Stacks: Bitcoin Layer 2 Could Be Huge (STX-USD)

Chun Han

Overview

Proposals to add scalability to Bitcoin (BTC-USD) bring up contentious debates in the Bitcoin community. Attempts to make Bitcoin scale by increasing the block size have led to splits from the Bitcoin network and the creation of new Bitcoin variants, known as hard forks. However, other blockchain networks have emerged that are scalable and do much more than send and receive peer-to-peer transactions. Advanced blockchain capabilities have proven useful for building decentralized applications (dApps).

Bitcoin inherently lacks advanced features such as smart contract execution and self-executing contracts. As one of the most secure and decentralized blockchain networks, the Bitcoin community largely frowns upon implementing changes to the Bitcoin network. These changes often result in a trade-off between network security and scalability.

Muneeb Ali and Ryan Shea started the Stacks (STX-USD) project (originally called Blockstack) as a blockchain team for Bitcoin. Stacks is the first blockchain project to receive one approval of token sale from the US Securities and Exchange Commission (SEC), making STX, Stacks’ native token, compliant with US regulations.

What constitutes Stacks’ Tech Stack?

Stack implements new technologies that unlock the full potential of Bitcoin. To achieve faster throughput and programmability on the Bitcoin blockchain, Stacks uses a set of technologies that anchor the Bitcoin network.

Proof of Transfer (PoX)

Stacks uses the proof-of-transfer (PoX) consensus mechanism, which it calls “an extension of the proof-of-burn mechanism,” and a layer on top of the proof-of-work (PoW) mechanism.

An underlying PoW blockchain secures a PoX blockchain; therefore, nodes that secure a PoX blockchain earn rewards in the cryptocurrency of the base blockchain.

A PoX network’s base blockchain is sometimes called its anchor chain, as they are anchored to a PoW network.

Stacks’ anchor chain is Bitcoin. Miners on Stacks’ PoX blockchain receive BTC rewards. When stackers stake STX, they earn rewards in Stacks’ anchor cryptocurrency BTC.

The Stacks team says they chose Bitcoin as their anchor blockchain because the Bitcoin network is the oldest blockchain network and has stood the test of time. Bitcoin is also one of the most decentralized blockchain networks and its original coin BTC has become the most recognized cryptocurrency.

Microblocks for high throughput

Stacks use a mechanism called microblocks to achieve increased transaction throughput. Stacks’ block time (block time) is at the same rate as the Bitcoin network; however, microblocks allow the Stacks blockchain to perform state transition between blocks in the anchor chain.

Block leaders are elected on the Stacks network to batch or stream transactions. In the streaming model, elected block leaders select transactions from the mempool and package them into microblocks. Using this approach reduces transaction processing time.

Miners on Stack are encouraged to mine microblocks. Miners can choose not to mine macroblocks, but opt for the batch model.

Clarity programming language

Stacks has a proprietary smart contract language designed for the blockchain. Smart Contract developers code business logic on Ethereum (ETH-USD) blockchain uses Solidity smart contract language, and web3 developers building on Stacks use Clarity.

Stacks says that in designing Clarity, it looked at the flaws and vulnerabilities of existing smart contract languages like Solidity. Taking lessons learned from common Solidity exploits, Clarity was built to be secure by design.

Clarity is an interpreted smart contract language, unlike Solidity, a compiled language. Compiled languages are converted to byte code before being sent into the chain. This poses a certain level of vulnerability as the compiler adds another layer of complexity. A compiler error can lead to the execution of an unintended bytecode, creating the risk of an exploit. Clarity, as an interpreted smart contract language, executes and commits to the chain as written.

Byte codes, the format in which compiled smart contract codes are converted, are low-level and cannot be read by humans. This makes it difficult to verify exactly what a smart contract is doing at runtime.

An interpreted language like Clarity retains its high-level, human-readable format, making it easy to verify what a smart contract is doing.

What has been built on Stacks Layer-2?

A blockchain network that offers NFT, DeFi and smart contract capabilities can prove its worth by the number of real-world applications built on the blockchain.

NFTs, defi and crypto domains on stacks

NFTs can be traded on Stacks’ NFT marketplaces. The popular Stacks NFT marketplaces are Gamma, Byzantion, Stacks Art and Superfandom. Some of Stacks’ NFT marketplaces offer cross-chain functionality.

NFTs on the Stacks blockchain are commonly called Bitcoin NFTs. Some popular Bitcoin NFT collections include Bitcoin Monkeys, Megapont Ape Club, and Belle’s Witches.

DeFi functionalities such as lending and launching tokens have been made available on the Bitcoin network, thanks to Stack’s layer-2 solution. Stackswap is a Stacks-based DeFi platform that enables users to exchange tokens, coin and trade NFTs, and perform crypto loans on the Bitcoin network.

Stacks has also introduced Web3 domain names to Bitcoin. Like the Ethereum Name Service, Stacks’ “.BTC” domain allows users to encapsulate their Web3 identity in a simple, easy-to-read address format.

Technical analysis

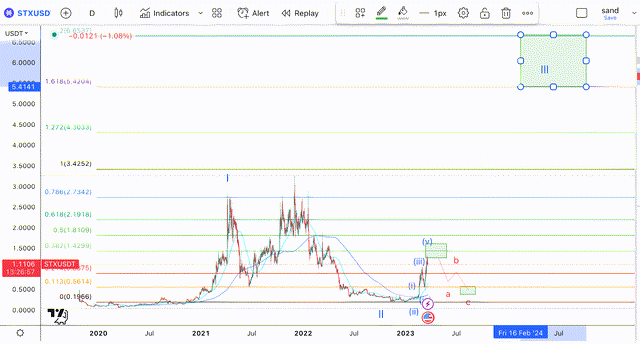

My long-term target for STX will take us at least into the $5.4 region:

STX long-term (Author’s work)

This is 1.618 ext of wave 1, using the arithmetic chart, as I see the log chart as too bullish. Still, this represents a rally of at least 400%.

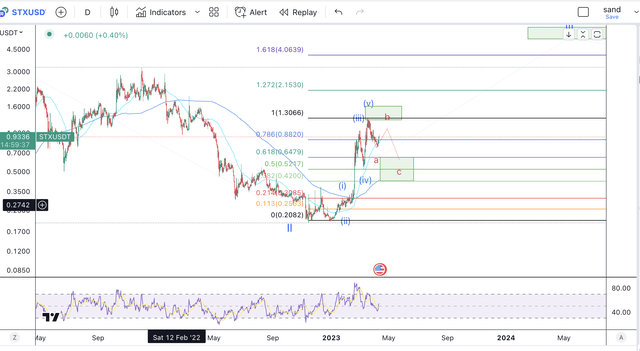

In the more immediate term, I think STX has already completed an impulse to the upside and we should now see a significant retracement:

STX short term analysis (author’s work)

I add a buy order at $0.756

Remove

There are several layer-2 protocols built on Bitcoin; Stacks’ approach to enabling advanced features rather than focusing mainly on scaling makes it stand out.

Bitcoin is undoubtedly the most popular blockchain network. When retail and institutional investors discuss crypto investments, Bitcoin is the number one choice. Stacks’ use of Bitcoin as an anchor chain makes it stand on the shoulders of giants. As crypto continues to gain mass adoption and more institutional investors add Bitcoin to their portfolios, the need for asset tokenization, NFTs and DeFi capabilities on the Bitcoin network will become apparent. Stacks has embarked on an amazing journey to unlock Bitcoin’s full potential.

Editor’s Note: This article covers one or more microcap stocks. Be aware of the risks associated with these stocks.