Stocks, crypto likely to see retracement amid ‘greedy’ sentiment – Fairlead Strategies

Diego Thomazini/iStock via Getty Images

Investment adviser and technical analyst Katie Stockton said Thursday that the rally stocks have seen in the early stages of 2023 could begin to fade in the near term as “greedy market sentiment makes for a fragile bond.”

Speaking to CNBC, Fairlead Strategies’ founder and managing partner noted that conditions could hit housing and Bitcoin particularly hard. However, she added that these feelings are temporary and will not last long.

“I would say it’s more short-term to medium-term. It’s not yet affecting the long-term goals, so it tells us that the support levels are still very realistic,” the Fairlead Strategies founder said. “I think 3200 is probably less likely from what we saw in January, the 3800 levels that were tested are still testing at relevant levels.”

Stockton reported that she sees resistance for the S&P 500 (SP500) at around 4,228 (revised from 4,020 previously) as support levels increase. The S&P 500 was just below 4,130 in Thursday’s intraday trading.

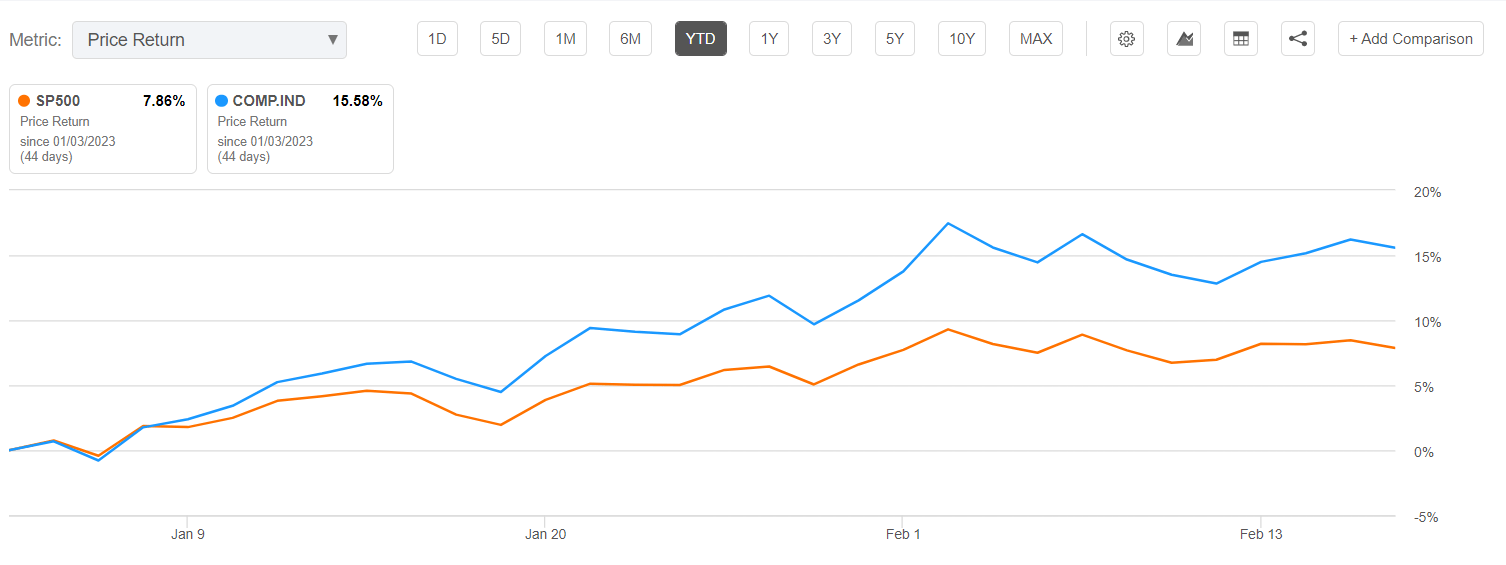

Stockton highlighted the importance of megacap stocks, which have seen many breakouts and pullbacks in January after being pushed down in 2022. When it comes to comparing the broader market indices, Stockton pointed out that the Nasdaq 100 has outperformed the S&P 500 so far this year.

Looking at recent moves in the crypto space, one of the key areas Stockton highlighted, Bitcoin (BTC-USD) jumped more than 9% to $24.95K in Thursday’s intraday action. Meanwhile, Ethereum (ETH-USD) rose 9% to $1,719.94.

Looking at the broader market action: Nasdaq Composite (COMP.IND) -0.6%S&P 500 (SP500) -0.5%Dow (DJI) -0.4% to 33,926.

Meanwhile, take a quick look at the S&P 500 and Nasdaq Composite Index so far this year:

Crypto stocks have seen a significant rally so far in 2023. While down more than 1% in Thursday’s intraday action, Coinbase (COIN) has more than doubled so far in 2023, though the stock is still down 67% over a 12-month period span.

Elsewhere in the sector, Marathon Digital (MARA), MicroStrategy (MSTR), Riot Platforms (RIOT), and Hut 8 Mining (HUT) all more than doubled in 2023 as well, including a rally of more than 150% by HUT. Meanwhile, Silvergate Capital ( SI ) has lagged behind, climbing 19%.

For more on market action, see why Seeking Alpha contributor Fountainhead says: “The S&P 500 could correct between 7 and 10% over the next three to four months.”