Tenet Fintech Considers Business and Capital Raising Moves (OTCMKTS: PKKFF)

alexsl/iStock via Getty Images

A quick overview of Tenet Fintech Group

Tenet Fintech Group (OTCPK:PKKFF) reported its Q1 2022 financial results on May 31, 2022, and the firm reported increasing revenue.

The company operates an online network for small businesses in China and other countries.

PKKFF appears to be at a crossroads in a number of ways and presents both future opportunities and a number of risks.

Interested investors should watch, list the stock and track the announcements that could bring volatility in the short term.

Until we gain greater visibility into the firm’s capital raising plans and business transition, I am on hold for Tenet Fintech.

Tenet Fintech Overview

Toronto, Canada-based Tenet was founded in 2008, originally as a commercial lending platform in China, connecting small businesses with commercial lenders.

The company has expanded its focus to create a network of online hubs that provide resources to small business owners as they seek to expand their addressable market.

The firm is led by CEO Johnson Joseph, who was previously president of Peak Positioning Technologies.

The company’s primary offerings include:

-

Tenet Business Hub

-

Loan and credit offers

-

Advertise products

-

Network with other business owners

-

Market intelligence reports

The company acquires platform users via the website and other online marketing measures. Joining the Business Hub is free.

Tenet Fintech’s market

According to a 2021 market research report by Allied Market Research, the FinTech lending market was estimated at $450 billion in 2020 and is projected to reach nearly $5 trillion by 2030.

This represents an expected CAGR of 27.4% from 2021 to 2030.

The main drivers of this expected growth are increased efficiency achieved by lenders and greater selection of borrowers.

The Covid-19 pandemic also increased awareness of the use of online financing opportunities among business people worldwide.

In particular, the report forecasts that balance sheet lenders will continue to dominate the market versus marketplace lenders.

Tenet Fintech’s recent financial results

-

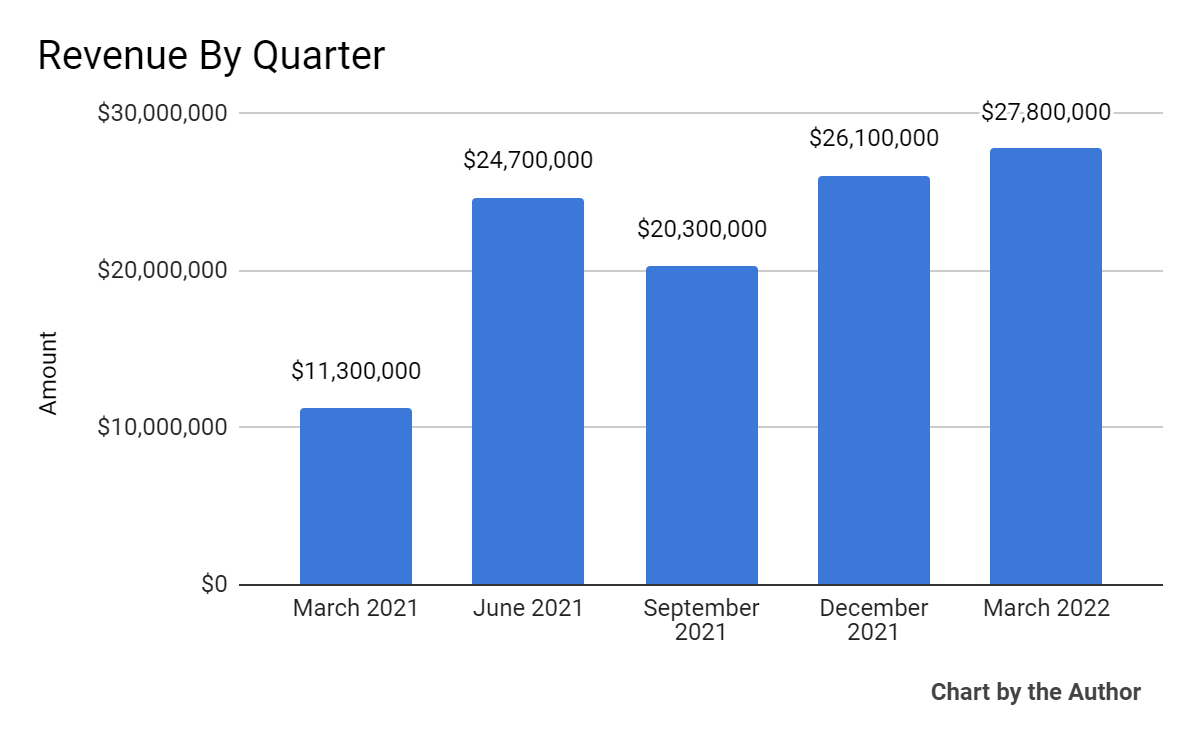

Total revenues per quarter have trended higher, albeit unevenly:

5 quarter total revenue (seeking alpha)

-

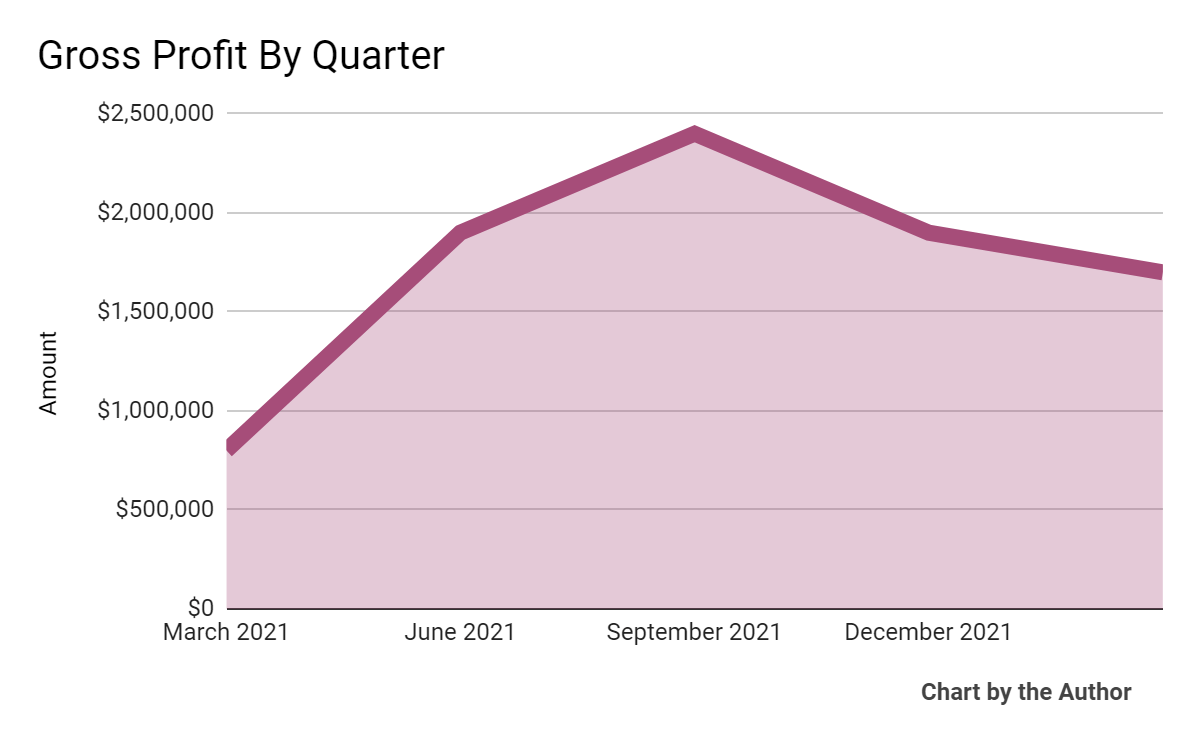

Gross profit per quarter has produced the following results:

5 quarter gross profit (seeking alpha)

-

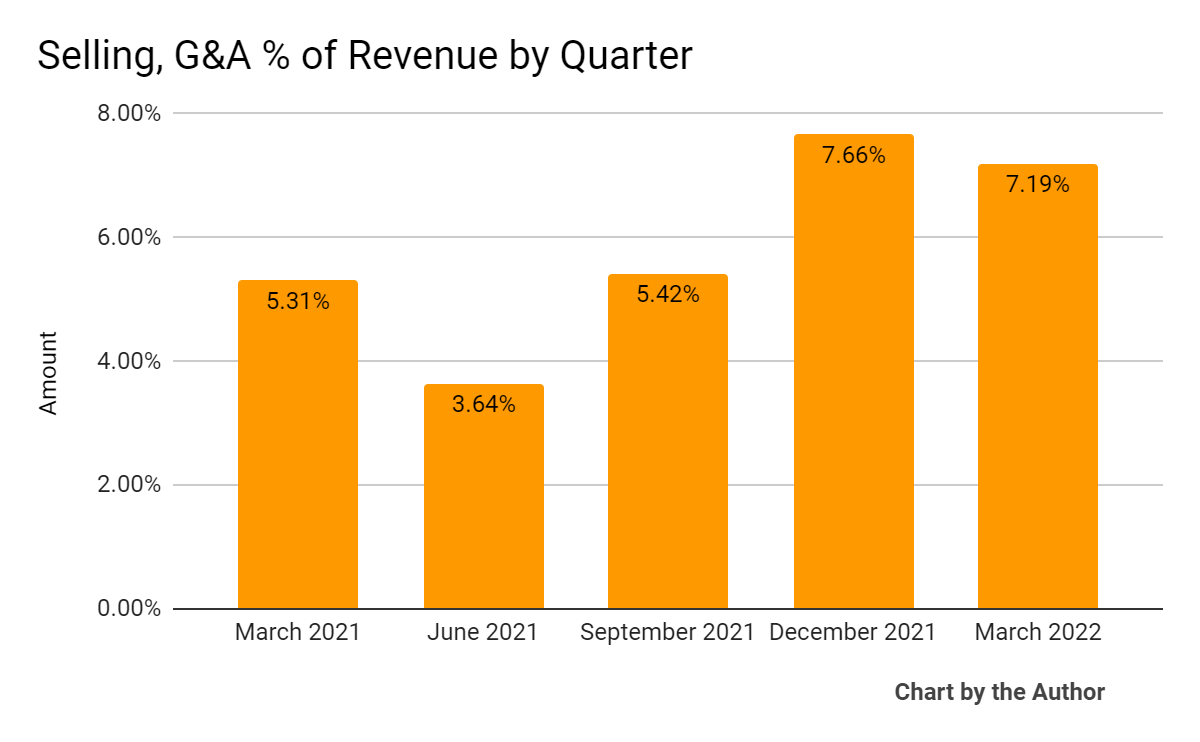

Selling, G&A expenses as a percentage of total revenue per quarter have trended higher as revenue has increased:

5 quarter SG&A % of revenue (seeking alpha)

-

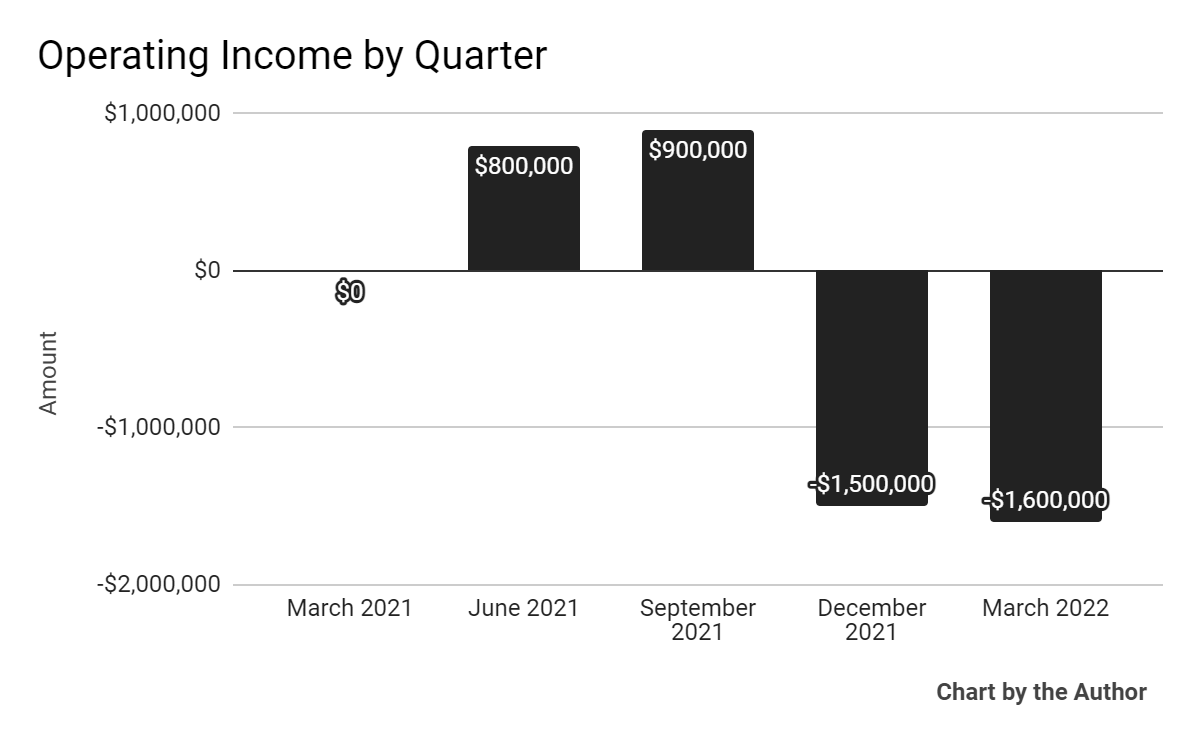

Operating losses by quarter have worsened in recent quarters, as the figure below shows

5 quarter operating income (seeking alpha)

-

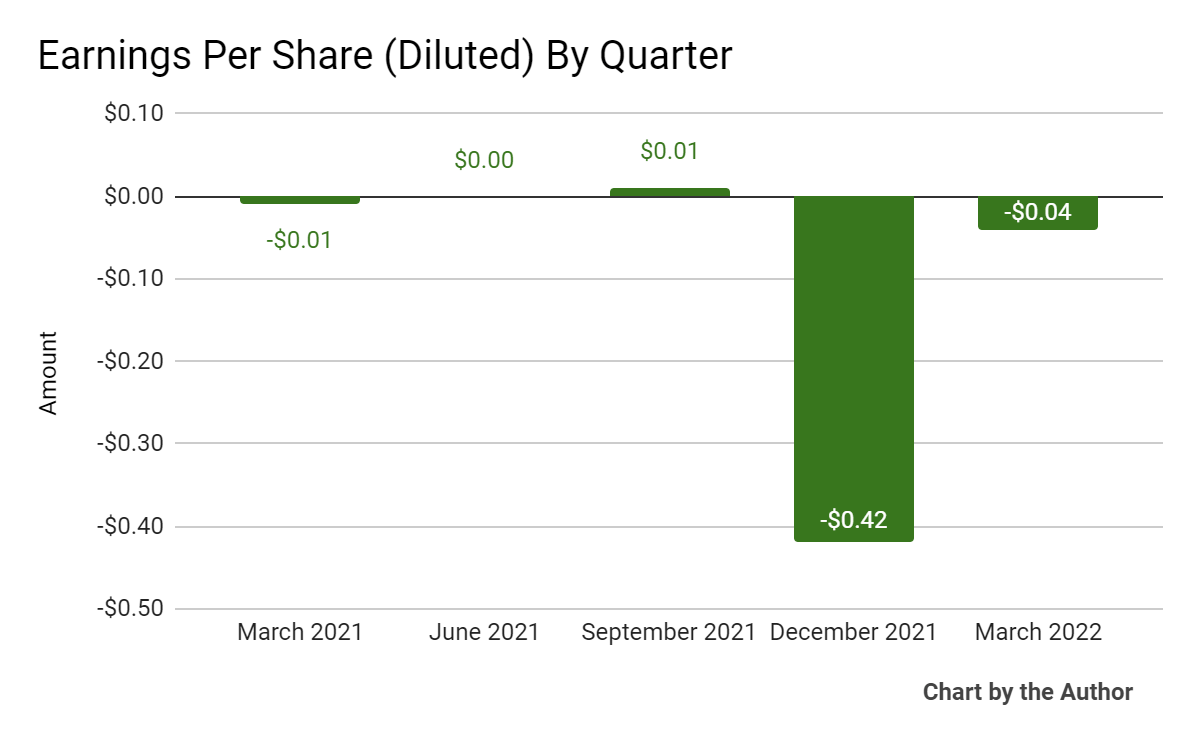

Earnings per share (diluted) have become negative in recent quarters:

5 quarterly earnings per share (seeking alpha)

(All data in the charts above are GAAP)

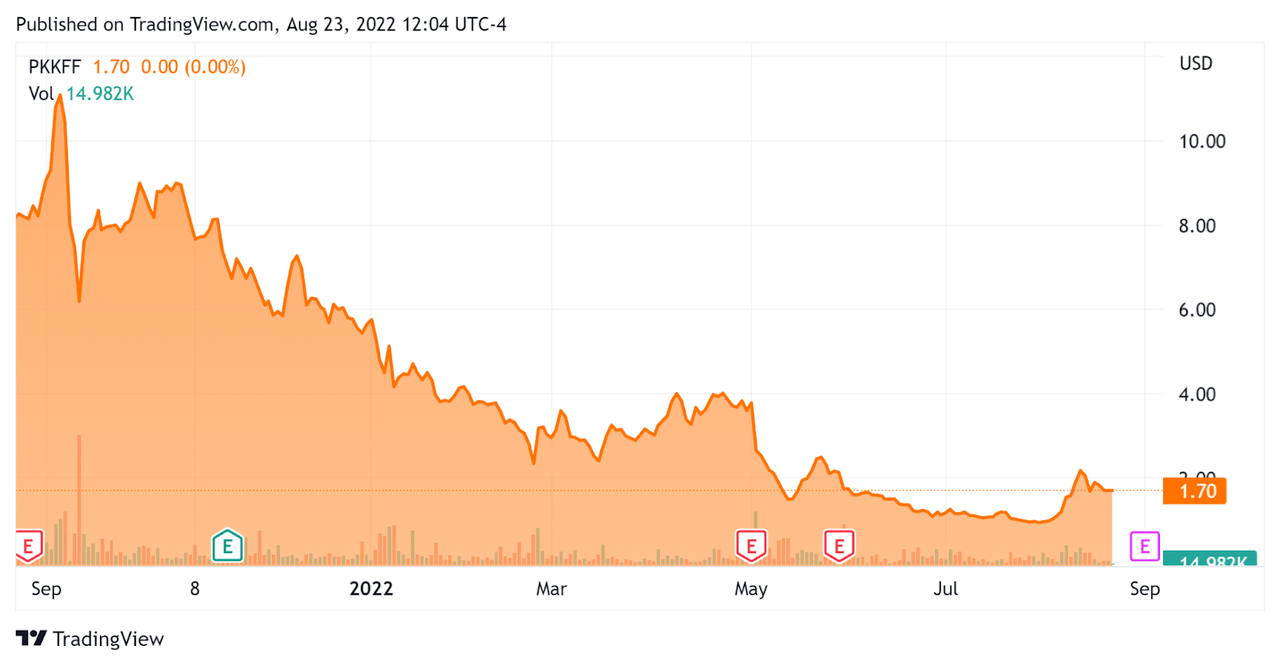

Over the past 12 months, PKKFF’s share price has fallen 79.1% compared to the US S&P 500 index’s fall of around 7.8%, as the chart below shows:

52-week share price (Seeking Alpha)

Valuation and other calculations for Tenet Fintech

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.69 |

|

Income growth |

134.3% |

|

Net income margin |

-42.2% |

|

GAAP EBITDA % |

-0.9% |

|

Market value |

$169,580,000 |

|

Group value |

$167,770,000 |

|

Cash flow from operations |

-$31,380,000 |

|

Earnings per share (fully diluted) |

-$0.45 |

(Source – Seeking Alpha)

The Rule of 40 is a rule of thumb for the software industry that states that as long as the combined revenue growth and EBITDA percentage rate equals or exceeds 40%, the firm is on an acceptable growth/EBITDA trajectory.

PKKFF’s latest GAAP rule of 40 calculation was 133.4% as of Q1 2022, so the firm has performed extremely well in this regard, as per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recently rev. growth % |

134.3% |

|

GAAP EBITDA % |

-0.9% |

|

Total |

133.4% |

(Source – Seeking Alpha)

Comment on Tenet Fintech

In its latest earnings call (Source – Seeking Alpha), covering first quarter 2022 results, management highlighted the company’s revenue growth in China driven by strength in its primary supply chain segment.

However, management is seeking to expand its focus to other “verticals that have more interesting profit margins,” including oil and gas, insurance and eventually clean energy.

In addition, the firm wants to become more involved in funds transfer and settlement activities, as well as via funds transfer and payment processing services.

The company also recently launched a shipping platform called Yun Fleet, allowing the firm to offer shipping services as part of its desire to “take as much control as possible over all aspects of the transactions that take place in our business center.”

As for the financial results, top-line revenue increased 144% year-over-year, while gross profit fell sequentially.

However, operating income remained negative, partly due to higher wages and benefits and fringe benefits from inflationary pressures in labor costs.

The company recently sought to list on the Nasdaq to access a proposed $30 million capital raising.

However, the firm’s China operations caused questions from the SEC that have served to stall the process.

The management claims that the firm’s primary business is not really the China business. Instead, it is seeking to launch a business hub in Canada powered by its AI and analytics technologies, followed by future launches elsewhere.

Essentially, the firm wants to build a global social network for SMBs, which informs its AI and analytics engine.

A potential upside catalyst is the ability to raise the necessary capital in Canada or on the London Stock Exchange or other European markets.

The primary risk to the company’s prospects is its inability to raise additional capital to fund its AI and analytics-driven social media business ambitions.

Another risk is that the management seems to want to transform the business into a social network for small businesses, with a range of service offerings powered by the AI and analytics engine.

It is a tall order to achieve profitably at scale and one that will require significant investment capital.

Management is considering a wide range of investment vehicles, possibly in a tranched process, and these vehicles may or may not be dilutive to shareholders.

So the company appears to be at a crossroads in a number of ways and presents both future opportunities and a number of risks.

Interested investors should watch, list the stock and track the announcements that could bring volatility in the short term.

Until we gain greater visibility into the firm’s capital raising plans and business transition, I am on hold for Tenet Fintech.