SQ, MELI or V: Which Fintech stock can give the best returns?

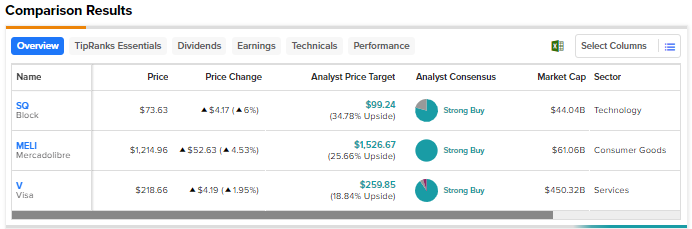

Macro uncertainty and the growing fear of an economic downturn is expected to affect consumer spending and, in turn, the performance of financial technology or fintech companies. Nonetheless, Wall Street remains optimistic about the long-term prospects of several fintech stocks due to the growing shift to digital payments. We used TipRanks’ stock comparison tool to place block (NYSE:SQ), MercadoLibre (NASDAQ:MELI), and Visa (NYSE:V) against each other to pick the fintech stock with the highest upside potential according to Wall Street analysts.

Block (NYSE:SQ)

Block ended 2022 with better revenues and gross profit than expected. However, the fintech’s adjusted earnings per share (EPS) fell short of estimates due to higher expenses. The company assured investors that it will focus on efficiency this year and “meaningfully” reduce the pace of expense growth compared to previous years.

Block expects to deliver approximately $1.3 billion in adjusted EBITDA in 2023, reflecting growth of over 30%. The company’s two ecosystems, Square for merchants and Cash App for individuals, are growing from strength to strength. Block is experiencing greater retention of its Square solutions from larger merchants and those using multiple products. Last year, mid-market sellers who adopted four or more products had 15 times greater retention than those who adopted only one product.

Meanwhile, Cash App had 51 million active users making monthly purchases in December 2022, up 16% year-on-year. Also, two out of three active transactions made every week on average.

Is blocking a buy right now?

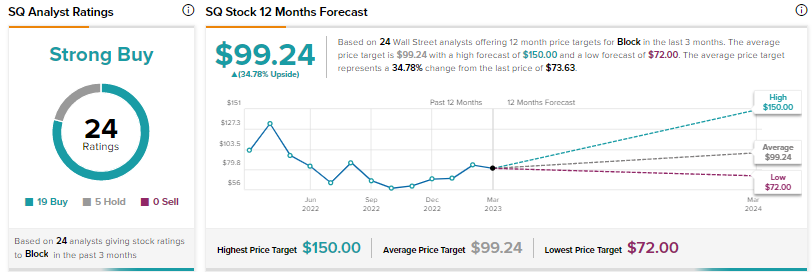

UBS analyst Rayna Kumar reiterated a Buy rating on Block with a $102 price target after meeting with the company’s management.

“Block’s aggressive pace of innovation should continue to drive premium growth. Over the next 3 years, we expect Block to generate a low 20s gross profit CAGR,” Kumar said.

Overall, Wall Street’s Strong Buy consensus rating for block stocks is based on 19 Buys and five Holds. The average price target of $99.24 implies almost 35% upside potential from current levels. Shares have risen over 17% so far in 2023.

MercadoLibre (NASDAQ: MELI)

The e-commerce and fintech company MercadoLibre is often called the “Amazon of Latin America”. Last month, the company posted positive results for the fourth quarter, driven by solid momentum in its fintech business. Unique active fintech users increased 27% to nearly 44 million in Q4 2022, while total payment volume (TPV) through Mercado Pago, the company’s payment platform, grew 45% in US dollar terms.

Over the last three years, the company has increased its TPV more than 4 times and its fintech revenues have increased almost 5 times. Overall, MercadoLibre’s fintech business has emerged as a major contributor to its revenue and earnings. The company continues to expand the scope of its financial services and increase revenues.

What is the price target for the MELI share?

Following the results, BTIG analyst Marvin Fong raised his price target for MercadoLibre to $1,400 from $1,245 and reaffirmed a Buy rating. Fong believes that the company’s adjusted EBITDA should triple in 2023 compared to 2021.

The analyst’s new price target is based on 27 times 2024 EBITDA estimates. Fong argued that while this is a “relatively high multiple in this more sober market,” he believes the company’s 25% to 30% revenue growth and its leading position in Latin- America’s fast-growing digital market justifies a premium valuation.

Other Wall Street analysts are also bullish on MercadoLibre, with the stock earning a strong buy consensus rating based on nine unanimous buys. At $1,526.67, average MELI stock price suggests 25.7% upside potential. The shares have risen almost 44% so far this year.

Visa (NYSE:V)

Payment processing giant Visa started Fiscal 2023 with better-than-expected results in the first quarter (ended December 31, 2022). Revenue increased 12% to $7.9 billion and adjusted EPS increased 21% to $2.18. Steady payment volume and growth in processed transactions and continued recovery in cross-border travel drove Q1 FY23 results.

Visa continues to expand its presence worldwide and collaborate with other fintechs to increase its prospects. For example, a Mexican fintech Konfio that has already issued around 50,000 Visa small business cards recently extended its agreement with the company to issue Visa Business Infinite cards.

Visa also entered into an agreement with Latin America fintech platform Tigo Money and its parent Millicom to offer Tigo Money’s over 5 million wallet users the ability to digitize cash and make purchases wherever Visa is accepted with the Visa-Tigo Money Access Card.

Is Visa stock a buy, sell or hold?

Visa recently provided quarter-to-date estimates for the fiscal second quarter (through February 2023). Quarterly US payment volume increased 12%, cross-border volume grew 27%, and processed transactions increased 13% year-over-year.

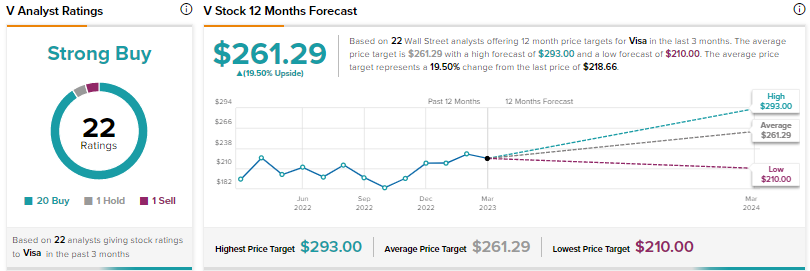

Following the update, Baird analyst David Koning noted that Visa’s operating figures through February were ahead of his estimates and suggested the company could beat his Q2 FY23 revenue estimates by over 1.5%.

Koning reiterated a buy rating on Visa with a $272 price target, saying, “We like Visa very much given a robust macro model, inflation helps, x-border improvement (especially in APAC), high quality earnings and potential valuation.”

Wall Street’s strong buy consensus rating for Visa is based on 20 buys, one hold and one sell. The average Visa stock price target of $261.29 suggests 19.5% upside. The shares have risen over 5% so far this year.

Conclusion

Despite near-term headwinds, Wall Street is bullish on all three fintech stocks discussed here. However, they see higher upside in Block compared to MercadoLibre and Visa. Block is expected to capture additional business in the fintech space, driven by the strength of the Square and Cash App ecosystems.

Aside from Wall Street analysts, hedge funds have a very positive confidence signal for Block. According to TipRanks’ Hedge Funds Trading Activity Tool, hedge funds increased their holdings by 5.7 million SQ shares last quarter.

Mediation