StoneCo Stock: Brazil, Entrepreneurship And Fintech (NASDAQ:STNE)

AsiaVision

Thesis

Investors looking for exposure to emerging markets and new business models (entrepreneurship) may like StoneCo (NASDAQ:STNE). The company is a leading payment technology company in Brazil and of the approximately 30 million entrepreneurial businesses in Brazil, StoneCo has conquered 2 million so far. Without a doubt, StoneCo is too trade relatively cheapwith a one-year forward P/B of x1.4 and P/S of approximately x2.

I value STNE based on a residual earnings framework and analyst consensus EPS and calculate material upside of approx. 46%. My target price is $16.08/share.

StoneCo is down approx. 35% YTD, versus a loss of nearly 15% for the S&P 500. Also, while StoneCo shares have retreated more than 50% since May, the stock is still 85% off its all-time highs.

Seeking Alpha

About StoneCo

StoneCo is a fintech company based in Brazil. Founded in 2012, the company has grown to become a leading provider of financial technology solutions, enabling BTC’s electronic payment infrastructure in store, online and mobile channels. As of June 2022, the company serves around 1.9 million active customers, most of whom are start-ups with small and medium-sized companies.

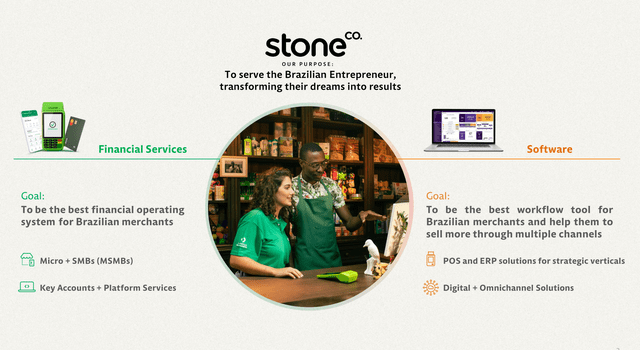

According to the company, the official mission reads as follows:

Our primary mission is to remain focused on empowering our clients to grow their businesses and help them trade and run their businesses more efficiently.

StoneCo investor presentation

StoneCo operates two core segments: Financial Services and Software. Financial Services includes payment solutions, credit and digital banking and accounts for approximately 85% of total revenues. Software encapsulates ERP, POS and digital solutions that help customers capture and monitor the payment ecosystem.

Economy

StoneCo is truly a company in high growth. From 2016 to 2021, the firm’s revenue rose at a 5-year CAGR of 50.3%, jumping from $130 million to $1,005 million. Accordingly, operating income rose from $24.7 million in 2016 to $200 million in 2021.

As of June 2022, StoneCo has about 1.93 billion in cash and short-term investments against a total debt of $1.5, making the company a net creditor of about 430 million.

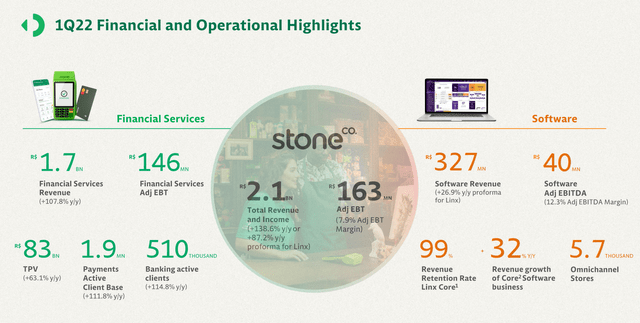

StoneCo Investor Presentation Q1

Analysts expect StoneCo to generate about $1.70B in revenue in 2022 and $2.02B in 2023. If realized, this would indicate a 2-year growth of around 41% since 2021 – indicating that StoneCo’s business still expanding rapidly. EPS for 2022 and 2023 are estimated at $0.27 and $0.55, respectively.

Residual income assessment

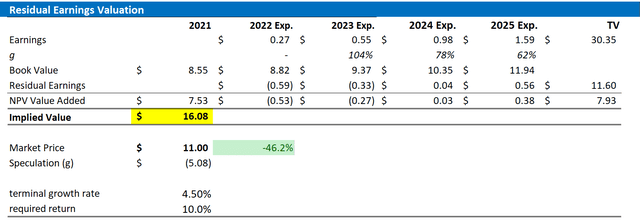

Now let’s look at the valuation. What might be a fair value per share for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and appeal to the following assumptions:

- To forecast EPS, I anchor the consensus analyst forecast available on the Bloomberg terminal through 2025. In my view, any estimate beyond 2025 is too speculative to include in a valuation framework.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the US 10-year Treasury rate as of 2 August 2022. My calculation indicates a fair return requirement of approx. 10%.

- To derive StoneCo’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For terminal growth rate, I use 4.5% percentage points. This is roughly global nominal GDP growth plus one percentage point to reflect StoneCo’s strong and above-average growth outlook.

Based on the above assumptions, my calculation yields a base target price for STNE of $16.08/share, implying a substantial upside of nearly 50%.

Analyst Consensus Estimates; Author’s calculation

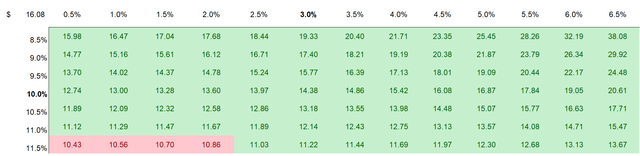

I understand that investors may have different assumptions with regard to STNE’s return requirements and terminal business growth. Thus, I also attach a sensitivity table to test various assumptions. For reference, red cells imply an overvaluation compared to the current market price, and green cells imply an undervaluation.

Analyst Consensus Estimates; Author’s calculation

Risks

I would like to highlight some notable risks that could cause the STNE share to deviate significantly from my target price:

First, arguably most of STNE’s current share price volatility – especially to the downside – is driven by investor sentiment towards risk assets, particularly growth companies like StoneCo. Thus, it is likely that the STNE share will experience significant volatility even if the company’s business outlook remains unchanged.

Second, all of StoneCo’s sales are generated in Brazil. Investors in the company are thus fully exposed to Brazil’s unique risks.

Third, StoneCo’s fundamentals are correlated to the success of SMEs in Brazil. And given global declining consumer confidence, wage and price growth, rising interest rates and rising unemployment, StoneCo’s business prospects could be pressured by macro headwinds.

Conclusion

I like the risk reward setup for StoneCo: The company is down approx. 85% from all-time highs and trades at a P/B of x1.4 and P/S of approx. x2. Also, StoneCo is growing revenue at >40% CAGR and the company does not appear to have any structural profitability issues – like many of its high-growth peers.

I think investors can enjoy close to 50% upside, as I calculate a target price of $16.08/share, based on a residual earnings framework.