Surprising signs of strength in the NFT market

The headlines are creating doom and gloom all over the world, and the non-fungible tokens (NFT) market is no exception. But there are unexpected signs of strength in the NFT space that I think will pull through the bear market.

Alarm bells started ringing when NFT marketplaces experienced a mass contraction from exponential heights in the early months of this year.

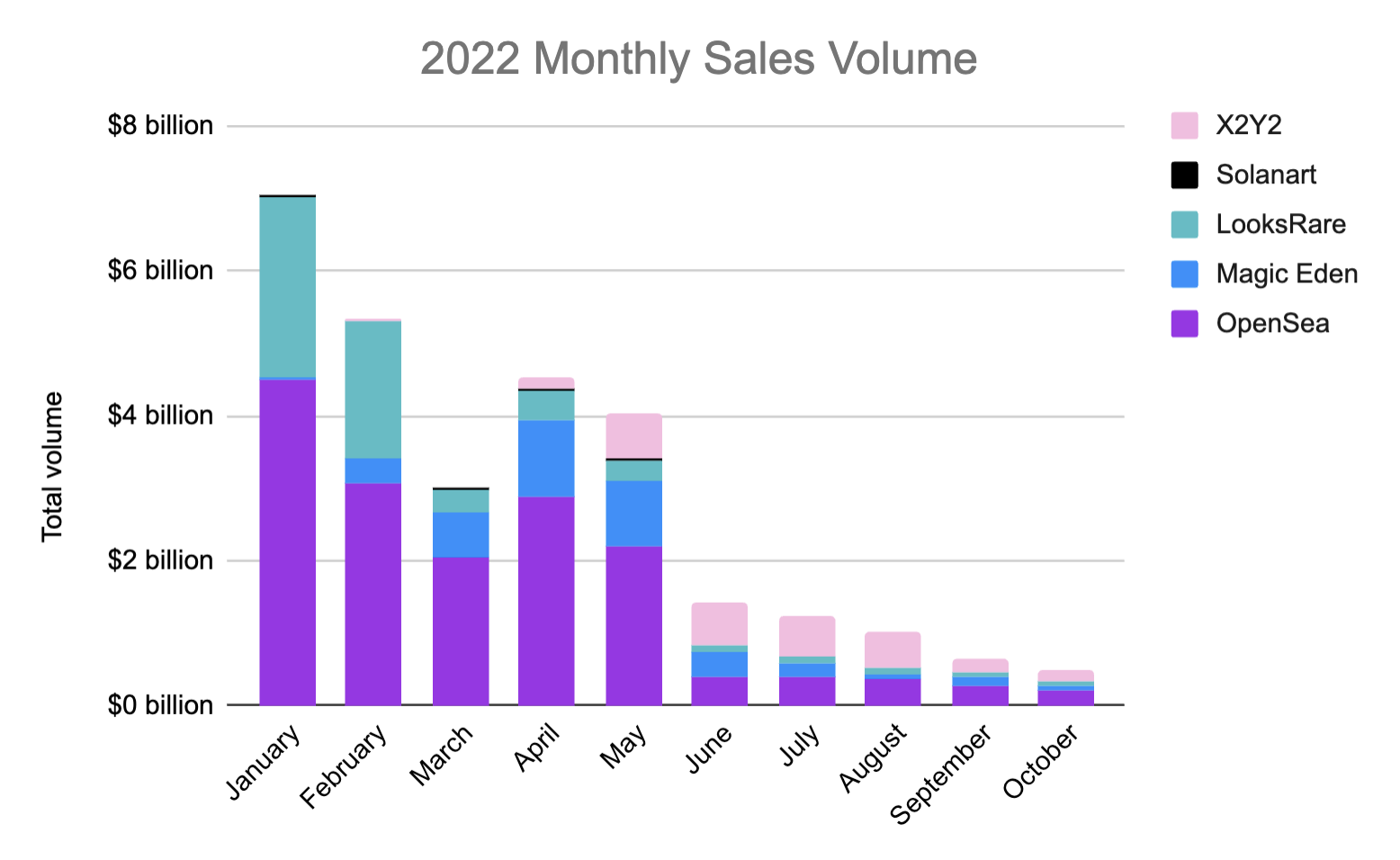

The latest Balthazar NFT Marketplace update recorded USD 494.27 million in sales volume in October 2022 across five top NFT marketplaces combined: OpenSea, Magic Eden, LooksRare, Solanart and X2Y2. This is 93 percent down from January, which produced $7.06 billion in sales.

Black Bear Value Fund October 2022 Update

Black Bear Value Fund Update for the Month Ended October 31, 2022 Q3 2022 Hedge Fund Letters, Conferences and More Dear Partners and Friends, Black Bear Value Fund (the “Fund”) returned +9.5% net, in October and +10 .3% for 2022. HFRI returned +4.3% in . . . PARDON! This content is exclusively for paying members. read more

Black Bear Value Fund Update for the Month Ended October 31, 2022 Q3 2022 Hedge Fund Letters, Conferences and More Dear Partners and Friends, Black Bear Value Fund (the “Fund”) returned +9.5% net, in October and +10 .3% for 2022. HFRI returned +4.3% in . . . PARDON! This content is exclusively for paying members. read more

Q3 2022 hedge fund letters, conferences and more

Find a qualified financial advisor

Finding a qualified financial advisor doesn’t have to be difficult. SmartAsset’s free tool matches you with up to 3 financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interest.

If you’re ready to be matched with local advisors who can help you reach your financial goals, get started now.

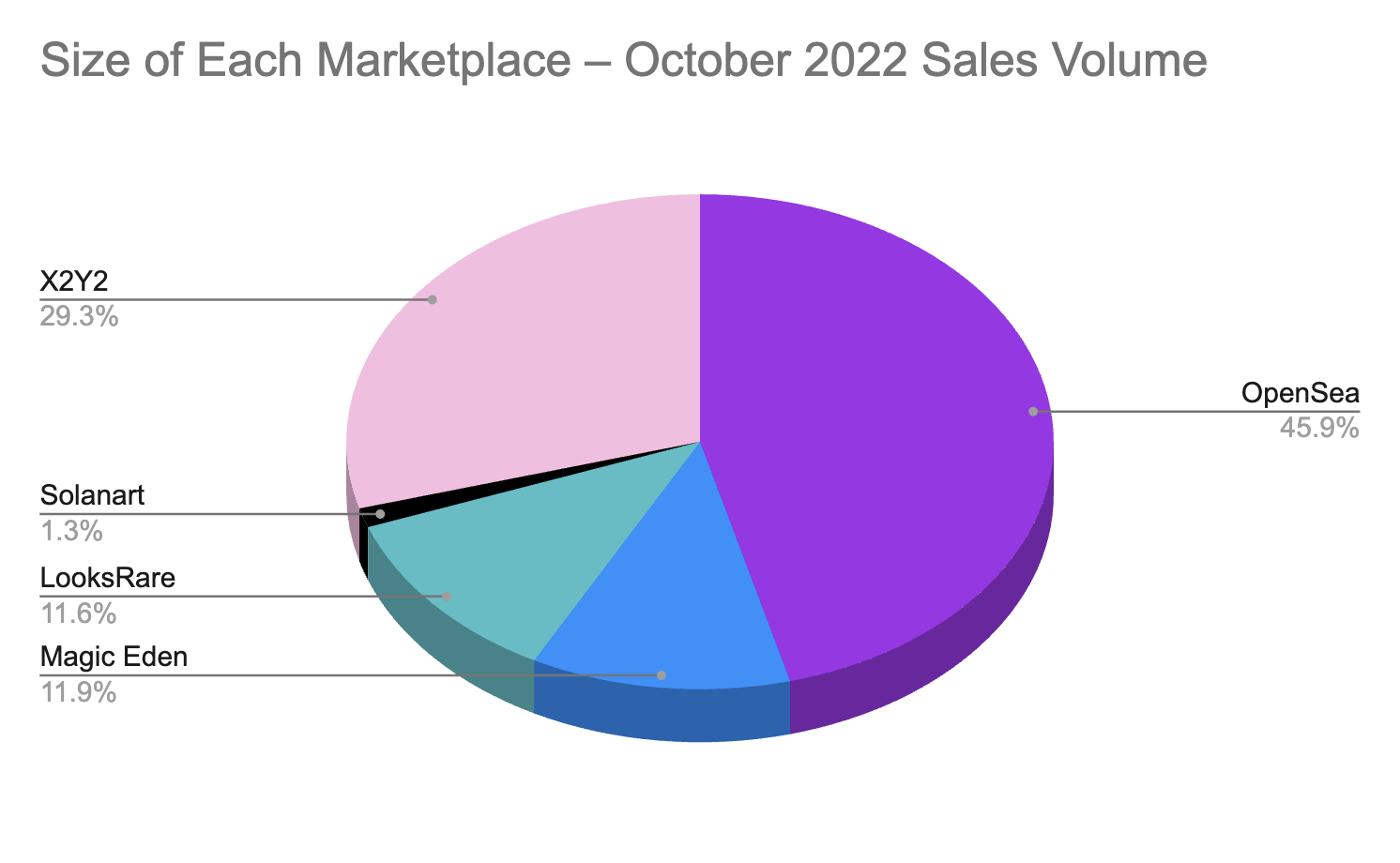

In February 2022, however, there was a new player in town. The X2Y2 marketplace launched with US$11.04 million in sales volume in its first month, and has grown 1,213 percent by October, to US$145.04 million in sales volume. In eight months, it has become the number two marketplace on Ethereum.

October NFT sales were at a record low

Overall, NFT sales in October were the lowest level for 2022, down USD 147.28 million from September (-23%).

Source: Balthazar, DappRadar

But not all NFT marketplaces saw a month-on-month decline. In fact, two marketplaces saw increases in NFT sales.

LooksRare recorded a 10.61 percent increase in sales in October compared to September – up by US$5.51 million to US$57.47 million. While Solanart saw an increase of 38.21 percent, up by $1.73 million to $6.25 million.

OpenSea, the largest NFT marketplace in the world, has recorded a decrease in sales volume since April 2022. It was down 15.52 percent in October from September, with USD 41.69 million lower sales volume. It recorded $226.86 million in sales in October.

X2Y2 dropped 22.98 percent in October, while Magic Eden saw the biggest drop of 54.25 percent, down $69.55 million compared to September.

On the flip side, despite the downward trend, sales volume from 2022 to October has doubled compared to 2021. The total sales volume for the five marketplaces combined was USD 14.29 billion in 2021, compared to USD 28.80 billion in 2022 until October.

The most exciting part of this research report shows an increase in market share with X2Y2 at the expense of OpenSea’s stranglehold on the market. In January, OpenSea had 63.7 percent of the market share across the five markets, and by June it had more than halved to 29 percent.

In contrast to X2Y2, which had a share of 3.4 percent of the sales volume in April, to 15.7 percent in May and 49.2 percent in August. In October, X2Y2 registered 29.3 percent.

Some fundamental changes occurred during this time. In June, X2Y2 offered a no-fee promotion, and in August it stopped requiring buyers to pay royalties.

There is some very aggressive marketing going on in the area resulting in a shift in dominance. This sends a very strong signal that new players are entering the space and pushing hard with explosive growth.

Source: Balthazar, DappRadar

Users have not backed down

Another comforting sign is that the number of users has not dwindled during the bear market. In fact, if we look at the total number of users in February (2.09 million) when X2Y2 launched, it was only 12.6 percent less in October (1.82 million). And September (2.04 million) had almost the same number of users as February.

Although there was a 10.6 percent decrease in users from September, the number of users has remained between 1.75 million and 2.44 million (peaking in May) this year.

Users are also shopping more than ever. The Balthazar report recorded 26.83 million trades in October, compared to 3.78 million trades in January. But they spend less per trade. The average trade in October was USD 898, down 20.3 percent from September (USD 1,127).

While the market has come off radical highs, as was expected, we will see a more gradual, less volatile level of growth as the market recovers. And the last 10 months have shown that this bear market is keeping the hatches down with surprise activity from traders, investors and new projects hitting the market.