Sweep up my money, it’s a bank run: Sweep networks for banks and fintech

FinTech and banks typically have much more money in their bank accounts than the $250,000 insurance limit set by the FDIC. This puts them in a bit of a pickle. That pickle can sometimes be the size of the SVB debacle.

As the dust settles on Silicon Valley Bank’s 48-hour fall, many fintechs are crawling out of the woodwork and offering solutions that can help businesses avoid losing their money to an unforeseen bank run.

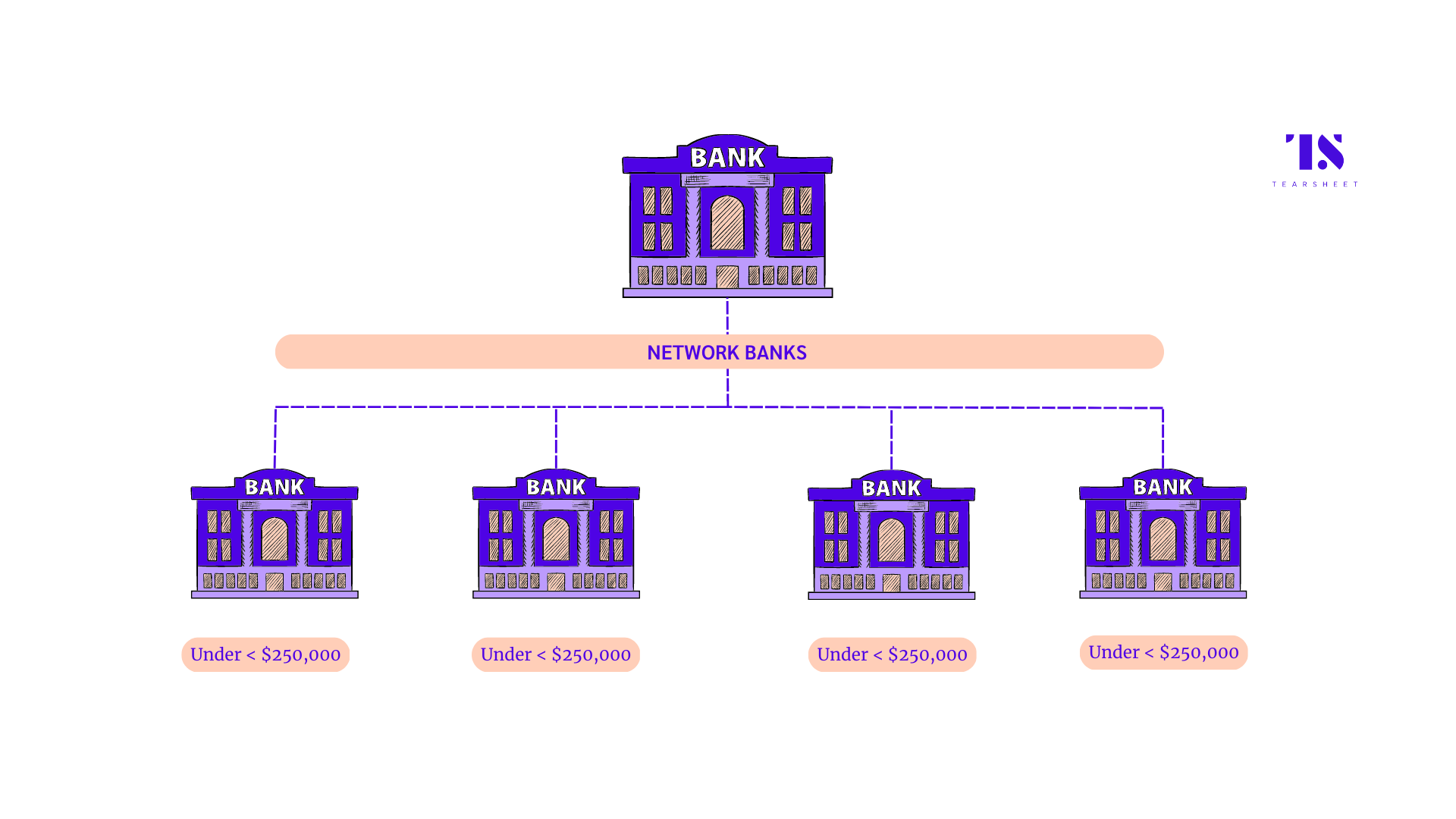

A popular solution is sweep networks. The solution is the problem of single errors that occurred with SVB and allows companies to share their deposits on a network of partner banks.

For example, if a company has $1 million dollars, it can split its deposits into four partner banks, with each split equal to the FDIC-insured limit of $250,000. This insures 100% of the money, whereas depositing it all in one bank would only have received 25% insurance coverage. However, this does not mean that the company must then have contact with 4 different institutions. Instead, it may depend on the swiping network chosen to handle the banking conditions in the background.

Who’s Who of Swipe Networks:

IntraFI is a popular swipe network, with a network of 3,000 banks across the country, where businesses can store their money in checking accounts, money market deposit accounts or CDs. Similar options for both companies and banks to get more of their deposits insured:

- Mercury: Mercury is a next-generation neobank that competes with SVB for venture-backed start-up banking. It works with two partner banks, Evolve Bank & Trust and Choice Financial Group. Currently, the network can offer up to a $3 million FDIC insured deposit limit. Their bank partner network includes Goldman Sachs and Capital One, with a total of 12 banks. Mercury customers may omit a specific bank(s) from their deposits, but this may affect the total amount of insurance available to them.

- Wintrust’s MaxSafe: Similarly with a network of 15 community banks, MaxSafe allows FDIC insurance up to $3.75 million.

- Depositors’ Insurance Fund: This network can help banks protect deposits beyond the FDIC insurance limit. Note that DIF is not a state-owned organisation, but an industry-sponsored insurance company. In the 1990s, it paid out more than $50 million to protect more than 6,500 depositors in 19 failed member banks.

- StoneCastle: For banks in the FICA network, the company offers up to $25 million in FDIC insurance.

- Rho: With its Treasury Management Account, the commercial startup offers up to $75 million in FDIC deposit insurance. This product is built on a network of 400 banks, where money can be insured and earn interest at the same time.

Reuben:

The catch? Redundancies cannot help with system-wide failures. So if there is a widespread crisis (think 2007-2008), there is very little chance that these distributed risk strategies will help.

Sweep networks allow companies to build redundancy into their deposits, negating any chance of a single point of failure like SVB. Instead of managing bank accounts and relationships with 14 banks themselves, companies can transfer this responsibility to the companies mentioned above. Which is great.

Omid Malekan, an adjunct professor at Columbia Business School, has a slightly different take on what SVB’s recent downfall and subsequent government rescue mean. “Depositors at SVB and SBNY who were above the FDIC limit should have been subject to impairment. But it didn’t, sending a powerful message to the market. If the government goes back on this now, it will undermine credibility. According to him, this shows that the government is not willing to let depositors lose money.

This does not mean that everyone is now safely out of the woods. Malekan wonders whether introducing more counterparties into the system will entail greater risk. What if they are fraudulent or make a mistake when routing money? And what if they go bankrupt?

Understand the fine print:

Also, companies should note that sweep network providers like Mercury retain the right to move their money. This can be done in a way that helps earn the supplier more money.

Consider the following two statements from Mercury’s disclosure statement about its network with Evolve Bank & Trust:

- You understand and agree that Evolve, as your agent, may place some or all of your funds on deposit with Evolve at one or more Program Banks in an amount determined in Evolve’s sole discretion based on available capacity in the Program Bank or other criteria, including rates paid on deposits by the Program Bank or fees paid to Evolve.

- You understand and agree that Evolve has no obligation to place funds in Program Banks to maximize the amount of deposit insurance available on your funds or to maximize the interest that your funds may earn. Evolve may place your funds without regard to whether such funds may exceed the deposit limit at one or more Program Banks, even if your funds may be placed in one or more Program Banks in an amount less than the Deposit Limit.

Businesses must tread carefully when it comes to using swipe networks to secure their accounts. It is wise not to put all the eggs in one basket. But it is also important to read the fine print very carefully.