Stablecoin pattern suggests massive Bitcoin breakout could be coming, according to Crypto Analytics Firm Santiment

Crypto analytics firm Santiment says the dwindling supply of stablecoins could be a sign that a massive Bitcoin (BTC) breakout is on the horizon.

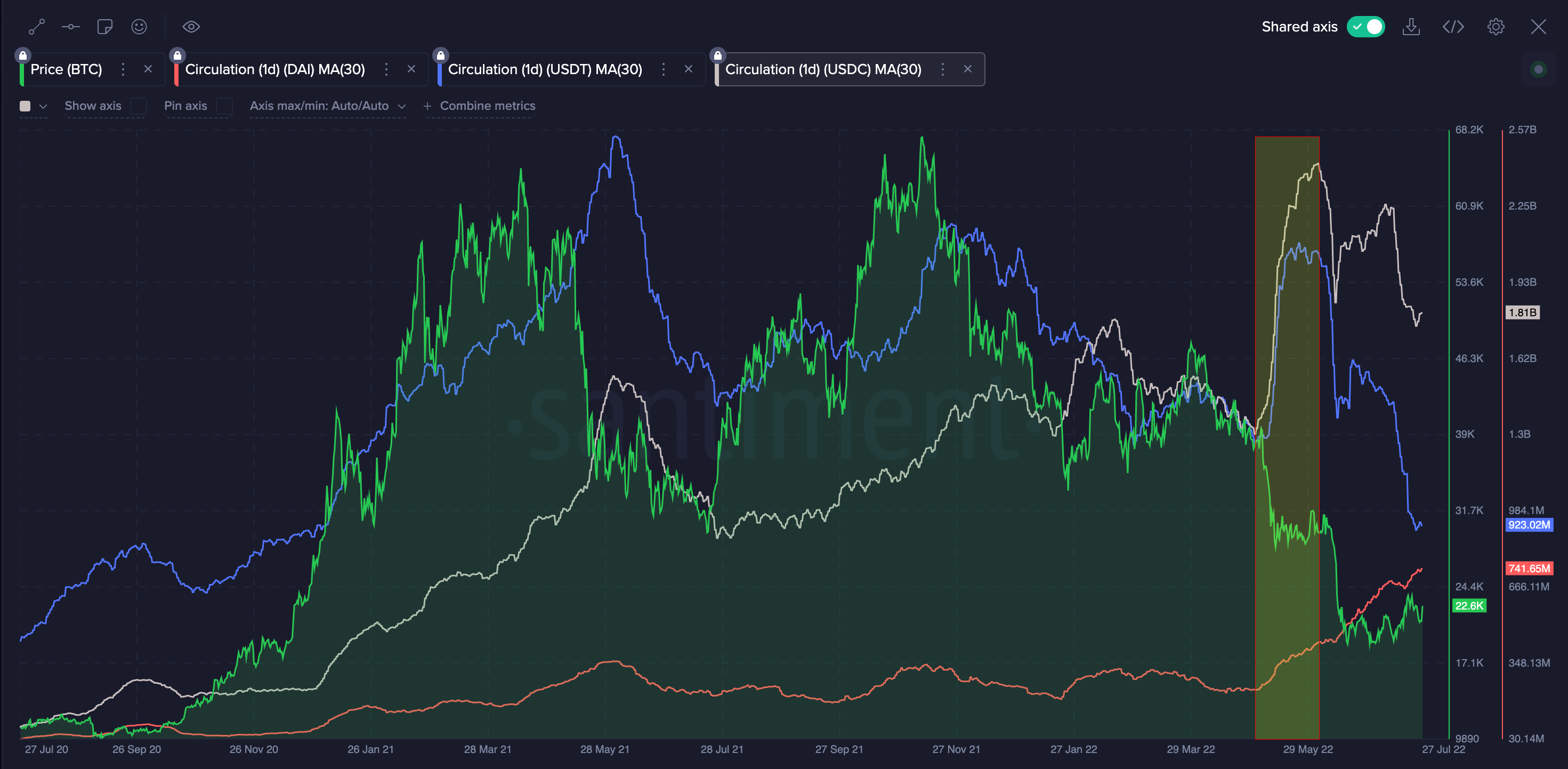

According to the market intelligence firm, the circulating supply of Tether (USDT) and USD Coin (USDC), the two largest stablecoins by market capitalization, has declined dramatically since May 2022.

Santiment says that the volume of these two assets continues to decrease even as the price of Bitcoin rises, which has previously heralded parabolic BTC rallies, specifically in July 2021 just before the royal crypt went from the $29,000 level to $69,000.

“Stablecoin circulation continued to decline even in a growing market. We might say that [the] first significant growth occurred on a declining circulation. Stablecoins tried to heat up strongly, but no, the market did not go up.

The best pattern can be [stablecoins] still decreasing [during a] extraction market. Like today. When stablecoins do not believe in mining yet, prefer to wait. We are probably witnessing the same as in July 2021 now, at least on two stablecoins.”

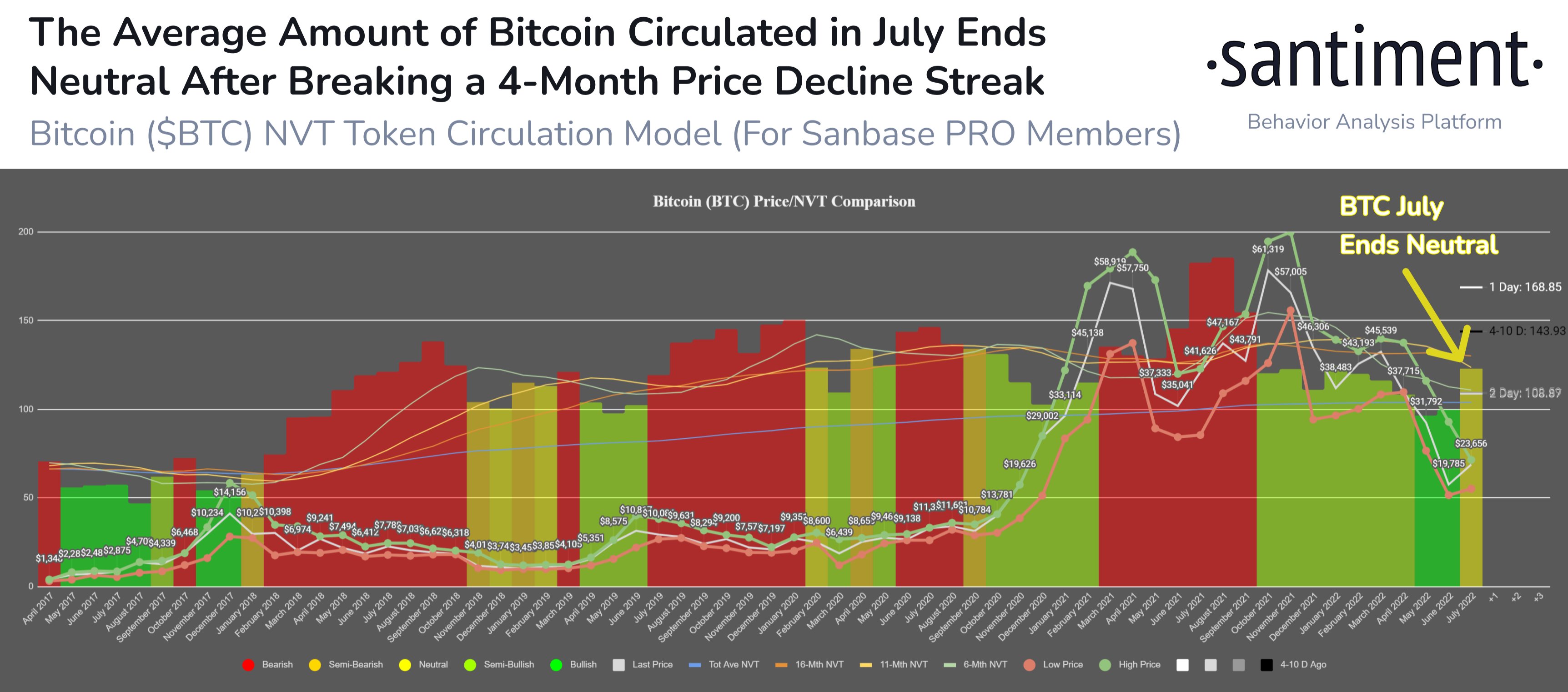

Santiment also notes that Bitcoin’s price is now in line with the valuation based on the network value-to-transaction (NVT) model, a metric that aims to measure an asset’s price based on the ratio of its daily market value to daily circulation.

“Bitcoin jumped +18% the following July [the] The NVT model’s increasing bullish divergence in May and June finally saw a price rally. With a neutral signal now that prices have risen and token circulation has fallen a bit, August could move in either direction.”

Bitcoin is changing hands at $23,297 at the time of writing, down 1.25% on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Garan Julia/Aleksandr Kovalev