Stop Investing, Save in Bitcoin – Bitcoin Magazine

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transferring to the finance corps.

Always up, always have to add more so as not to fall behind. I could feel the American dream slowly slipping away every year. We dutifully paid our bills, contributed to retirement accounts, invested carefully, and yet it felt like things got a little tighter every year. A little more difficult to contribute what we needed. When we found Bitcoin, it gave us hope.

“Hitting is mutual suffering. A round of chicken. Bitcoin changed the game. It made hitting valuable for the forward.”

—Matt Hill on “Bitcoin Audible,” episode 75

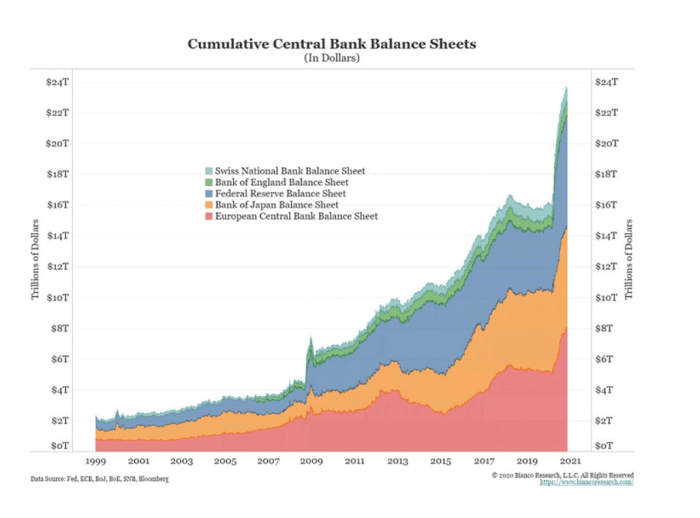

Now my wife and I are on strike, as many of you reading this article probably are. As soon as the cash registers started roaring after the covid-19 lockdowns began in 2020, I felt a sinking feeling that the world would never be the same again. Ungodly sums of money were thrown around the news stations with such causal indifference. Ultimately, the results speak for themselves:

We need better critics

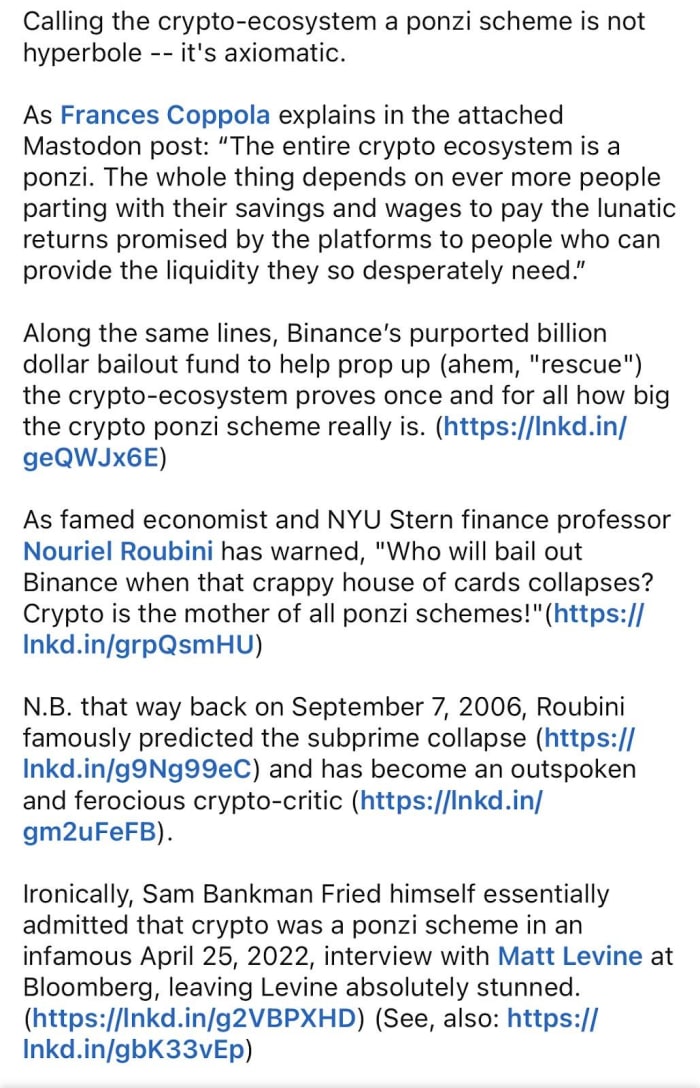

One of the most quoted criticisms I hear from seemingly sophisticated investors and economics PhDs alike is that Bitcoin is a Ponzi scheme: a game where the bigger idiot buys from the swindler huckster while the former investors dump their bags on the new one.

The LinkedIn post that inspired this article was accessed on November 27, but has since been deleted

The post above beautifully illustrated the complete lack of understanding, let alone critical thinking, around this particular line of FUD. The eerie lack of intellectual curiosity is astonishing, but somehow not surprising given my recent stint in academia:

“It all depends on even more people parting with their savings…“

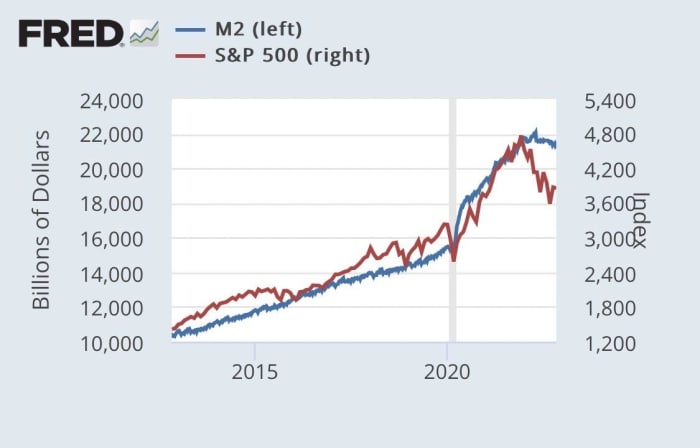

Isn’t this true of the stock market? The housing market? The commodity market? By that logic, any market with floating prices based on supply and demand is a Ponzi scheme. I guess it’s time to go back to the barter economy? Or does the stock market go up on earnings alone without buyers or demand?

In fact, prices appear to have risen faster than incomes since c. 1980, even when inflation is taken into account:

The image above shows the Shiller PE ratio for the S&P 500. It is the price-to-earnings ratio for the stock market, but adjusted for inflation. Can someone say “Cantillon effect”?

Fiat is Ponzi

Crypto is a symptom, not the underlying problem. Years of pent-up nihilism unleashed in get-rich-quick pump and dumps as the world seemingly collapses around us. It’s not hard to see why. But Bitcoin is not crypto, and crypto is not Bitcoin.

In what now feels like an instant, trillions of dollars were created to prevent the system from imploding. Suddenly, the stock market boomed while it seemed like everything was crumbling. I don’t even blame the central bankers. They responded to their incentives and did what they had to, but the effects were severe. If you weren’t already invested, you lost big, which made it that much harder to make your money work for you, to escape inflation, and ultimately to escape the rat race.

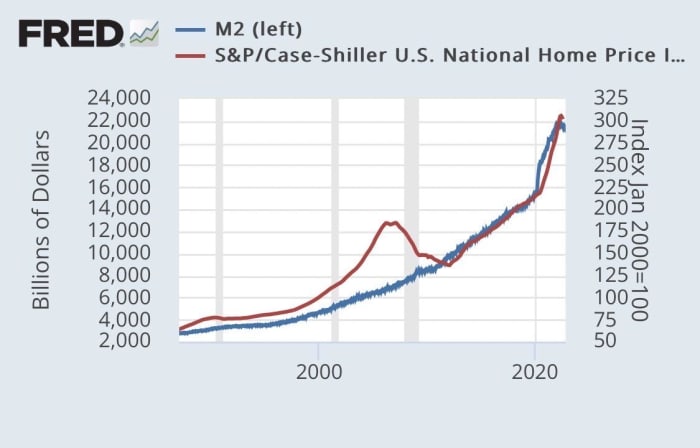

One of the most prominent illustrations for me is the graph below. It shows that you should buy a house, any house, it doesn’t matter. Because if you don’t already own a house, if you choose to save instead, you may never actually be able to afford one. It doesn’t take much empathy to understand the economic desperation many feel today.

Now, I admit I’m not a professional statistician, but the charts seem to have a significant correlation. Perhaps CPI inflation may not be the only problem. Perhaps asset price growth could force savers to become part-time investors. Supply and demand has a price impact on bitcoin, yes, but doesn’t the stock market require new money to support prices as well?

Bitcoin is savings

Savings: Money set aside from the excess of income over expenses.

– Merriam-Webster

So why can’t we just save money anymore? The FRED graphs included here say it all. If you don’t become an investor, you will never keep up. That is, until now.

Bitcoin is our savings in a world without things worthy of investment. Even if it hits $1 million tomorrow, we’re not selling. What should we sell it for? To diversify? Into what? A stock market completely dependent on money printing? An investment property where our tenants do not have to pay rent at the stroke of the politician’s pen? A shiny stone with “intrinsic value”?

You see, how can Bitcoin be a Ponzi when Bitcoiners don’t even want your dollars? What you don’t understand is that we are playing a different game now. What you don’t understand is that we are trying to build something new; a better future for our children and grandchildren.

So if you think bitcoin is doomed to crash and burn, short it. Try to profit from our death, although I don’t think you will.

We will just keep buying and holding, keep showing you and Wall Street, and everyone else who refuses to try to understand Bitcoin. We have no anger or resentment towards you. We don’t want to eat the rich, or burn the system down; we just don’t want to play by your rules anymore. And if we go down with the ship, at least we lost everything fighting for something we believed in.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.