to $30,000 by May 11. And by mid-June, the price had fallen 62% from the end of March to $18,000.

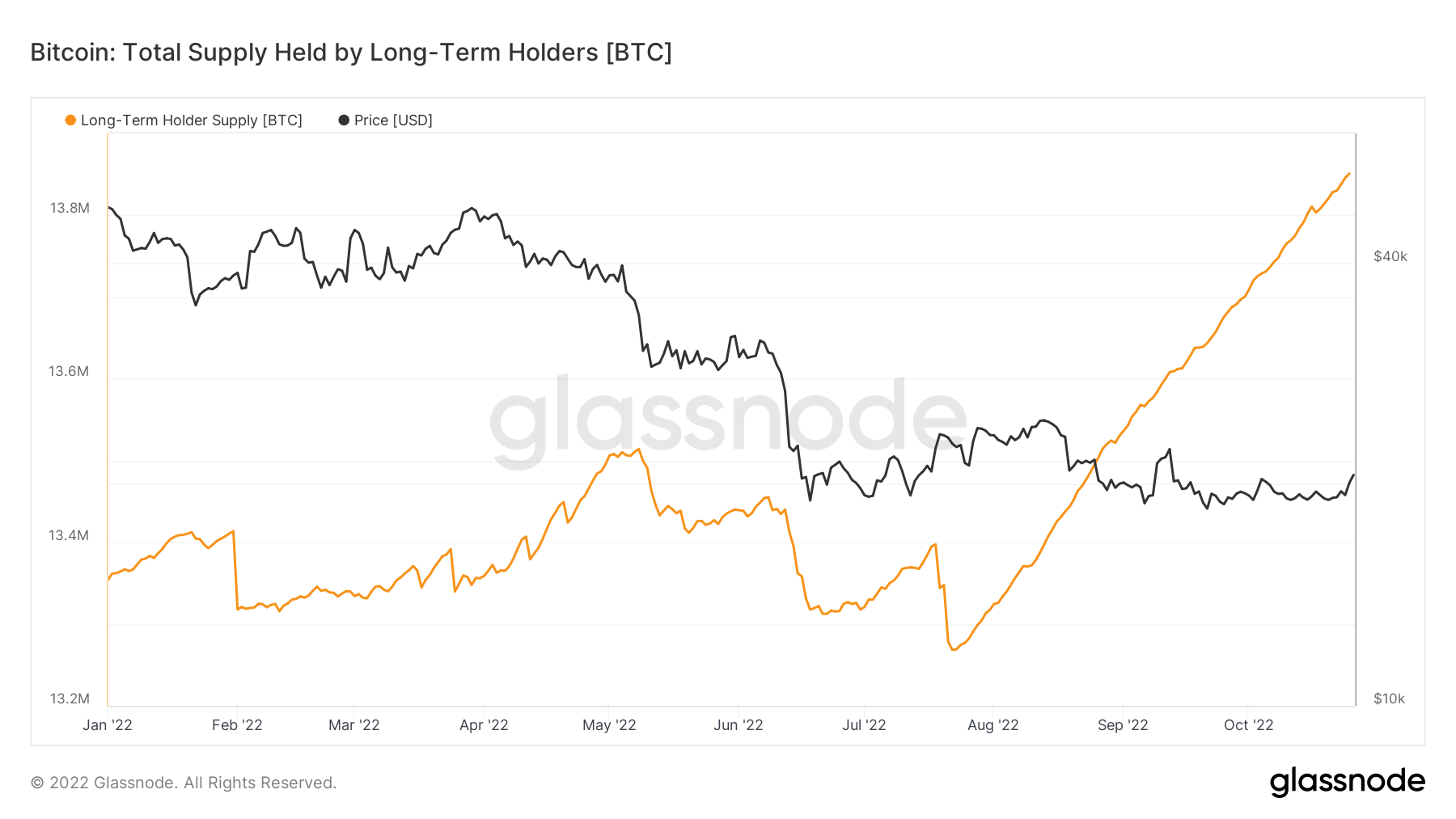

The diagram below shows the total supply held by long-term owners (LTH) – Glassnode defines LTHs as individuals with a position for more than six months. It highlights a gradual decline in LTHs in early May as the rumor of the UST de-peg spread.

This trend bottomed out in late July, leading to a continuous 45-degree start in LTH. A significant reason for this pattern is buying activity in early April and May (six months ago), which has since matured in the classification of LTH.

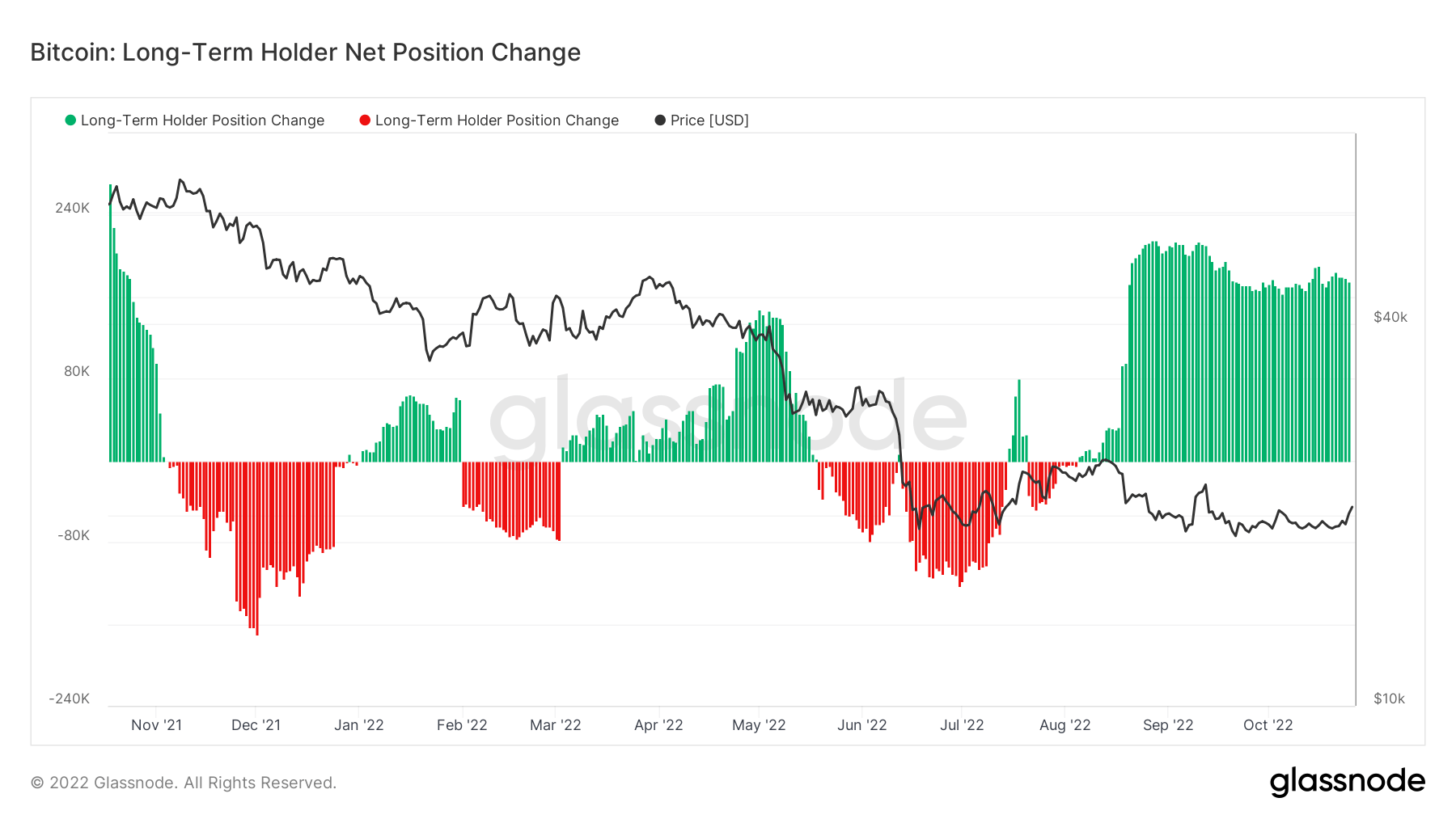

LTH’s net position change

Bitcoin: Long-Term Holder Net Position Change refers to token distribution of LTHs, which are marked in green as net accumulators or in red as net distributors taking out positions.

As the macro landscape worsened in the second half of the year, LTHs began selling their positions. However, the trend has reversed since September, with LTHs seeing value at these prices and accumulating accordingly.

Short term vs. long-term owners

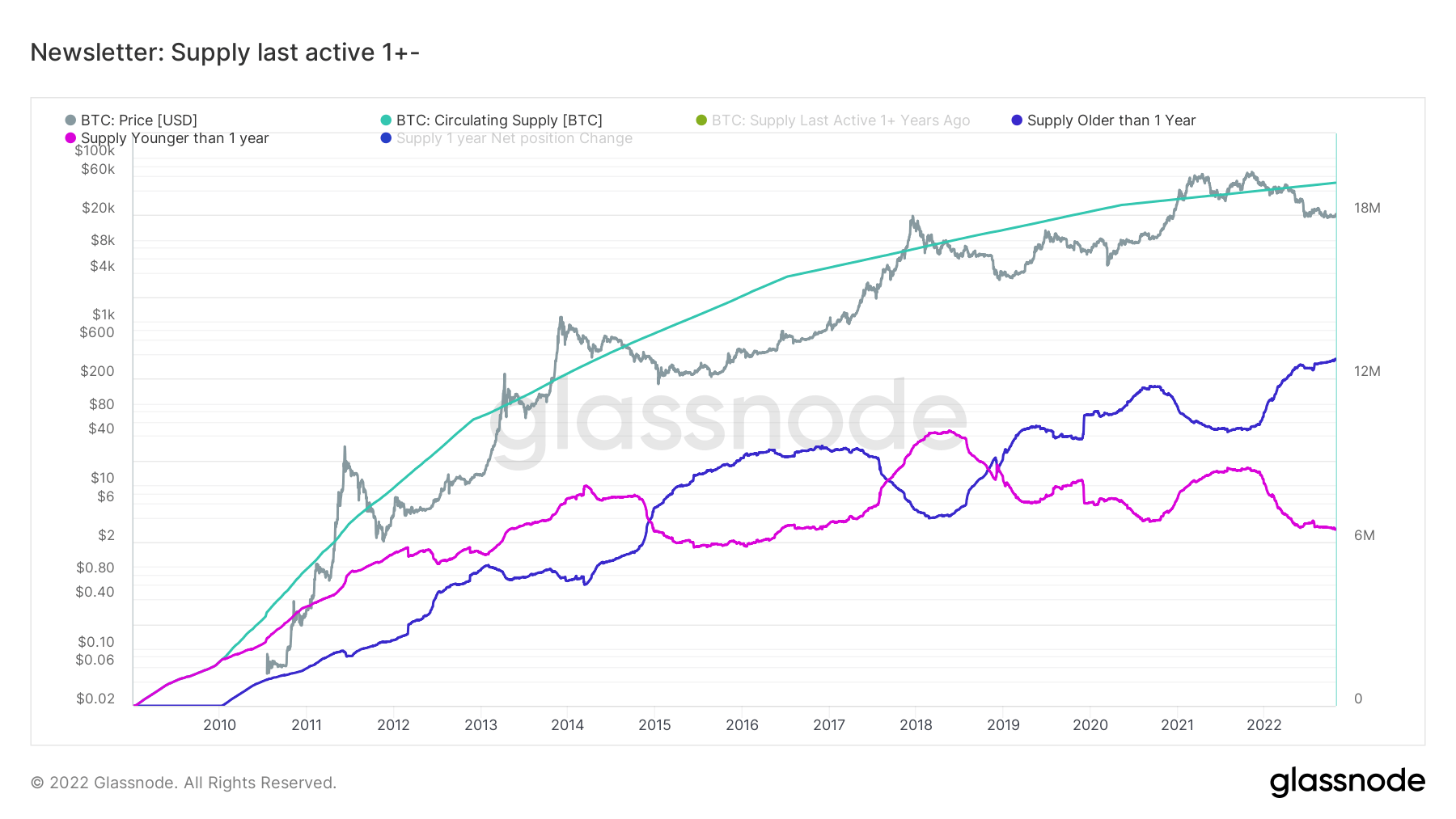

The chart below changes the definition of LTHs to held for more than one year, meaning short-term holders (STHs) refer to holdings of less than one year.

It was noted that price peaks in BTC coincided with leveling off or significant drops in STH supply. The exceptions to this were in the period before and including the $900 price peak in December 2013. In these cases, no pattern could be discerned in STHs.

Similarly, since the extreme period, market declines were accompanied by an increase in LTH supply, as LTHs accumulated tokens.

Fast forward to the present, LTHs are increasing higher, while STHs are decreasing rapidly. This has created a dramatically divergent pattern that has not been seen before to this extent.