Spending on crypto lobbying has skyrocketed by 922% since 2017

Crypto company lobbying has increased in recent years as the cryptocurrency industry continues to gain momentum. Such an increase in adoption has attracted more attention from legislators and regulators.

Lobbying is the act of trying to influence decisions made by government officials, often through the use of financial contributions or other incentives. Many companies, including those in the crypto industry, lobby to try to shape regulations and laws in their favor. Per BeInCrypto’s report last year, cryptocurrency lobbying spending had more than quadrupled in the past four years.

One reason for the increase in lobbying of crypto companies is the increasing regulatory scrutiny of the industry. Cryptocurrencies are a relatively new and complex technology; regulators are still trying to figure out how to properly regulate them. As a result, crypto companies are increasingly seeking to influence the regulatory process to ensure that any new regulations are favorable to their business interests.

Another factor driving the rise in lobbying by crypto companies is the growing mainstream acceptance of cryptocurrencies. As more and more companies and individuals adopt cryptocurrencies, the industry becomes more influential and powerful. Corporations seek to harness this power to shape public policy.

2022 Saw an increase in the lobbying trend

Recognized entities within the crypto sector have participated in said activity. In 2022 alone, well-known crypto companies made lobbying contributions of up to $25.57 billion to influence policy in their favor. The Money Mongers team shared similar insights with BeInCrypto via email.

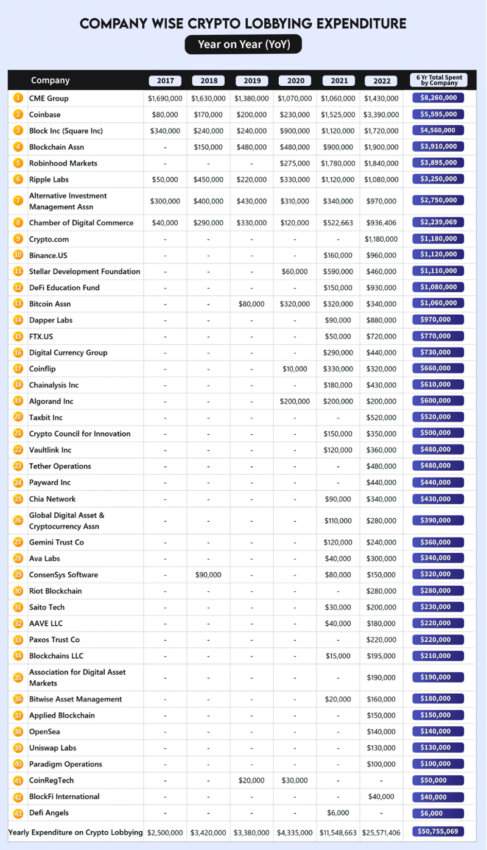

Not surprisingly, last year accounted for half of the total lobbying expenses of crypto companies. The previous six years accounted for $50.75 million, of which $25.57 million was spent in 2022. The second largest exchange by trading volume, Coinbase, spent $3.30 million, making it the highest spender of crypto lobbying expenditures . The screenshot below shares the expense segregation for the mentioned company.

It is important to note that it is common practice among people working in the public sector, including congressional staff, to take jobs with lobbying firms, as they understand the inner workings of the sectors they used to oversee. These people are called “revolvers,” and those who make the opposite switch (from lobbying firms to public office) are called “reverse revolvers.”

Other companies that made the top 10

Blockchain Association takes the next place with $1.90 million, followed by Robinhood with $1.84 million. Here is a list of the expenses for various companies last year. It is worth considering that the expenses listed below are for the companies involved in crypto. Not the lobbying applied to crypto, or about crypto specifically.

Other key highlights show that Binance’s US subsidiary outlays skyrocketed from $160,000 (2021) to $960,000 (2022), showing a 500% increase. Meanwhile, FTX.US saw a 1,340% growth in lobbying spending from $50,000 (2021) to $720,000 (2022).

Indeed, given the headwinds of last year, crypto companies have struggled to maintain their footing. In some cases, a few companies saw the exit gate after the crypto contagion effect. But this practice has been going on for years – the shared report draws a parallel back to 2017.

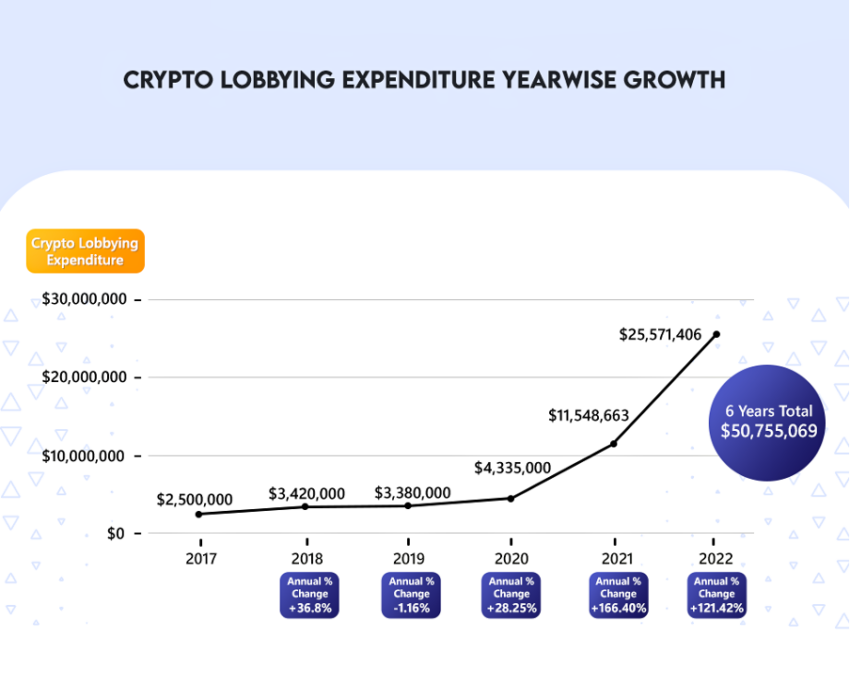

Lobbying expenses in the last six years

Companies have long been proponents of lobbying campaigns and have spent the most on lobbying as a whole. Over the past six years, lobbying spending has increased from $2.50 million in 2017 to $25.57 million in 2022. This represents a massive 922% increase, as seen in the graph below.

In particular, the jump from 2021 spending to 2022 has been significant, accounting for more than a 120% increase. Diving deep into specific institutions that aided the hike, the table looks like this:

Speaking to BeInCrypto, the team at MoneyMonger stated:

“It only makes sense that companies that can profit from crypto lobbying would spend a significant amount of money to ensure that crypto-friendly laws are passed as soon as possible. For this reason, spending on crypto lobbying has grown manifold over the last half decade.”

CME Group is leading the race

CME Group, which runs the Chicago Mercantile Exchange, has spent the most on lobbying-related activities since 2017 for several reasons. Firstly, the financial industry is heavily regulated, and CME Group is a major player in the derivatives market. As such, the company has a significant interest in influencing regulatory decisions affecting the business. Lobbying allows CME Group to directly advocate its interests with legislators, regulators and key decision makers.

Second, CME Group has faced several regulatory challenges recently, including efforts to increase transparency in the derivatives market and proposals to limit speculation. As a result, the company has had to use significant resources to defend its position and advocate for more favorable policies for the business.

Third, CME Group is a large and profitable company with significant resources to invest in lobbying and other advocacy efforts. The company has consistently been one of the best exchanges in the world, and it has the financial resources to support a robust lobbying effort. Overall, CME Group’s significant investment in lobbying-related activities is driven by interests in influencing regulatory decisions affecting the business. With a need to defend its position against regulatory challenges and other threats.

Some thoughts to consider

Even if a significant part of the money has been spent, it does not always guarantee results. Lobbying can come into play from different sides, not just specific to crypto.

However, there are concerns that the increase in lobbying by crypto companies could lead to undue influence on the regulatory process. Public interests must be adequately represented. It is important for lawmakers and regulators to carefully consider the potential impacts of new regulations on the crypto industry and the wider public to ensure that decisions are made in the best interest of all stakeholders.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.